Picture supply: Getty Photographs

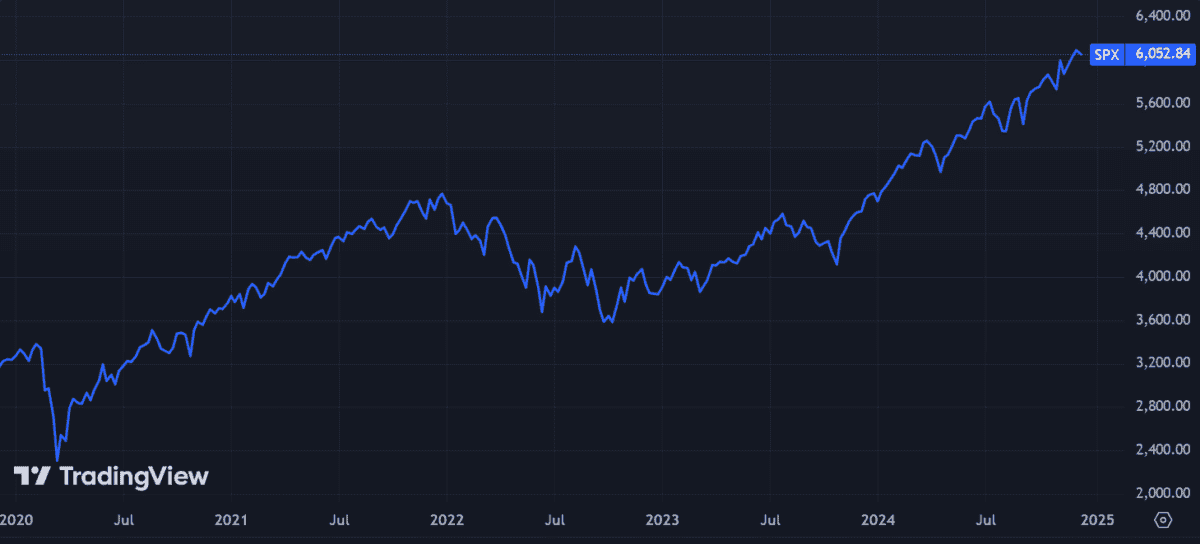

Since its inception in 1957, the S&P 500 — which includes the five hundred largest US corporations by market capitalisation — has offered robust returns whereas serving to shareholders to successfully diversify their portfolios.

If somebody had invested invested £30k 10 years in the past, how a lot would they’ve now?

Robust returns

Since 9 December 2014, the S&P 500 has risen a powerful 196% in worth. That equates to a mean annual return of 11.4%.

However that’s not together with dividends paid out throughout this time. With shareholder payouts included, the index’s common yearly return rises to a powerful 13.7%.

To place that into context, the typical annual returns (together with dividends) of the FTSE 100 and FTSE 250 sit means again, at simply above and beneath 6%, respectively.

So how a lot would the S&P 500’s robust efficiency have delivered in money phrases? Had somebody invested £30,000 in an S&P 500 index fund again in late 2014, they might now — with dividends reinvested — be sitting on a whopping £117,148.

Tech focus

The most important corporations within the US index are tech corporations, a sector that’s not effectively represented within the UK. And I feel these tech giants will proceed to push the S&P 500 increased.

These companies have soared in worth amid investor buzz over the evolving digital panorama. Extra just lately, market pleasure over synthetic intelligence (AI) — helped by robust buying and selling updates from Nvidia, Alphabet, and Microsoft — have boosted demand for his or her shares.

However AI isn’t the one recreation on the town. There’s a large number of different tech progress segments that would elevate the S&P over the long run, together with:

• Cloud computing

• Inexperienced expertise (together with renewable vitality and electrical automobiles)

• Robotics

• Cybersecurity

• Quantum computing

• The Web of Issues (IoT)

• Autonomous automobiles

A prime inventory I’m contemplating

To capitalise on these themes myself, I’ve added a few US exchange-traded funds (ETFs) to my portfolio.

One is the broader HSBC S&P 500 ETF, giving me publicity to the entire index. The opposite is the iShares S&P 500 Info Expertise Sector ETF, which provides me extra focused entry to tech shares.

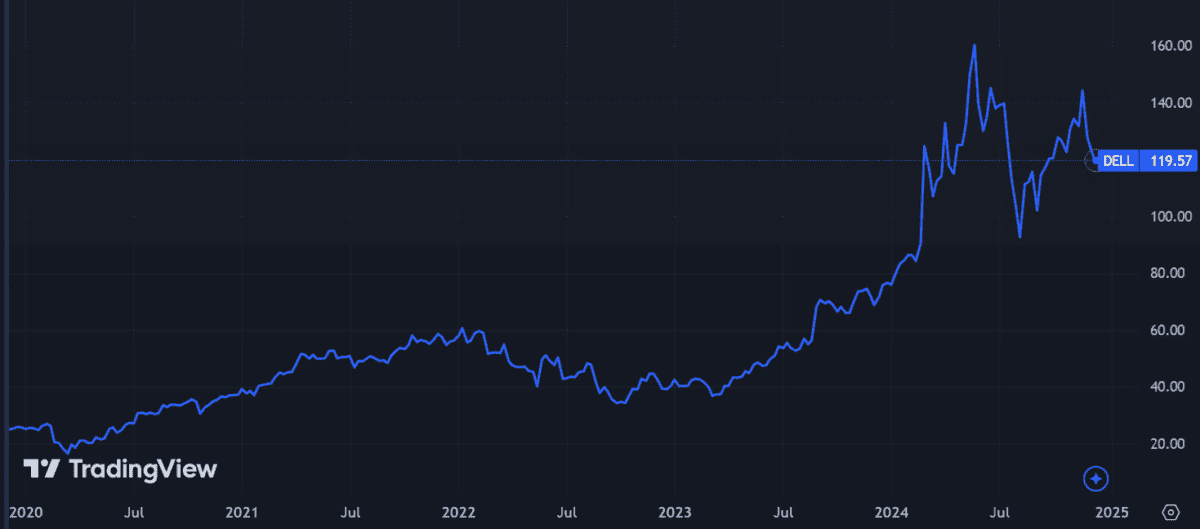

With my quest for diversification achieved, I’m additionally trying to enhance my returns by shopping for some particular person shares. Dell Applied sciences (NYSE:DELL) is one US share I’m contemplating at present.

Like Nvidia, the enterprise can be betting huge on the AI revolution. However to this point it hasn’t loved the identical spectacular outcomes, and so it doesn’t have the identical sky-high valuation as its tech rival.

Dell’s ahead price-to-earnings (P/E) ratio is 15.8 instances. That’s fairly low in comparison with the broader tech sector and effectively beneath the Nvidia’s hulking ratio of 47.1 instances.

It might not be reaching the identical spectacular outcomes as Nvidia simply but, however it has been making critical progress in AI.

Between September 2023 and June, it bought a powerful $3bn price of AI servers. And it reached a major milestone in November by promoting Blackwell server racks, the primary that use liquid cooling expertise. This may very well be a game-changer in vitality effectivity and server efficiency.

Though Dell faces substantial competitors within the AI area, I consider it’s a beautiful inventory for me given its encouraging latest progress — and particularly at present costs.