Picture supply: Getty Photos

“Diversification is the one free lunch in investing,” in accordance with the late economist Harry Markowitz. A method traders can diversify their portfolios is by investing an index just like the FTSE All-Share.

I’m unsure whether or not Markowitz would or wouldn’t have put his personal cash on this UK share index at this time. However as a house to a large spectrum of progress and revenue shares, it supplies traders an opportunity to make huge returns whereas additionally spreading danger.

In addition to the FTSE 100 and FTSE 250, the FTSE All-Share additionally contains the FTSE Small Cap Index. In whole, it covers round 98% of your complete market capitalisation of the London inventory market.

However how a lot would ISA traders have at this time if they’d invested £20,000 within the index a decade in the past?

Strong return

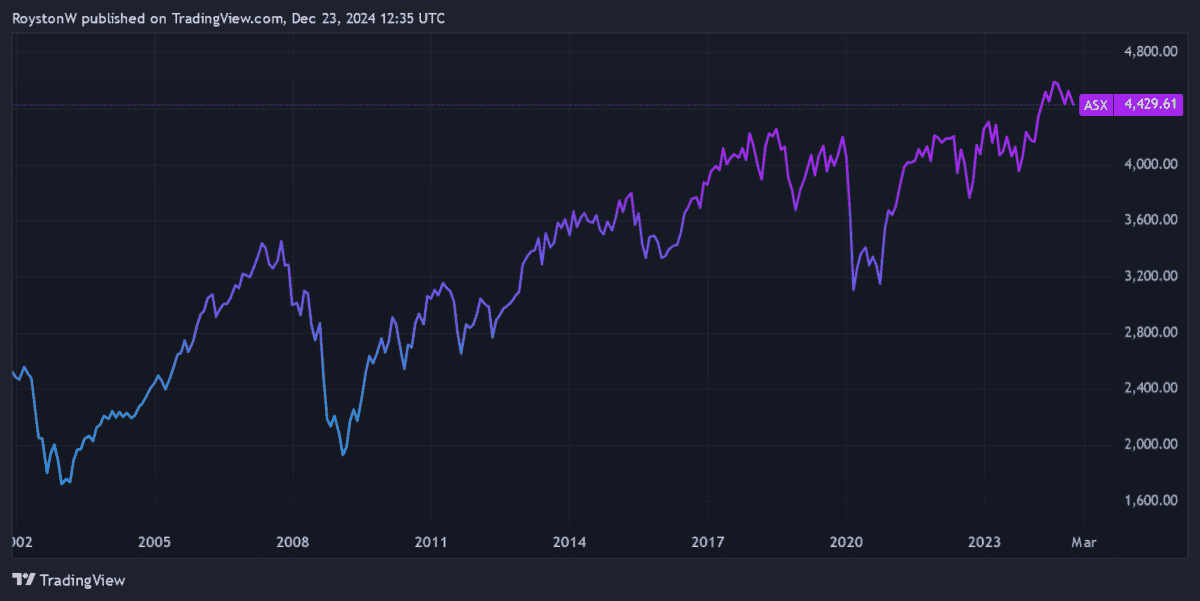

Since 23 December 2014, the FTSE All-Share has risen 24.9% in worth. Mixed with dividends, the typical annual return for the index comes out at 6.1%.

This efficiency means somebody who invested £20k — the utmost yearly allowance for a Shares and Shares ISA — would now be sitting on £36,752, give or take a couple of pennies.

That’s not a foul consequence. The truth is, it’s higher than the 5.5% common annual return the FTSE 250 would have supplied, together with the Footsie’s corresponding return of 6%.

An vital caveat

That stated, the FTSE All-Index’s returns are nonetheless far lower than what a lump sum funding may have achieved elsewhere.

Let’s say an investor determined to park their money within the S&P 500 as a substitute. Based mostly on a mean annual return of 11.3% since 2014, a £20,000 lump sum in an index fund would have made them a whopping £61,587.

Previous efficiency isn’t any dependable information to future returns. And following latest underperformance, some analysts imagine UK equities may outperform lots of their abroad friends in future, given their superior worth.

Nevertheless, there are additionally causes to count on UK shares to maintain lagging. The US inventory market has a excessive focus of high-growth tech shares that might drive it increased. Moreover, indicators of revived weak spot within the British financial system may weigh on home share costs.

One high inventory

Thus far, I haven’t been tempted to purchase a UK tracker fund. As a substitute I’ve purchased one which tracks the S&P 500, together with a few US-focused sector and thematic exchange-traded funds (ETFs).

Nevertheless, I’ve additionally bought some particular person UK shares I believe may outperform the market. Video games Workshop (LSE:GAW), an enormous within the tabletop gaming trade, is one I’ve elevated my holdings in throughout 2024.

Over the previous decade, it’s delivered a mean annual return of 40.3%, pushed by surging world curiosity in fantasy wargaming. It’s now a proud member of the FTSE 100 membership following promotion this month.

The identical robust efficiency isn’t assured. However I’m assured it might proceed its proud report as retailer numbers develop all over the world, and it appears to supercharge royalty revenues by movie and TV offers with Amazon.

Earnings may sluggish throughout financial downturns. However on stability, I believe this progress share will stay a greater funding for me than a FTSE All-Share tracker fund.