Picture supply: Getty Photos

Development shares are anticipated to outperform the broader market over the long term. And their dividends — in the event that they pay them — are usually decrease than common.

A few of these corporations are nicely established and improve their earnings by means of intelligent innovation or market dominance. Others is likely to be pre-revenue hoping to discover a invaluable useful resource that may change its fortunes without end.

Sizzling air?

Helium One International (LSE:HE1) falls into the latter class. It’s began flowing helium to the floor of its mine in Tanzania. This implies taking a stake is much less speculative than it as soon as was. Nevertheless it’s but to promote any gasoline so shopping for its shares stays high-risk.

That’s in all probability why it attracts a lot on-line curiosity. The prospect of watching an early-stage funding develop into one thing a lot greater is interesting.

People who invested in, for instance, Nvidia, as a part of its January 1999 IPO will know what that looks like. However on the time, it was producing worthwhile gross sales.

Helium One hasn’t obtained that far. And that’s why it must preserve elevating cash.

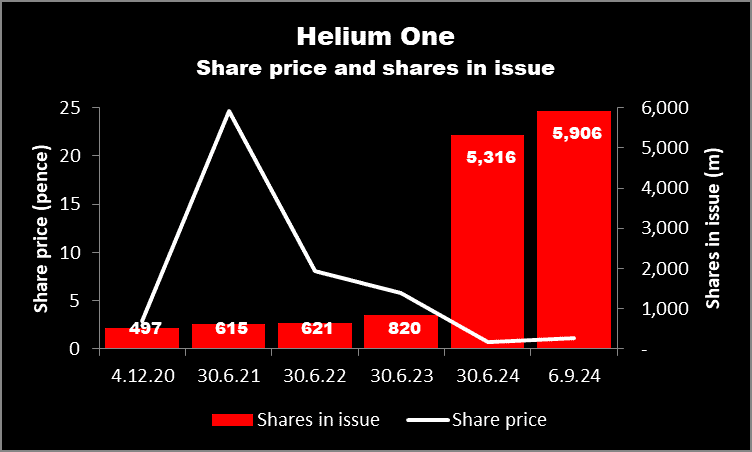

The chart under illustrates that the corporate now has over 10 instances extra shares in challenge than when it floated in December 2020.

This isn’t a criticism. It’s an inevitable truth of life for a enterprise that’s making losses.

Nonetheless, it doesn’t seem to have broken the corporate’s market cap an excessive amount of. Because the chart under exhibits, there was an preliminary peak however it’s nonetheless price over £50m.

Chart by TradingView

However should you have been rich sufficient to personal 5% of the corporate on the finish of 2020, you’d now have solely 0.84%. In fact, this assumes you didn’t take part in any fundraising.

Not for me

And that’s the principal purpose why I wouldn’t need to make investments at this stage.

To keep away from my shareholding being diluted, I feel I’d should half with extra cash sooner or later. Nonetheless, many of the firm’s new shares have traditionally been positioned with institutional buyers at a major low cost to the prevailing market worth. As a small personal investor I in all probability wouldn’t be capable of take part, even when I wished to.

There are different the reason why I’d be nervous about taking a stake.

Though in all probability unlikely in Tanzania, there are examples of African governments nationalising corporations with none compensation being paid.

Additionally, from an operational perspective, mining and exploration is among the most troublesome industries. There are quite a few issues that would go incorrect.

Nonetheless, get it proper, and Helium One may very well be a really profitable firm.

The gasoline is important for a lot of high-tech purposes. Between now and 2030, world demand is anticipated to extend by over 40%.

And in response to the corporate: “The helium market has distinctive provide, demand and storage dynamics, resulting in virtually a continuous improve in costs.”

However regardless of these positives, taking a stake can be too dangerous for me. I’d fairly spend money on an organization that’s promoting gasoline and worthwhile.