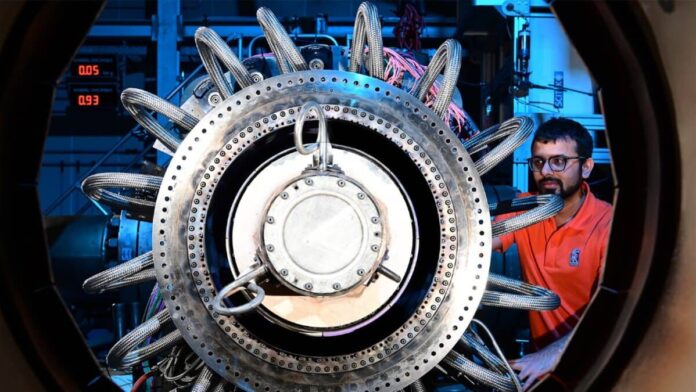

Picture supply: Rolls-Royce Holdings plc

From near-extinction to report highs, Rolls-Royce (LSE: RR) shares have staged a very epic comeback.

Just below 4 years in the past, the FTSE 100 inventory was buying and selling for a mere 39p. Right this moment, it’s altering fingers for 470p. That interprets right into a staggering 1,103% enhance!

This implies Rolls-Royce is a 10-bagger or extra for these sensible sufficient to have invested close to the pandemic low.

Sadly, I solely cottoned on to the massive turnaround potential later. After some dithering, I lastly pushed the purchase button at 149p.

I’m eager so as to add to my holding however the share value hardly ever stops for breath. Is now the proper time to purchase?

One other upbeat replace

In Could, the engine maker delivered a constructive buying and selling replace forward of its half-year outcomes on 1 August.

Chief Government Tufan Erginbilgiç stated: “We’re driving progress, delivering contractual enhancements and improved margins, unlocking efficiencies and creating worth throughout the group. We’ve had a powerful begin to the 12 months…[which] gives additional confidence in our steering for 2024.”

Within the 4 months to 30 April, massive engine flying hours returned to 100% of pre-pandemic ranges, and will rise by one other 10% for the complete 12 months. That is being pushed by the continued restoration of worldwide air site visitors in Asia.

In the meantime, the agency’s fleet continues to develop, with a considerable latest order for 60 Trent XWB engines from IndiGo. This was its first ever take care of India’s largest airline, which retains 60% share of the home passenger market regardless of having a fifth of its fleet grounded because of the failure of engines made by Pratt & Whitney, a US rival to Rolls-Royce.

India might be a really massive progress market transferring ahead.

It goes on

The agency’s defence enterprise can also be rising as nations beef up their militaries. Australia has confirmed spending for the AUKUS submarine programme, which incorporates Rolls-Royce reactors. AUKUS is a trilateral defence pact for the Indo-Pacific area between Australia, the UK, and US (therefore the identify).

The corporate additionally highlighted latest upgrades from the three main credit score rankings companies. And it has decreased its gross debt place by repaying a €550m bond from underlying money.

One ever-present threat here’s a main engine recall, as has occurred with RTX-owned Pratt & Whitney. In September, RTX stated it expects this engine problem to price as much as $7bn. This contains compensating prospects for misplaced capability.

What about valuation?

Presently, the inventory is buying and selling at 31 occasions ahead earnings. That’s greater than BAE Techniques (20.4) and RTX (19.7).

Then once more, Rolls-Royce is predicted to develop quickly. By 2027, it’s aiming for underlying working revenue of £2.5bn-£2.8bn, an working margin of 13%-15%, and free money stream of £2.8bn-£3.1bn. It’s heading in the right direction to attain this.

In 2027, the agency is forecast to submit earnings per share of 23p. If it does, the ahead earnings a number of is round 20 occasions for 2027.

So the inventory could also be overvalued within the close to time period however respectable worth over the long term, if these forecasts show right.

For me, I stay bullish right here. As world airways add to their fleets and extra planes are flown, Rolls-Royce ought to generate regular streams of earnings for many years.

If the August half-year replace is constructive, I could properly purchase extra shares.