Picture supply: Getty Pictures

UK shares have largely rallied from the underside round two years in the past. Nonetheless, some have been left behind. A type of shares is Jet2 (LSE:JET2).

Whereas Jet2 is up 137% over 5 years, this comparability begins from a really low base. As an alternative, we are able to really see that the airline’s inventory is flat versus the place it was in December 2020 — for context, the UK was in lockdown on the time.

In different phrases, zero share value progress in four-and-a-half years. And that in itself is a hazard. I like shares with momentum as a result of they’re extra prone to attain truthful worth faster.

Nonetheless, this lack of momentum is a threat I’m keen to take with Jet2. I’ve lately added it to my portfolio. I merely imagine the inventory is vastly undervalued.

Right here’s what the charts say

Jet2 inventory trades round seven instances ahead earnings. That’s not costly for UK-listed firms and it’s not significantly costly for airways. The worldwide airways common is at present round 7.4 instances.

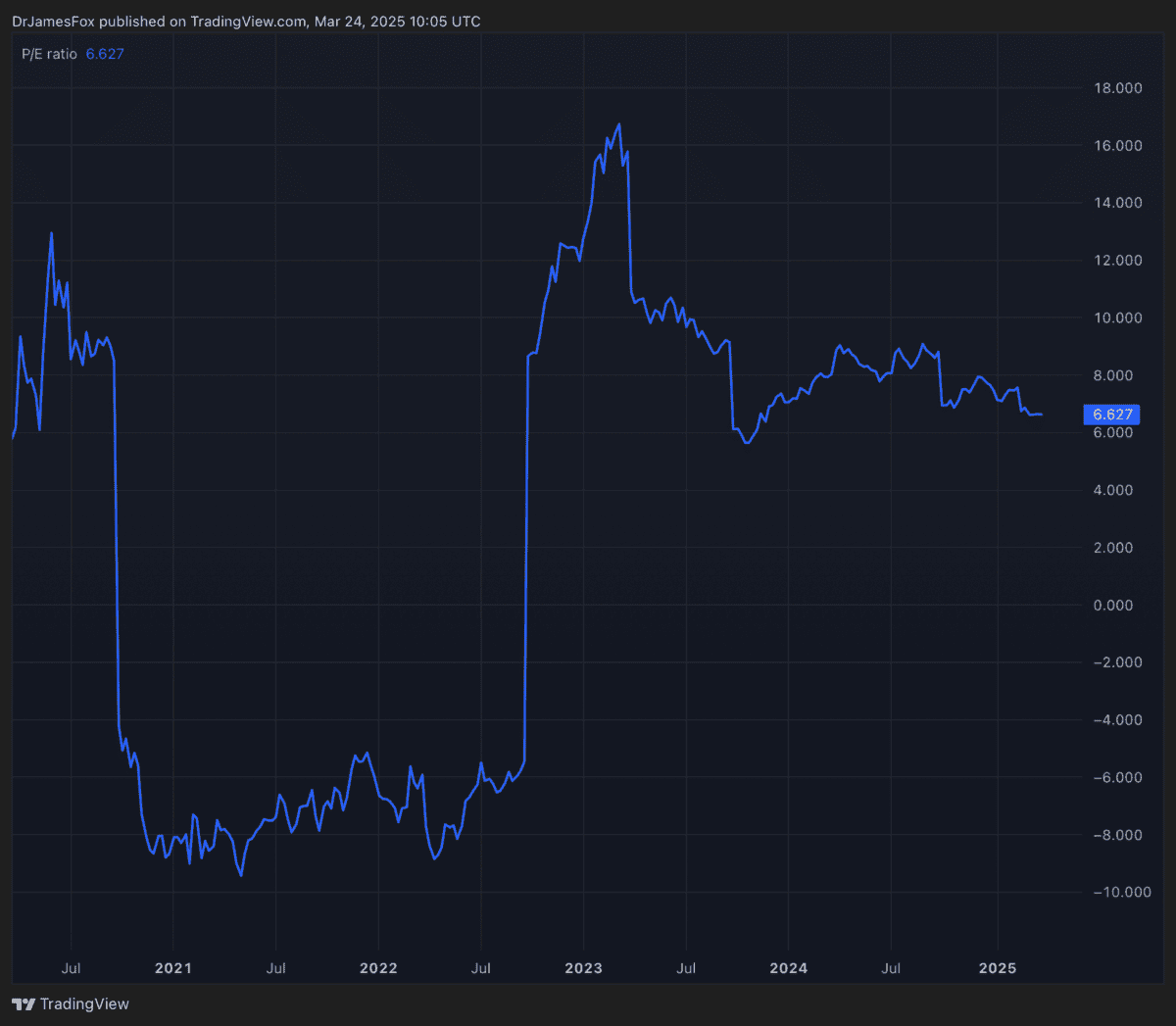

The above knowledge reveals the price-to-earnings (P/E) ratio fluctuating, but it surely’s again in step with the place it was 5 years in the past. We are able to additionally observe the impression of the P/E on earnings in 2020 and 2021, when it turned adverse.

