Picture supply: Getty Photos

Producing a £2,000 month-to-month second earnings by a Shares and Shares ISA is an achievable objective with cautious planning and disciplined investing. Assuming a 5% withdrawal fee — achieved by dividend shares — for portfolio sustainability, an investor would want an ISA valued round £480,000.

Scared already?

£480,000 may sound like some huge cash. And it’s. Nonetheless, constructing a portfolio this massive is way simpler than many Britons assume. It merely takes time.

As an instance, let’s take into account a 30-year-old who begins investing £1,000 month-to-month in a Shares and Shares ISA. Assuming a mean annual return of 8% (which is consistent with historic inventory market efficiency), by age 55, their ISA could possibly be value over £480,000. This state of affairs doesn’t even utilise the total £20,000 annual ISA allowance.

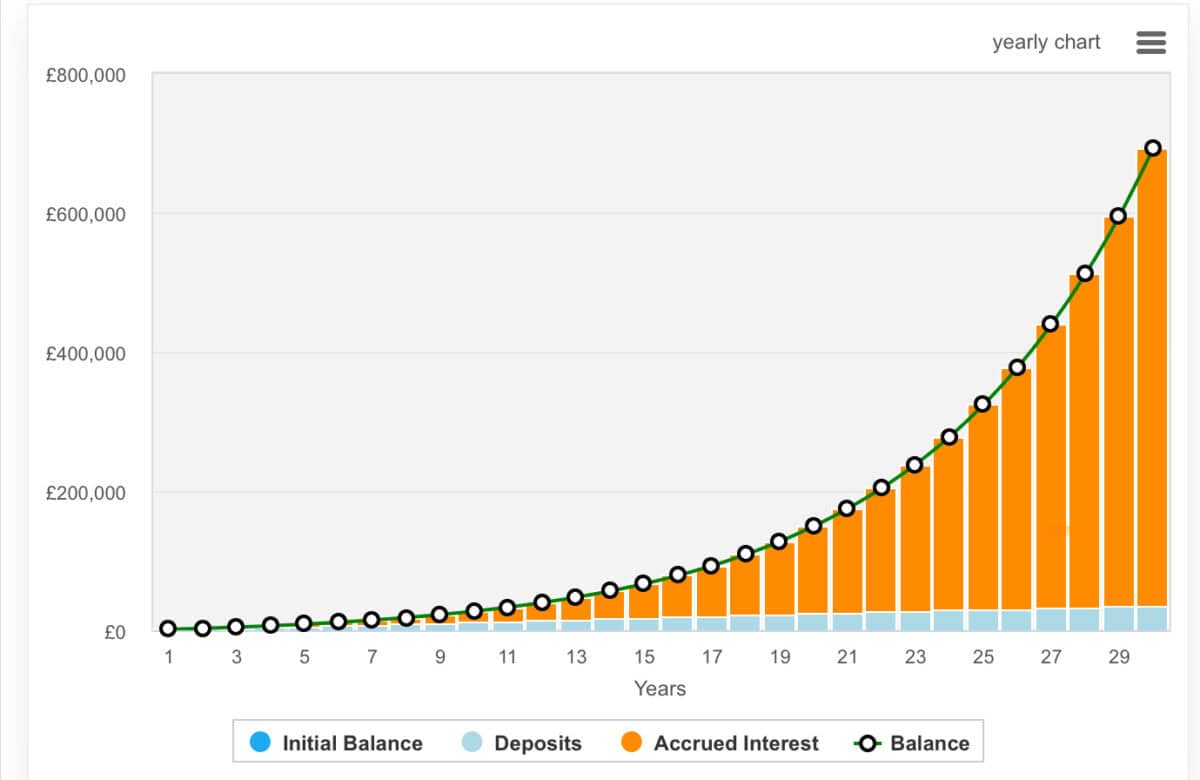

It’s essential to do not forget that consistency is vital. Common contributions, coupled with the facility of compound curiosity, can flip seemingly small sums into vital wealth over time. Furthermore, as one’s profession progresses and earnings doubtlessly improve, there could also be alternatives to spice up contributions, accelerating progress in the direction of the objective.

Nonetheless, it’s additionally vital to spotlight that some buyers obtain a lot greater charges of return. My portfolio worth has nearly doubled over the past 12 months and my long-term common may be very robust.

For instance, if a 15% fee of return was common over 28, an investor might attain this £480,000 mark with simply £100 of month-to-month contributions. That is demonstrated within the graph under.

One inventory to think about for the journey

At present, I’m using a number of completely different methods for a number of completely different portfolios. The smallest of those is my daughter’s pension — as a one-year-old, her most contribution is round £240 per 30 days, which is topped up by the federal government.

Regardless of a very long time to maturation, I’m nonetheless following a growth-oriented method. And since I’m investing comparatively small figures, I’m preferring funds and ETFs to achieve diversification, such The Monks Funding Belief, Scottish Mortgage Funding Belief, and Berkshire Hathaway (NYSE:BRK.B).

The latter presents an fascinating alternative at this second. Berkshire has more and more bought a few of its prized holdings, together with Apple, and now sits on $300bn in money. This money will seemingly be put to work on opportunistic acquisitions if the market goes into reverse.

Nonetheless, it is a long-term funding into America. Warren Buffett’s conglomerate owns a number of the most vital components of the American economic system together with banks, fee card providers, railroads, and insurance coverage.

Nonetheless, as with each funding, there are some dangers. The conglomerate’s immense dimension might restrict future progress alternatives, as discovering acquisitions or investments able to considerably shifting the needle turns into more and more troublesome in at this time’s aggressive market.