Picture supply: Getty Photographs

Warren Buffett first purchased Apple (NASDAQ:AAPL) shares in 2016 and the outcomes have been spectacular. However is the inventory nonetheless a very good funding?

It’s a lot more durable to see Apple shares as a cut price at immediately’s costs. However I believe there are causes to be constructive on it for buyers keen to look beneath the floor.

Funding returns

Accounting for change charges and inventory splits, 5 years in the past, £10,000 would have purchased me 310 shares in Apple. The market worth of that funding immediately can be £45,255.

That’s a median annual return of 35% per 12 months. However with a market cap of round $2.8trn and buying and selling at a price-to-earnings (P/E) ratio of just below 30, it’s tough to suppose this will proceed.

One large cause for that is that the corporate’s income development has been slowing – and even stalling. Over the past decade, gross sales have grown at a median of round 7%, which is regular however not spectacular.

A 13% decline in revenues from China – which accounts for round 20% of whole gross sales – is a part of the issue. However I believe buyers ought to look past top-line development when contemplating Apple shares.

Margins

Not all development is income development – a method for a corporation to make more cash is by increasing its margins. And I believe that is the important thing for Apple going ahead.

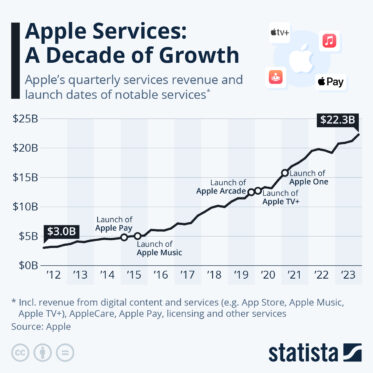

The corporate divides its income into two sources. There’s what it generates from promoting merchandise like iPhones, and providers income that comes from locations just like the App Retailer.

The margins in these completely different operations are very completely different. Gross margins within the merchandise division are round 39%, in comparison with 73% within the providers a part of the enterprise.

This implies Apple doesn’t must develop its general gross sales to extend its earnings. Larger revenues in its providers enterprise will increase earnings even when the highest line as an entire doesn’t enhance a lot.

Progress

I believe that is the important thing to future development for Apple. Gradual development in general revenues masks the truth that gross sales within the agency’s providers division have elevated by a median of twenty-two% over the past decade.

That is the place I believe the corporate’s future development goes to come back from. This a part of the enterprise is producing report gross sales and isn’t actually displaying a lot signal of slowing down.

In accordance with Apple’s newest report, revenues from its providers enterprise elevated by 11% over the last three months of 2023 and this offers a giant increase to earnings.

Given this, I believe buyers who suppose the inventory is overpriced as a result of general income development has been gradual recently are making a mistake. There’s way more to consider right here.

Endurance

In some ways, Apple is a good demonstration of what Warren Buffett seems to be for in a inventory to purchase. It’s a enterprise that has demonstrated the flexibility to continue to grow its earnings steadily over a very long time.

I don’t suppose that is prone to change any time quickly. That’s why I maintain the inventory and I’m on the lookout for a possibility to purchase extra of it.