Picture supply: Getty Photographs

The worth of Authorized & Basic (LSE: LGEN) shares is now even decrease than it was final November. After an excellent begin to the 12 months, it flipped-flopped across the 250p degree earlier than deciding that something above 220p is simply too formidable.

That’s okay, I’m not even indignant.

In the long term, my shares proceed to ship wonderful returns by way of dividends. Now at 9.5%, Authorized & Basic has the third-highest yield on the FTSE 100.

What’s extra, it has a strong observe file of accelerating funds. They’ve risen at a median price of 13.3% per 12 months for the previous 15 years.

However lest we overlook, previous efficiency is not any indication of future outcomes! So will the dividend large proceed to ship because it has prior to now?

To reply that query, I’m looking on the inventory’s dividend forecast.

Earnings and dividend forecast

First, I ought to spotlight that dividend estimates have declined since June, when the corporate introduced a significant overhaul. This included the sale of its housebuilding enterprise and the departure of its asset administration chief. It additionally launched a brand new shareholder technique, together with a £200m share buyback programme.

The share value slipped 5% on the information and has struggled to recuperate since. Nevertheless, the forecast continues to be comparatively constructive wanting forward.

The yield has elevated from 6% in 2019 to virtually 10% this 12 months, largely pushed by a falling value. Analysts count on it to proceed climbing to above 10% subsequent 12 months and 10.29% in 2026.

| Monetary 12 months | Dividend per share | Dividend yield |

|---|---|---|

| 2024 | 21.3p | 9.8% |

| 2025 | 21.8p | 10.04% |

| 2026 | 22.3p | 10.29% |

However a rising yield is just not price a lot if the share value retains falling.

The expansion forecast offers some hope that it received’t. Gross sales are anticipated to rise 5.15% subsequent 12 months and an additional 5% in 2026. Internet earnings is anticipated to comply with go well with, forecast to rise 33% subsequent 12 months and eight.29% in 2026.

In the meantime, the annual dividend is forecast to extend by lower than half a penny annually. The ultimate dividend for 2024 is about at 21.3p, anticipated to succeed in 21.8p in 2025 and 22.3p in 2026.

What’s most attention-grabbing is that earnings per share (EPS) is anticipated to outperform dividends, rising to 24p per share subsequent 12 months and 26p by 2026.

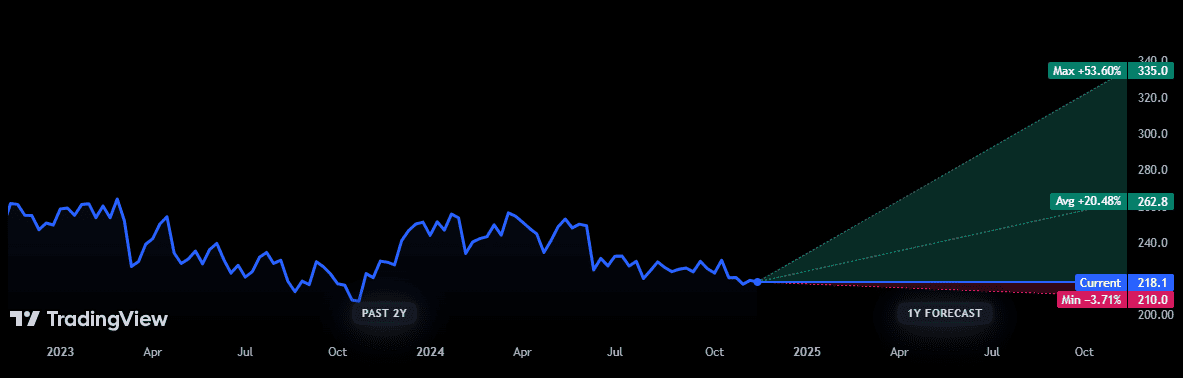

Analysts are reasonably constructive in regards to the share value, with a median 12-month goal of 262p — up 20.5% from at this time’s value.

Issues

There are just a few components that threaten Authorized & Basic’s efficiency, such because the latest hikes in Nationwide Insurance coverage and minimal wage. These are prone to eat into earnings throughout the subsequent earnings spherical.

Because it stands, earnings don’t fairly cowl the present dividend so an additional drop may grow to be a difficulty. If EPS doesn’t enhance as forecast, the corporate could have to chop dividends. Each these conditions may threaten the share value.

Total, I believe the present value is sweet worth and issues look possible to enhance from right here. In fact, that’s on the belief that current situations will probably be maintained. Proper now, lots is happening on this planet, so any short-term predictions needs to be taken with a pinch of salt.

However long-term? I plan to be holding my Authorized & Basic shares properly into retirement.