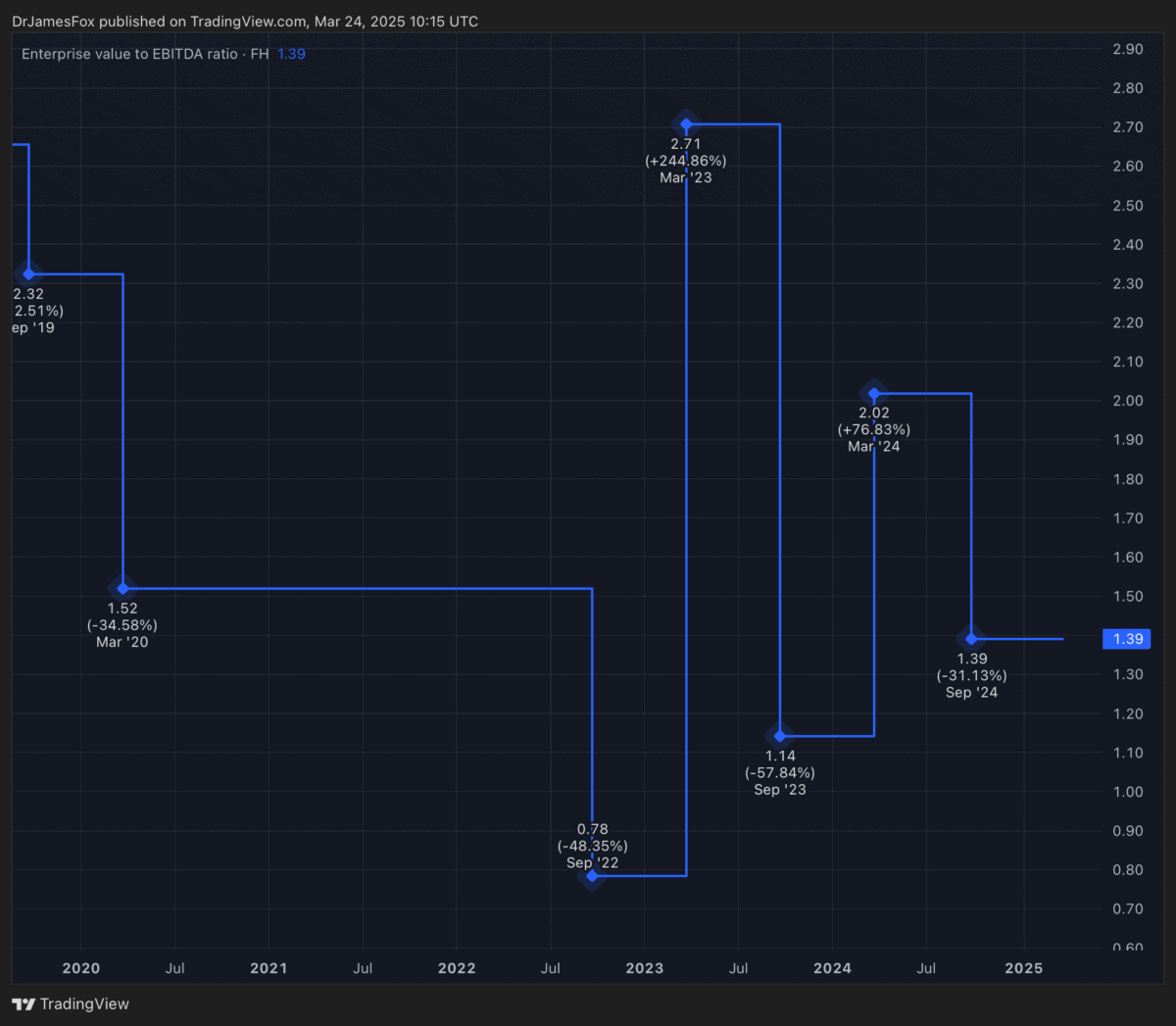

Nonetheless, the actual indicator of worth is the EV-to-EBITDA ratio. Most airways don’t have a internet money place, however Jet2 has £2.3bn in internet money. Because of this, its EV-to-EBITDA ratio is definitely slightly shut to at least one. In different phrases, it’s enterprise worth is nearly coated by only one yr of EBITDA (earnings earlier than curiosity, tax, depreciation, and amortisation).

By comparability, IAG trades at 5.4 instances ahead earnings and with an EV-to-EBITDA ratio of three.4. The inference right here is that Jet2 has been vastly neglected.

An organization overview

Jet2, the UK’s largest inclusive tour operator and a number one leisure airline, is strategically positioned for progress regardless of dealing with business challenges. Analysts anticipate earnings progress over the medium time period, supported by Jet2’s increasing market presence and investments in fleet modernisation.

The Leeds-based firm has a barely older fleet, at 13.9 years, than a few of its friends. And Jet2 plans to speculate £5.7bn between 2025 and 2031 to improve its fleet, transitioning to a majority Airbus configuration and growing capability from 135 to 163 plane. The brand new A321neo plane are anticipated to reinforce operational effectivity with decrease gasoline consumption and better seating capability.

This funding aligns with business norms, representing roughly 11.4% of projected income for 2025 and declining additional as income grows to an estimated £8.6bn by 2027. Actually, the corporate’s internet money place is forecast to hit £2.7bn by 2027.

Nonetheless, buyers ought to be aware potential dangers. Rising prices, together with wages, airport expenses, and upkeep bills, may strain revenue margins. Moreover, aggressive pricing within the European leisure market and a pattern in the direction of later bookings might create challenges.

Regardless of these challenges, Jet2’s robust market place, money place, valuation, and strategic investments are compelling. That is why I’ll proceed wanting so as to add to my place at present costs.