Picture supply: Getty Photos

Passive investing has turn into the automobile of alternative for many buyers as we speak. It’s straightforward to see why. On the depths of the worldwide monetary disaster in early 2009, the S&P 500 sat at 750 factors. Since then, the index has gone on the largest bull market in its historical past and now trades at over 6,000. An increase of over 700% implies that a £10,000 funding made then could be price £70,000 as we speak.

Environment friendly market speculation

Passive investing can hint its roots again to the Sixties in a tutorial principle often known as the environment friendly market speculation. The thought behind this principle is which might be so many good, lively managers doing elementary and valuation evaluation that shares all the time commerce at their honest market worth. This reality makes it tough for lively managers to persistently beat the market.

Initially confined to giant pension funds, passive investing methods started to go mainstream within the late Nineteen Nineties. At this time, index funds, and the newer innovation of exchange-traded funds (ETFs), are marketed as a low-cost, diversified method to investing.

S&P 500 bubble

Passive investing is a superb technique when a inventory market is rising. However the inexorable rise of the US inventory market over the previous 15 years is, I consider, breeding complacency.

One space that has involved me for a while is inventory market focus. If I put money into an S&P 500 tracker, I’m supposedly shopping for right into a broad basket of shares throughout completely different sectors. However that isn’t the case anymore on condition that the highest 10 holdings are predominantly within the know-how area and account for 34% of your entire weighting.

Simply because a passive investing technique has labored so nicely previously, doesn’t imply it would proceed to take action. And one full unknown as we speak is that most of these funding autos have by no means been examined in a real bear market. In any case, the 2020 decline lasted only a handful of weeks and the decline in 2022 lasted solely 9 months.

I’m nonetheless choosing shares

A small share of my Shares and Shares ISA portfolio is allotted to an S&P 500 tracker. However for me now isn’t the time to be asleep, which is why I predominantly decide my very own shares.

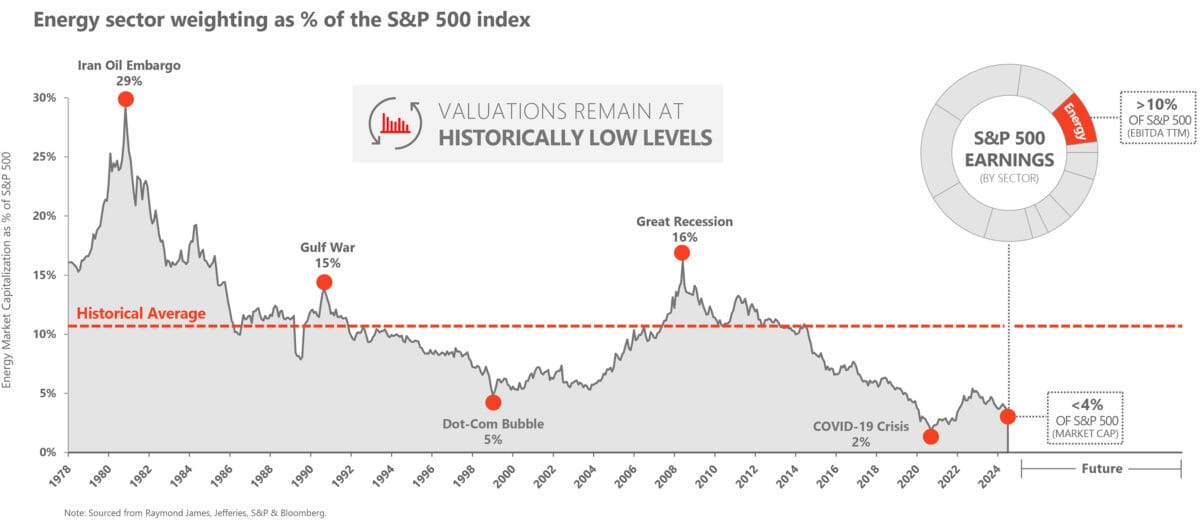

One sector that I stay bullish on in the long run is vitality. The next chart from Devon Power, highlights how distorted the market has turn into. The mixed weighting of the highest three shares, Apple, Nvidia, and Microsoft is 5 occasions your entire vitality market. That to me screams alternative.

Supply: Devon Power

I’m of the view that we’re getting into a section the place demand for vitality goes to soar. Onshoring of producing functionality within the US continues at tempo. The acceleration of the inexperienced revolution will, paradoxically, drive a surge in demand for vitality, as the results of extremely energy-intensive mining operations for metals.

However the largest driver for vitality will come from the tech firms themselves. Knowledge centre progress to handle generative AI capabilities will see an explosion in vitality demand like we now have by no means witnessed earlier than.

I significantly like BP and Shell due to their ultra-cheap valuations in comparison with their US friends. Neither is priced to mirror what I see as an oncoming tsunami in demand over the following decade and extra.