Picture supply: Getty Pictures

We’ve seen many UK shares hit document highs this yr. Within the FTSE 100, these embody high quality shares like RELX and 3i Group, in addition to extra outperformance from Rolls-Royce. Within the FTSE 250, shares as diversified as fintech outfit Plus500 and branded merchandise agency 4imprint Group have additionally reached new peaks.

One other surging mid-cap inventory that has caught my eye just lately is QinetiQ Group (LSE: QQ). Shares of the defence firm have powered 51% larger in 2024 and now sit simply beneath a document 481p.

However is there any worth left after such a robust run? Right here’s my take.

Geopolitics

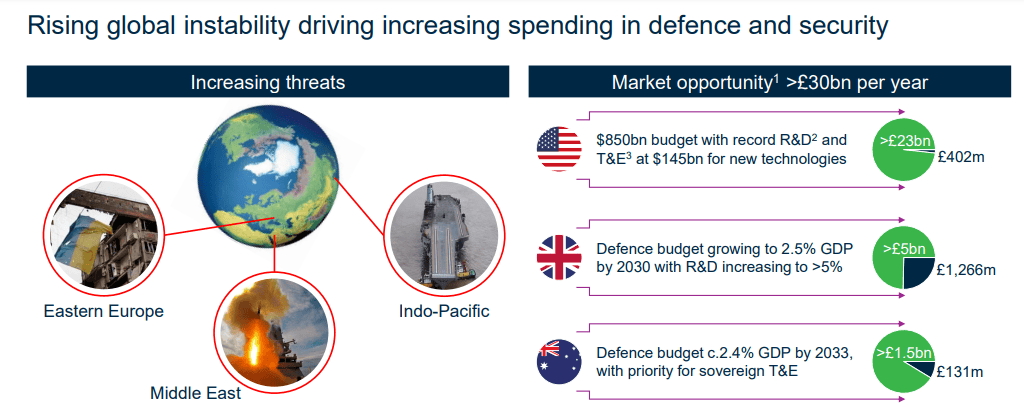

QinetiQ is a defence inventory, so it’s most likely not shocking to see it surging just lately. In spite of everything, we’re residing in maybe essentially the most harmful interval for the reason that finish of the Chilly Conflict. The dreadful battle in Ukraine reminds us of this, whereas the US and China proceed their sabre-rattling.

Consequently, international defence spending is heading larger, which advantages companies like QinetiQ and BAE Programs (one other inventory hitting document highs this yr).

Considerably surprisingly although, the QinetiQ share worth was decrease in April than it was again in early 2020. It was solely in Could when the inventory took off like a rocket.

Sturdy monetary efficiency

This adopted the agency’s elevating of its annual steerage for the yr ending 31 Could (FY24). It stated income rose 21% yr on yr to £1.9bn, whereas underlying working revenue jumped 20% to £215m.

In the meantime, order consumption reached a document excessive of £1.74bn, lifting its order backlog to £2.9bn. It additionally launched a £100m share buyback programme and hiked the dividend by 7% (although the yield is at present a modest 1.7%).

CEO Steve Wadey stated: “We’re…on observe to ship our FY27 outlook of circa £2.4bn natural income at circa 12% margin…we’re nicely positioned and have a transparent technique with optionality for funding in sustainable development.”

Rising market alternatives

One threat right here can be a sudden discount in defence spend by Western nations, particularly with Australia, the UK and US collectively representing 94% of its income. The UK alone makes up 66%, so there’s a component of overconcentration.

Sadly although, a transfer in direction of international disarmament doesn’t appear possible. Certainly, world army expenditure is anticipated to rise for the tenth straight yr in 2024, reaching a document $2.47trn.

The UK authorities is aiming to extend defence spending to 2.5% of GDP. And NATO has pledged to spend 2%+ of GDP on defence yearly (23 of 32 members are set to realize the goal this yr).

Consequently, QinetiQ sees giant alternatives in all its markets, particularly within the US. It made simply over £400m in income there in its final monetary yr however now sees a £23bn+ complete market alternative.

Extra potential

The final time I wrote concerning the inventory in April, I stated it regarded good worth. It nonetheless does, in my opinion, buying and selling at 14.9 occasions ahead earnings. That’s round half that of friends.

Plus, QinetiQ’s market cap of £2.7bn is a fraction of BAE System’s £38.7bn, so in idea has much more scope to develop.

I have already got shares in BAE. But when I didn’t and if I used to be seeking to spend money on a defence inventory, I’d think about shopping for QinetiQ.