Picture supply: BT Group plc

I offered my BT Group (LSE: BT) shares final month regardless of the share value climbing 16% this yr. Whereas I don’t essentially remorse the sale, I’m now questioning if I ought to have held on to them.

One main firm thinks so: Bharti International not too long ago introduced plans to purchase a 24.5% stake in BT. The Indian multinational conglomerate is a mum or dad firm of Bharti Airtel, the bulk proprietor of the UK-listed telecoms firm Airtel Africa.

My sale was a part of a method to cut back my variety of holdings and rebalance the capital into defensive shares. Whereas it helped to decrease my threat rating, it additionally lowered my common dividend by stripping out BT’s respectable 5.5% yield.

So on reflection, was it the precise alternative?

Digital delays

My foremost concern about BT is the danger it poses with its weighty debt load. Years of funding into the group’s plans for a completely digital UK community have left it in a deep gap. The hassle has been additional delayed by disruptions, prompting the group to increase its anticipated completion date to the top of January 2027.

How far more debt will that add to its present sum of £18.5bn?

The determine is already significantly larger than its £14.3bn market cap. In fact, I’m not anxious that an organization as established as BT will fail. However in my expertise, debt and dividends don’t play nicely collectively.

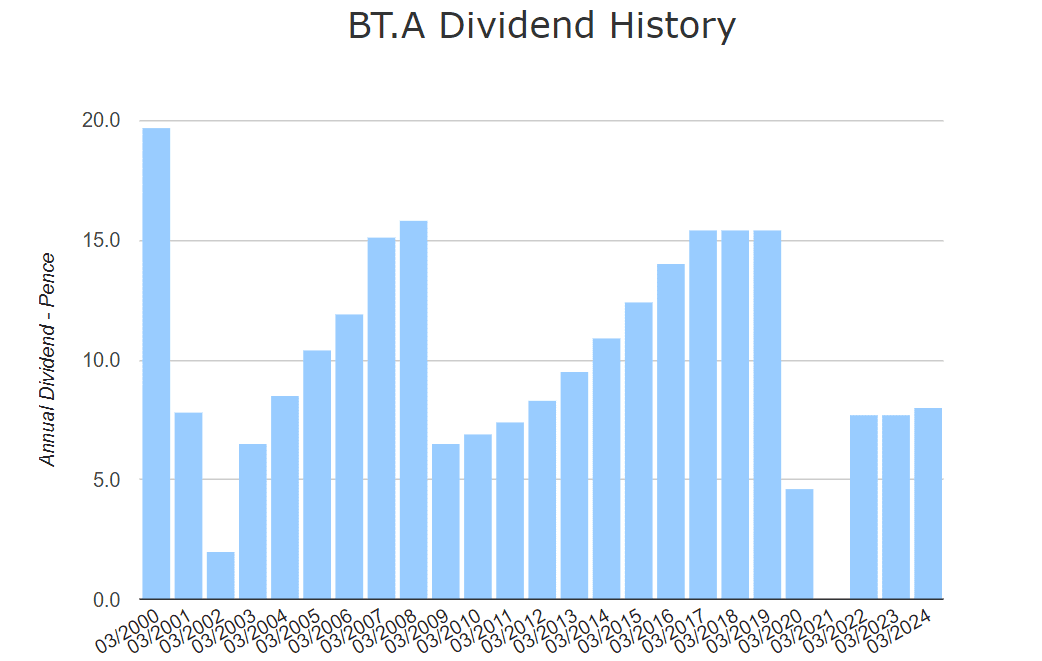

How lengthy earlier than it begins chopping dividends to fulfill debt obligations? It wouldn’t be the primary time — BT has minimize, lowered, or paused dividends 9 instances because the millennium started.

Holding afloat

For now, issues look okay. Working revenue (EBIT) is ample to cowl curiosity funds by 3.7 instances and the group’s annual 8p dividend per share is just under earnings per share (EPS).

There’s no rapid purpose to assume issues will flip south.

One promising metric is BT’s excessive earnings development potential. Future money stream estimates put the share value at 73% under truthful worth. With earnings anticipated to extend 68% within the coming 12 months, the group’s ahead price-to-earnings (P/E) ratio is 10.3. Even its trailing P/E ratio of 16.7 is under the business common.

The valuation is much like that of competitor Vodafone, with a P/E ratio of 19.2 and a share value undervalued by 69%. And as soon as Vodafone slashes its dividend to five% subsequent yr, the 2 firms will likely be very nicely matched (barring the excessive debt-to-equity ratio).

The underside line

From a risk-averse standpoint, I don’t really feel I used to be too hasty promoting my BT shares. If all the pieces goes easily with the digital improve, I’ll come to remorse the choice. BT seems to have respectable development potential so if it could keep away from additional disruption, I believe a 12-month value goal of 200p shouldn’t be unrealistic.

That mentioned, it could be some time earlier than I’m tempted to purchase again into the inventory. Till it exhibits indicators of creating severe inroads to decreasing its debt, I’m selecting to err on the aspect of warning.