Picture supply: Getty Photos

Excessive-yield shares will be engaging. However whether or not or not I believe they’re relies upon partly on the sustainability of the yield – and in addition the valuation implied by the share worth. Lately I’ve been weighing some execs and cons of including a FTSE 250 inventory to my ISA that yields 9.9%.

This may imply that, for each £1,000 I invested now, I might hopefully earn slightly below £100 in dividends annually.

Whether or not that finally ends up occurring in follow, although, would rely on what happens in future with the corporate’s dividend. No dividend is ever assured, in any case.

Monetary providers specialist

The FTSE 250 firm in query is abrdn (LSE: ABDN), the monetary providers supplier.

With a 30% share worth fall over the previous 12 months alone, and 47% over 5 years, the Metropolis clearly has issues concerning the firm’s attractiveness.

On the plus facet, abrdn has a well known model (albeit one whose worth I believe has been lowered with the weird elimination of most of its vowels), a big buyer base and operates in a market wherein I count on to see excessive long-term demand.

Regardless of that, the corporate has definitely been dealing with challenges. Revenues have fallen for the previous two years in a row, for instance.

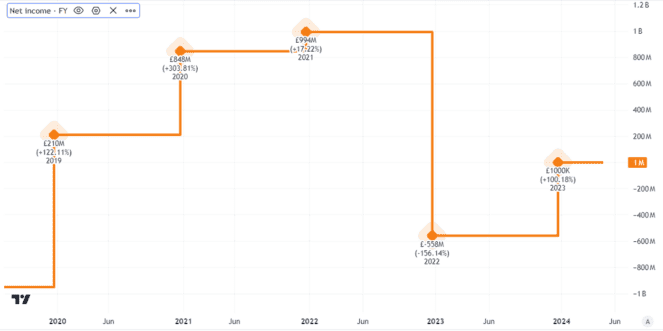

Additionally worrying, wanting on the firm’s internet earnings lately, there have been some dramatic swings. Some years have seen sizeable losses.

That raises questions on how effectively the corporate has been translating its enterprise belongings into monetary efficiency.

Can the dividend survive?

Final 12 months, for instance, the FTSE 250 enterprise made a post-tax revenue of simply £12m.

What does that imply for dividend sustainability?

Arguably, earnings are usually not the important thing factor to take a look at. They’re an accounting measure, however dividends are mainly funded out of money flows. So usually, an organization’s money flows will be extra informative about how effectively lined a dividend is than its earnings.

Right here once more, although, the image has been inconsistent.

In truth, abrdn’s free money movement image just isn’t solely inconsistent however fairly alarming. The enterprise has strengths however in some latest years it has seen important money exit of the door fairly than are available.

The annual dividend per share was reduce by virtually a 3rd in 2020.

Since then it has been maintained. However given the inconsistent enterprise efficiency I’m involved concerning the medium-term sustainability of the FTSE 250 firm’s dividend.

No plans to purchase

Clearly, administration is conscious that it faces challenges.

The agency is reducing prices and goals “to sustainably restore our enterprise to a extra acceptable degree of profitability”. The primary quarter noticed optimistic internet flows, which means purchasers are placing extra money in than they’re taking out.

However there may be clearly a whole lot of work to be carried out and the way that goes stays to be seen. So, for now, I cannot be shopping for, regardless of the juicy dividend yield.