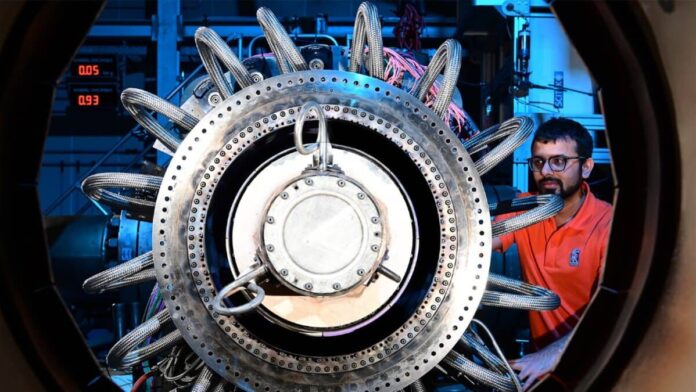

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce Holdings shares have hit all of the headlines this 12 months, with the value up 150% previously 12 months. Does the valuation look a bit toppy, although?

On a forecast price-to-earnings (P/E) ratio of 28, I feel it simply could be. A minimum of for now.

However I feel different aerospace and defence shares have handed underneath the radar. And I reckon QinetiQ (LSE: QQ.) could possibly be one in every of them.

Sturdy forecasts

Each corporations are on sturdy forecasts for the subsequent few years. And whereas I do fee Rolls-Royce as a top quality firm for a long-term purchase, I’m extra drawn to the QinetiQ valuation.

Forecasts put the P/E at 15, and right down to 12 by 2026. Dividends are anticipated to be a bit higher too, at 2% to 2.5%, although it does appear like Rolls ought to catch up.

On high of that, QinetiQ launched a brand new share buyback at Q3 outcomes time in January.

Buyback

CEO Steve Wadey mentioned: “Given the group’s excessive money technology and confidence within the long-term outlook, we’re happy to announce the launch of a £100m share buyback programme to extend returns to shareholders, while sustaining the flexibility to ship our long-term progress technique.“

We should always have a This autumn replace on 16 April, with FY outcomes on 23 Could.

Defence increase

The human tragedy of world battle has been appalling in recent times. However the Russian invasion of Ukraine has already led nations in Western Europe to lift the extent of their defence spending.

Even on the interim stage, QinetiQ posted a 19% rise in orders, for a brand new file excessive of £953m. Income within the half rose by 31%, with underlying working revenue up 35%. On an natural foundation, these positive factors have been 19% and 25% respectively.

There’s a hazard right here, although. If these interim figures weren’t sufficient to push the valuation up very far, what do traders fear about?

Cyclic danger

It might nicely be the cyclical nature of the enterprise. When present orders are all stuffed, European states are beefed as much as full defence energy, and the struggle ends, would possibly corporations like QinetiQ face a dry spell?

That’s why I’d warning in opposition to relying an excessive amount of on issues like P/E measures for any business that may see large swings in demand.

I’m additionally a bit cautious of debt. And the steadiness sheet confirmed a small rise on the midway stage, to £273.8m.

Nonetheless, in January’s buyback announcement, the agency did say it has a web debt/EBITDA ratio of lower than 1.5 instances. So possibly I’m unduly involved, at the least for now.

Diversification

Considering again to Rolls-Royce, there’s a extra numerous enterprise there. Whereas QinetiQ will depend on defence, Rolls can also be large in civil aviation, energy technology… and simply has its fingers in additional pies.

So there’s acquired to be extra security there, and which may justify the upper valuation for Rolls-Royce shares.

However QinetiQ is unquestionably on my ISA candidates checklist. It’s fairly a giant checklist, thoughts — greater than my financial institution steadiness.