Snapchat has printed its newest efficiency replace, which reveals a rise in customers in This autumn 2024, and a higher-than-expected income end result. Although issues nonetheless linger for the app, which stays at a troublesome level in its improvement.

First off, on utilization. Snapchat added 10 million extra customers in This autumn, taking it to 453 million each day actives.

Snapchat is nothing if not constant. When you take a look at the expansion figures right here, quarter on quarter, Snapchat has added nearly precisely the identical quantity, round 9 million additional customers on common, over the previous 5 quarters.

So Snap is rising, although it’s not gaining momentum. Which isn’t so dangerous, as including thousands and thousands extra actives is a optimistic, although its regional progress remains to be one thing to notice inside that broader growth.

As a result of whereas Snap is including customers within the “Remainder of world” class, it misplaced customers in America all year long, and was principally flat in Europe.

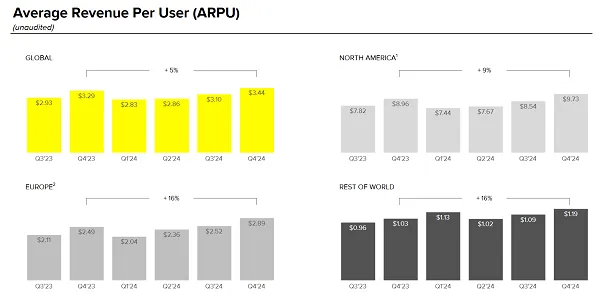

Which is a possible downside if you additionally consider these quantity:

Snapchat nonetheless makes far more cash from its North American customers, and people in additional developed markets. So whereas progress in Asia, most notably India, is propping up Snap’s numbers, it’s nonetheless not gaining within the areas that will be of most profit to its backside line.

That bodes properly for future potential, however much less so for its fast prospects.

But even so, Snap is being profitable, with the app posting a 14% year-over-year enhance within the quarter, bringing in $1.56 billion in whole.

For the yr, Snap generated $5.36 billion, a 16% year-over-year enhance. So Snap’s enterprise efficiency is enhancing, regardless of its lack of U.S. and EU person progress, which is a testomony to the Snap staff enhancing its advert choices, and maximizing its alternatives in key markets. Certainly, the corporate doubled its variety of energetic advertisers within the This autumn interval.

As per Snap:

“Direct Response advert income progress was up 14% year-over-year in This autumn and was the biggest driver of our advert income progress in 2024. Sturdy demand for Pixel Buy and App Buy Optimizations led to income from app-based buy optimizations rising greater than 70% YoY in This autumn.”

So Snap is doing higher with the alternatives that it has, and is constructing on its present viewers attain. And that’s driving outcomes which can be higher than many anticipated, although I stay cautious about its future growth prospects, as there are solely so many advertisements that it might probably show earlier than reaching saturation level.

By way of different alternatives, Snap says that Snapchat+ subscribers grew from 7 million to 14 million in 2024, with this system now bringing in an extra $500 million in annual income. That signifies that Snap added 2 million extra Snapchat+ subscribers over the Christmas interval, with its promotions round gifting Snapchat+ clearly having an influence.

Although that end result additionally serves as one other reminder of why subscription social is troublesome, as a result of regardless of all of Snap’s success, in getting 14 million folks to pay for its add-on options, it’s nonetheless only a fraction of the corporate’s total income.

Which is why Elon Musk’s bold plan to generate half of X’s income from subscriptions was all the time going to be a giant ask. For context, X Premium at present has round 1.3 million whole subscribers.

Snapchat+ has been much more profitable, offering a bundle of add-ons that Snap customers really need. Nevertheless it’ll all the time be a supplemental income stream.

By way of content material, Snap says that more than a billion Snaps have been shared publicly every month in This autumn, which can be a giant shift, on condition that Snap has historically been a extra non-public, enclosed platform. Its efforts to get extra creators sharing their updates within the app, through monetization incentives, is seemingly producing outcomes, although I’d additionally observe that the expansion of Highlight, its TikTok-like video feed, would have been one other key issue on this respect.

