Picture supply: Domino’s Pizza Group plc

DP Poland (LSE: DPP) shares rose 9.9% Thursday (27 March), bringing their one-month achieve to 13%. The five-year return is 82%, although it’s been a predictably bumpy journey for this penny inventory.

DP Poland is the operator of Domino’s Pizza shops and eating places throughout Poland and Croatia. What simply despatched the share value up? And does the information make me wish to make investments extra money?

Strategic acquisition

Yesterday, the agency introduced that it had acquired Pizzeria 105, the fourth largest pizza restaurant model in Poland, for round £8.5m. Pizzeria 105 is a franchised enterprise that operates 90 areas throughout the nation.

CEO Nils Gornall commented: “This acquisition fast-tracks our transition to a predominantly franchised, capital-light mannequin, with over half of our shops set to be franchise-operated from completion. By welcoming 76 skilled franchise companions, we increase our presence into 31 new Polish cities.”

Pizzeria 105’s primary supply of earnings was gross sales of products to its franchisee companions and royalty charges. The founder will stay a shareholder to make sure a easy transition and convey invaluable native experience, the client famous.

Lengthy-term plans

DP Poland says Pizzeria 105 is worthwhile and the deal is anticipated to be instantly earnings enhancing from completion.

That mentioned, the numbers are fairly small right here. Income was £1.7m final 12 months, with £1m in EBITDA, from £30.8m of system gross sales on the franchised shops. However DP Poland says they may profit from Domino’s model and advertising assist, which is able to present a path to drive a 56% larger order rely.

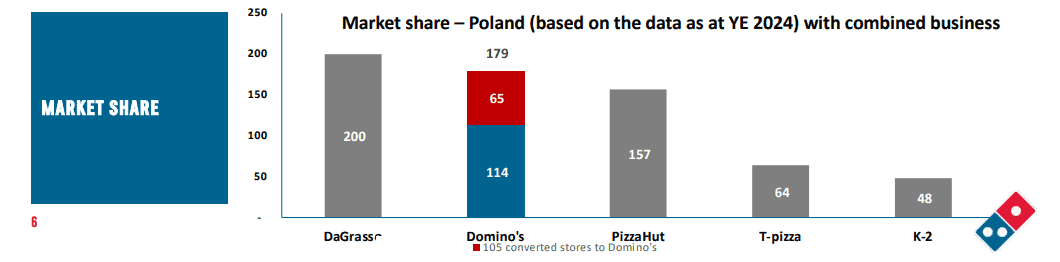

The deal additionally accelerates the corporate’s plan to have 200 Domino’s shops in Poland by 2027, with half of the shops franchise-owned. Long run, the corporate goals to have 500+ areas in Poland. Croatia is a a lot smaller a part of the enterprise for now.

Nonetheless loss-making

In 2024, like-for-like system gross sales grew 17.9%, marking the third consecutive 12 months of double-digit progress. Earlier than this acquisition, the agency was tipped to extend income to round £65.8m this 12 months, good for 23% progress. A primary revenue is likely to be additionally eked out.

Nonetheless, whereas current reductions in web losses and enhancements in EBITDA point out a constructive trajectory, DP Poland hasn’t but formally achieved web profitability. On the finish of 2024, it had £13.4m in money and was debt-free. However the truth that it’s nonetheless loss-making provides some danger right here.

Additionally, new shares are being issued as a part of the deal. Additional shareholder dilution can’t be dominated out.

Ought to I order in additional shares?

This acquisition suits in properly with the corporate’s plan to show Domino’s into the main pizza model in Poland. So I feel it may become a sensible transfer.

In contrast to many elements of Europe, Poland’s financial system is rising strongly. GDP progress was 2.9% final 12 months, beating forecasts, and it’s anticipated to speed up to at the very least 3% this 12 months, then 3.6% in 2026. That’s a supportive backdrop for client spending, eating out, and pizza deliveries.

If the corporate continues taking market share and turns worthwhile, I feel the inventory may commerce a lot larger than 10p within the years forward. For context, the market-cap right this moment is simply £92m.

Given the dangers although, I’m going to maintain this as a small however doubtlessly high-reward holding in my portfolio.