Picture supply: Getty Photographs

One widespread method to worth shares is to take a look at their price-to-earnings (P/E) ratio. As a rule of thumb, the decrease it’s, the cheaper the share is, though there are a few necessary caveats to contemplate: the sustainability of the earnings and the agency’s debt each matter. In the intervening time, one well-known FTSE 250 share sells for pennies and has a P/E ratio of simply 8.

So, is it a discount I ought to purchase for my portfolio?

Nicely-known shopper model

The share in query is Dr Martens (LSE: DOCS).

With an iconic footwear model, giant buyer base, and distinctive place out there, I feel there’s a lot to love concerning the enterprise.

So, why is the FTSE 250 share promoting for pennies? (And why has it fallen 88% because it listed on the London inventory market simply three years in the past?)

The reply lies within the agency’s weak efficiency currently.

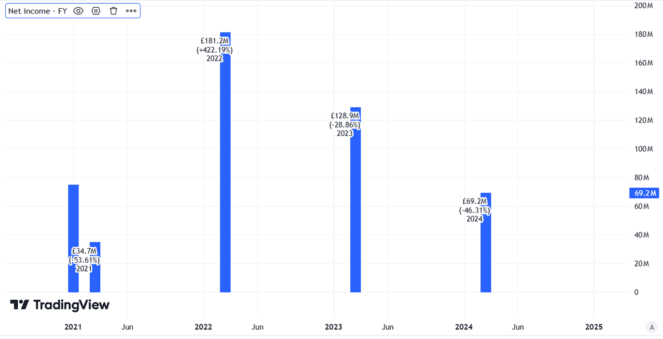

Take final 12 months for example. Revenues fell by 12%. Revenue after tax crashed by 46%.

Created utilizing TradingView

In the meantime, web debt rose by 24%. As I mentioned above, debt issues with regards to valuation as servicing and repaying it may possibly eat into earnings.

Potential for turnaround

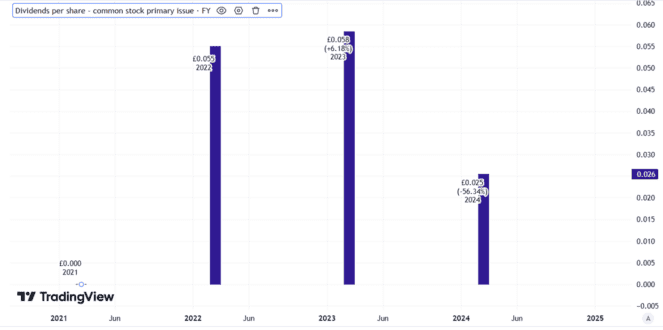

Nonetheless, whereas the corporate’s earnings after tax fell badly, it remained firmly within the black. It reduce the dividend, however didn’t cancel it altogether.

Created utilizing TradingView

Weak US shopper demand was given as a key cause for final 12 months’s poor efficiency. However the enterprise introduced plans to deal with that, together with growing advertising and marketing spend within the essential area.

The newest replace got here in July, when the corporate mentioned that buying and selling in its most up-to-date quarter had been in step with expectations. I feel an enormous take a look at will come this month, when Dr Martens is ready to announce its interim outcomes.

In the event that they comprise optimistic information about gross sales traits and prices, I reckon the present share worth may grow to be a discount.

Nonetheless, the reverse may occur. If there are solely weak indicators of a turnaround (or none in any respect), the share worth might fall additional. Dr Martens footwear will not be low cost and US shopper spending stays pretty weak.

I’m not shopping for

I’m in no rush to purchase right here. The corporate’s enormous share worth decline since itemizing factors to numerous components that concern me, from web debt to the seeming fragility of the enterprise mannequin.

At finest, I feel the enterprise can begin to present proof of a turnaround and see the share worth climb. However any such turnaround is unlikely to occur in a single day. So there’ll probably be time for me to purchase when proof of it comes, even when which means paying the next worth than at present for the FTSE 250 share.

In the meantime, the dangers concern me. Dr Martens is a powerful model however it’s a enterprise that has been battling sizeable challenges. These might proceed.