Picture supply: Getty Photographs

One frequent plan at the beginning of the 12 months is to speculate. However whereas many individuals see any given 12 months because the one wherein they’ll begin shopping for shares, such plans can fall by the wayside even earlier than January is out.

A typical purpose for that’s lack of funds. There at all times appear to be different calls for on our cash.

However in truth, it doesn’t essentially take a big amount of cash to begin shopping for shares. Right here is how an investor might achieve this this January (in truth this week), in three steps.

Step 1: establishing a dealing account

When the second comes to really purchase shares, there must be a means to take action. Reviewing the choices for how you can purchase and promote can take time and so can establishing an account.

So I feel it is smart to begin by deciding on the share-dealing account or Shares and Shares ISA that fits a person’s wants greatest and get the ball rolling.

Step 2: perceive some key ideas of investing

Subsequent I feel it is smart to grasp some primary ideas about what makes for good investing.

For instance, think about Apple (NASDAQ: AAPL). The corporate’s share worth has soared over time. Certainly, it has greater than tripled up to now 5 years alone.

On prime of that, the tech large is massively worthwhile.

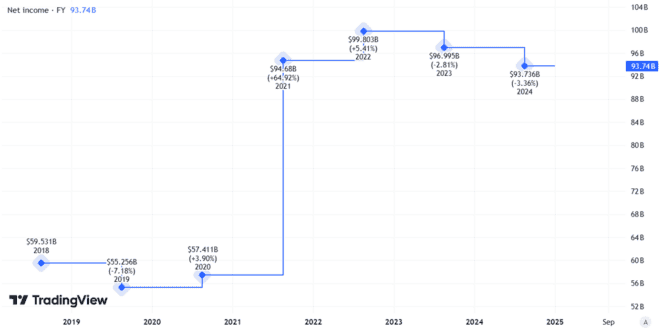

In recent times, the corporate’s annual web revenue has been not far off $100bn, which I discover a staggering quantity.

Created utilizing TradingView

Nevertheless, discover that within the chart above the online revenue – whereas nonetheless huge – has truly declined.

That might mirror dangers resembling rising competitors from extra competitively priced Asian telephone firms, in addition to elevated prices from disrupted provide chains. I feel each stay dangers for Apple’s earnings.

Nonetheless, on the proper worth I want to personal the share. Its goal market is large and it enjoys what Warren Buffett (a giant Apple shareholder) calls a ‘moat’: aggressive benefits resembling its model and proprietary expertise.

However earlier than I begin shopping for shares in what I feel is a superb enterprise, I think about whether or not it may additionally be an ideal funding. Largely that may rely upon what I pay for the share. An awesome enterprise just isn’t essentially an ideal funding.

So, from day one buyers want to grasp some primary ideas of valuation.

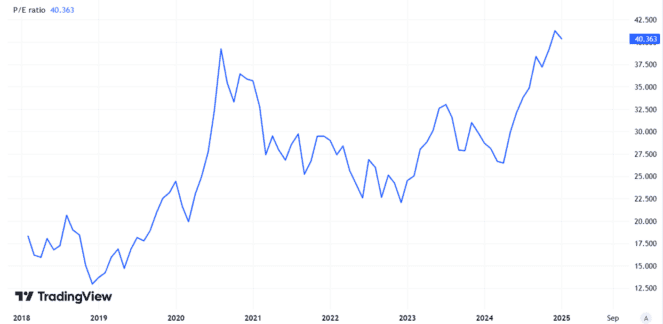

For instance, Apple’s share worth is at the moment 40 instances annual earnings per share. That’s too excessive for my style and explains why I’ve no plans to purchase the share. It’s also near its highest degree for years.

Created utilizing TradingView

Step 3: begin constructing a share portfolio

Having acquired to grips with such ideas, I feel a brand new investor might be able to make a purchasing listing and begin shopping for shares.

One easy however vital risk-management precept is diversification and £500 is sufficient to unfold the alternatives over a number of completely different shares.

Now the important thing query is: which of them?