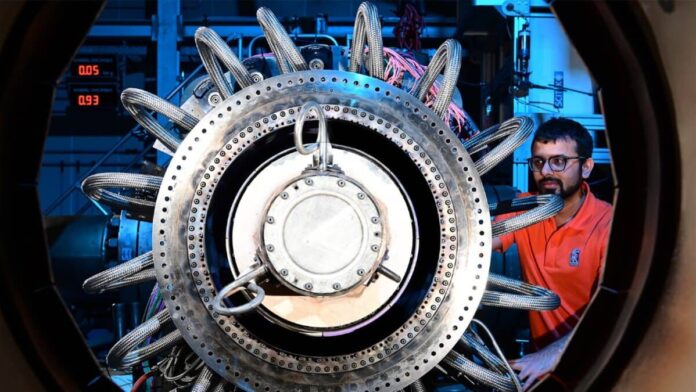

Picture supply: Rolls-Royce Holdings plc

Surely, Rolls-Royce (LSE: RR.) shares — and anybody holding them — loved a incredible 2023. Had I invested roughly this time final yr, I’d have greater than trebled my cash in simply 12 months.

That’s the kind of barnstorming efficiency I’d count on from a sizzling tech inventory that’s unveiled the ‘subsequent massive factor’. It’s not what I’d anticipate from a lumbering FTSE 100 engineer.

Does it make sense to say that this inventory has exceeded its attain and is about for a a lot completely different 2024? Probably not.

You ain’t seen nothing but!

One of many causes the shares have stored motoring larger is the large and ongoing restoration within the journey business.

After a number of lockdowns, many people merely couldn’t wait to get away after the pandemic. And plenty of the plane we boarded stayed within the air through the corporate’s engines which, naturally, require ongoing upkeep. All this was nice information for the corporate’s backside line.

One wonders whether or not the prospect of rate of interest cuts later within the yr may present one other increase to demand as discretionary spending rises. And on a extra miserable word, the agency’s Defence division can also proceed to profit from protracted geopolitical tensions.

I have to say that CEO Tufan Erginbilgic comes throughout as very spectacular too. Fairly frankly, Rolls-Royce was in such a state that it required a no-nonsense chief. And following job cuts and far streamlining, that’s precisely what it now appears to have.

When buyers sense that they’ve received the appropriate individual on the helm and the outlook on buying and selling is sufficiently sturdy, they’re extra prepared to stay round.

Not a basket case

However share value actions over the close to time period are as a lot depending on human feelings as numbers on a spreadsheet. And that is the place the funding case begins to wobble for me.

It’s honest to say that the Rolls-Royce share value has galloped larger as a result of expectations surrounding the corporate had been arguably as soon as as little as they could possibly be.

Who wished to personal an organization making engines that weren’t even getting used? Not me. Who wished to personal an organization that was drowning in its personal complexity and a dollop of debt? No, thanks.

However braver contrarians believed the agency was so hated that the one approach was up — as long as it didn’t exit of enterprise. It’s an irritatingly easy thought in hindsight. And it was proper.

Traders are promoting…

The issue is that issues at the moment are fairly completely different. Whereas the Metropolis specialists are projecting nice progress in 2024, this appears to be greater than priced in.

Rolls-Royce shares change palms for twenty-four occasions forecast earnings. That suggests near-perfect execution going ahead.

The difficulty is that the extra we count on, the larger the danger of being upset. And there’s at present no dividend stream to compensate for any ache if we’re.

Apparently, I seen that the corporate was solely the eighth hottest purchase at funding platform Hargreaves Lansdown final week. It was nevertheless, the preferred promote.

One week of buying and selling gained’t inform us a lot. However as long as the value seems updated with the (good) information, I ponder whether we would see extra profit-taking in 2024.

Has the ‘simple cash’ been made? Solely time will inform.