Picture supply: Getty Pictures

Defence is a sector I need extra publicity to inside my Self-Invested Private Pension (SIPP). With a number of wars raging and stress between among the world’s strongest nations rising, I feel allocating some capital to this business is a great transfer.

Now, one solution to get publicity to defence is to spend money on British agency BAE Techniques (LSE: BA.). I’ve taken a distinct strategy nevertheless, and acquired a defence Change Traded Fund (ETF) for extra diversified publicity to the theme.

I nonetheless like BAE Techniques shares

BAE Techniques shares do look fairly enticing to me. Proper now, the corporate’s income and earnings are rising at a fairly wholesome fee as nations scramble to guard themselves. Subsequent yr, they’re projected to develop 8% and 12% respectively.

In the meantime, the valuation appears affordable. With analysts anticipating earnings per share (EPS) of 75.9p for 2025, the forward-looking price-to-earnings (P/E) ratio is 16.4 – solely just a little bit above the market common.

With a single inventory nevertheless, there’s no assure I’ll profit from the expansion of the defence business. That’s as a result of there’s all the time a level of company-specific threat.

On this case, governments may award contracts to different main defence contractors similar to Lockheed Martin and L3Harris. Or defence spending may very well be centered on areas that BAE doesn’t specialize in (eg synthetic intelligence (AI)).

So I made a decision to take a extra diversified strategy to the defence sector and I purchased an ETF for my portfolio. This reduces stock-specific threat significantly.

In 37 years within the intelligence occupation, I’ve by no means seen the world in a extra harmful state.

Sir Richard Moore, MI6 Chief

Broad publicity to the defence business

The fund I went for was the HANetf Way forward for Defence ETF (LSE: NATO). This can be a comparatively new product that was solely launched in 2023.

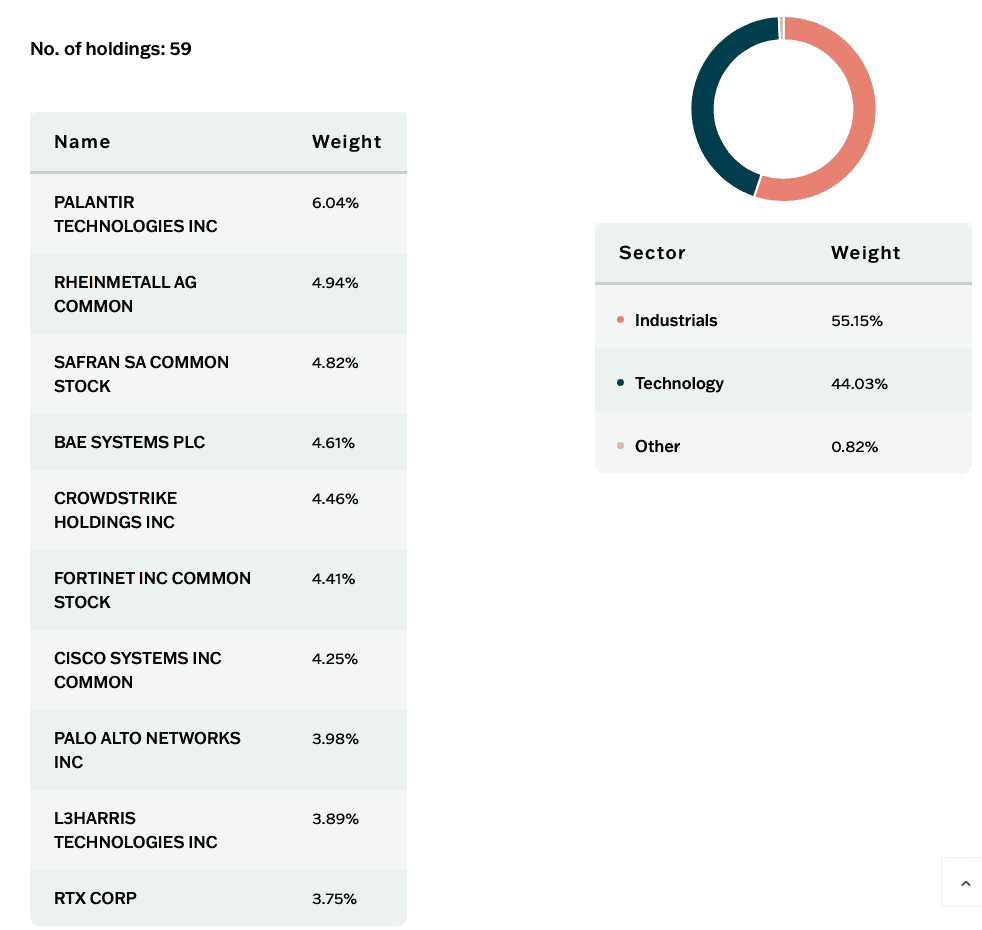

What I like about this ETF is that it provides me publicity to many alternative defence corporations (together with BAE Techniques). In complete, there are practically 60 shares within the portfolio (from a number of geographic areas together with the US, Europe, and the UK).

I additionally like the truth that there are corporations which might be closely concerned in cybersecurity and AI similar to Palantir Applied sciences and CrowdStrike. The character of defence is quickly evolving and these sorts of corporations give me publicity to cutting-edge applied sciences which might be shaping the way forward for the business.

As for charges, they’re fairly affordable at 0.49% a yr. I additionally must pay buying and selling commissions to purchase and promote nevertheless, on condition that it’s an ETF.

After all, there are nonetheless no ensures I’ll do effectively with this funding. If international spending on defence was to drop, the sector, and this ETF, may underperform. Equally, if cybersecurity shares have been to expertise a pullback, the product may wrestle.

I’m optimistic it can do effectively over the long term although. Within the years forward, I count on authorities spending on defence to stay excessive.