Picture supply: Getty Pictures

Authorized & Common (LSE: LGEN) is a well-liked earnings inventory and it’s straightforward to see why. Lately, it’s been an absolute money cow. Can traders anticipate an enormous payout for 2024? Let’s check out the dividend forecast.

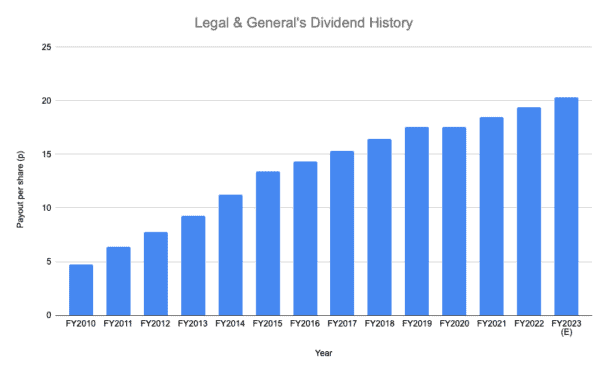

Authorized & Common’s dividend historical past

Earlier than we take a look at the forecast for 2024, it’s price bearing on Authorized & Common’s latest dividend monitor report. As a result of it’s spectacular.

Certainly, since FY2010, Authorized & Common has both maintained or elevated its payout yearly. And in that point, the distribution has risen significantly.

Again in FY2010, the overall payout was simply 4.75p per share. For FY2022, nevertheless, it was 19.37p per share. That represents development of 308%, or 12.4% a yr on an annualised foundation.

It’s price noting that, on account of its dividend monitor report, Authorized & Common is a part of the S&P UK Excessive Yield Dividend Aristocrats Index. This options high-yielding UK shares which have managed to keep up or improve their dividends for no less than seven consecutive years.

Given its inclusion on this unique group, I feel administration is more likely to do all the pieces it could to keep up the wonderful dividend monitor report within the years forward.

2024 forecast

As for the forecast for 2024, the consensus estimate is at the moment 21.4p per share.

That’s one other huge payout. At as we speak’s share worth of 251p, that equates to a yield of round 8.5%.

Be aware nevertheless, that Authorized & Common usually pays its dividends in June and September. The June payout is the ultimate one from the earlier yr , whereas the September distribution is the interim payout for the present yr.

So the distribution for FY2024 is more likely to be paid in September after which June 2025.

No ensures

Now, it’s price stressing that analysts’ forecasts aren’t at all times correct.

So there’s no assure Authorized & Common will really pay out 21.4p per share for FY2024.

One threat to pay attention to right here is that the monetary providers firm has a brand new CEO. And he might resolve to vary the capital allocation coverage.

I’d be shocked if the brand new chief exec did go for a minimize. As a result of as I stated earlier, firms often wish to protect their monitor information.

However we are able to’t rule one out. Particularly when dividend protection (the ratio of earnings per share to dividends per share) is low. For 2024, the dividend protection ratio is barely forecast to be round 1.25.

A horny inventory as we speak

It’s price declaring that the large dividend isn’t the one attraction of this inventory.

One other interesting characteristic is its low valuation. At present, it trades on a forward-looking P/E ratio of round 9.4 – properly under the UK market common.

Provided that it has each a low valuation and a excessive yield, I feel there’s loads to love concerning the inventory as we speak.

As at all times although, diversification is necessary when investing in shares like Authorized & Common. As a result of there’s at all times the prospect it might underperform.