Nonetheless, extra publicly out there content material means extra choices to maintain customers entertained, and engaged within the app, so this can be a related observe for Snap’s alternatives.

On its future bets, Snap says that it’s lately developed a “groundbreaking” new generative AI mannequin, which is able to producing high-resolution pictures on cellular units “in simply seconds.”

The mannequin, Snap says, runs fully on system, which considerably reduces computational value in comparison with bigger, server-reliant fashions.

“We’re excited to convey this know-how into manufacturing within the coming months to assist energy a few of Snapchat’s AI options, similar to AI Snaps, AI Bitmoji Backgrounds, and extra. By implementing this in-house constructed know-how, we’ll be capable to supply our neighborhood quick, high-quality AI instruments at a decrease working value.”

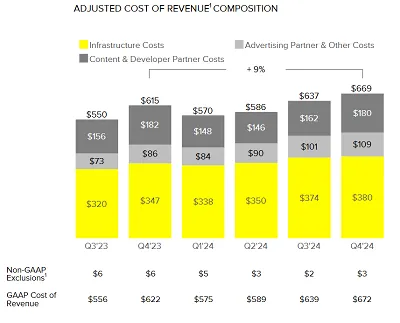

Which can be a worthy observe, contemplating Snap’s infrastructure prices are nonetheless rising.

A part of that, in fact, goes in the direction of its coming AR glasses, which it’s nonetheless testing with builders, with a view to a future launch.

Snap shared a primary take a look at the system final yr, and it says that these are actually within the arms of builders within the U.S., Austria, France, Germany, Italy, Netherlands, and Spain.

Snap additionally lately introduced a brand new program that’ll allow academics and college students to entry its AR glasses at decrease value, which it’s hoping will likely be one other avenue to broader adoption of its AR system.

However I don’t see it. I don’t see how Snap has any probability of with the ability to produce these glasses at decrease value with out them being of considerably decrease high quality than Meta’s coming AR system, whereas Meta’s glasses, by way of its partnership with EssilorLuxottica, usually tend to be extra trendy and interesting to a broader audiences.

And Meta’s Ray Bans, now with entry to Meta AI, are already common, so I don’t see how Snap plans to viably compete with Meta for market share, on condition that Meta’s eventual AR glasses will likely be higher trying, doubtless cheaper, and extra technologically developed than Snap’s AR spectacles.

Possibly Trump’s tariffs on China will have an effect, although with Zuckerberg seeking to cosy as much as staff Trump wherever he can, that additionally appears extra more likely to profit Meta over Snap.

There could possibly be one thing that I’m lacking, but when I have been a Snap investor, I’d be pushing for extra particulars on the roadmap for this mission. And if it’s simply “Tackle Meta and hope for the very best,” possibly it’s time to tug the plug and focus on different areas.

Both manner, Snap’s nous for AR results stays a major promoting level, with Lens utilization (when it comes to posted Snap’s that used Lenses) rising 49% year-over-year.

It’s a optimistic report card for Snap total, and a stable endorsement of its enterprise focus, which has seen it put extra effort into signing up extra advert purchasers, and making extra money, versus counting on the advantages of ongoing progress. As a result of whereas Snap is rising, it’s not shifting in its key income markets, which has put extra give attention to capitalization, versus growth in these areas.

And that’s additionally a unfavourable, as a result of if Snap’s progress is restricted, and/or it’s reached its peak in these areas, then it might probably solely make a lot income from these customers. Which places extra stress on the corporate to enhance its prospects elsewhere, by way of new partnerships in Asia and EU. Asia may current extra potential on this respect, however EU is all the time robust, and I’m unsure I’d be banking on that being a pathway to vital income progress.

Which signifies that the issues for Snap stay, with reference to the place it goes subsequent, and what it does to considerably drive its market trajectory. Certain, enchancment within the U.S. is nice, however should you’re not including customers, that’ll even be restricted, and the numbers right here may simply be reflective of the vacation promotions blitz.

Snap’s Q1 2025 outcomes may inform a unique story, whereas I stay skeptical of its future progress plans, each in AI and AR, as a result of scale of competitors stacked in opposition to it.