Picture supply: Worldwide Airline Group

Worldwide Consolidated Airways Group (LSE: IAG) suffered a painful hit final week that shed 10% of its share worth. The worldwide aviation conglomerate, which owns British Airways, Iberia, Vueling, and Aer Lingus, has been making headlines not too long ago. The corporate has benefitted from a surge in demand for air journey because the world recovers from the pandemic.

This resurgence had considerably boosted IAG’s monetary efficiency and positioned it for development. On 27 September, the inventory hit a yearly excessive of 212p – up 36% year-to-date. However as markets opened Monday (7 October) morning, it was buying and selling under 192p.

Why the sudden fall?

Gasoline is without doubt one of the largest bills for airways, accounting for a big portion of their working prices. Subsequently, they’re extremely vulnerable to fluctuations in oil costs. Rising gasoline prices can cut back their profitability and result in increased ticket costs for passengers. Conversely, falling costs can enhance their monetary efficiency and probably lead to decrease ticket costs.

Because the Center East is a significant oil-producing area, geopolitical occasions within the area can considerably influence international oil costs. Final week, the escalating battle between Iran and Israel despatched shockwaves by the market, hurting its share worth.

What does this imply for buyers?

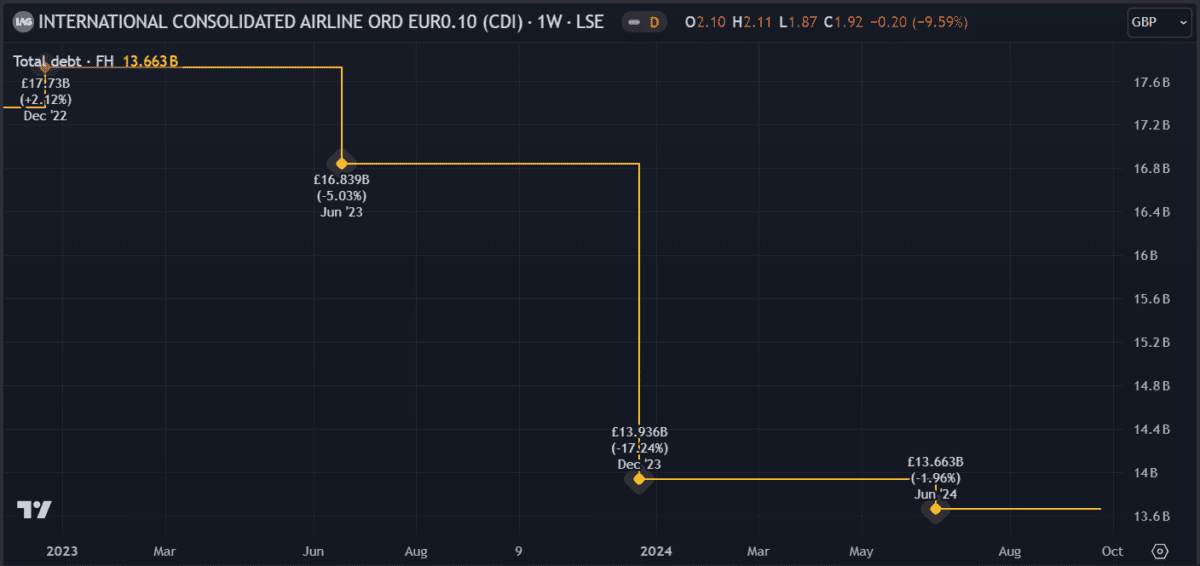

IAG stays a pretty funding proposition for a number of causes. First, the corporate’s sturdy monetary place is an indication of its resilience. Regardless of the challenges lately, it has managed to not solely carry out effectively but additionally cut back its debt ranges. This monetary stability offers a stable basis for future development.

Second, it advantages from a diversified enterprise mannequin. With a portfolio of airways that function throughout totally different areas, it’s at much less danger from financial downturns in particular areas. This diversification may improve the corporate’s total profitability and stability.

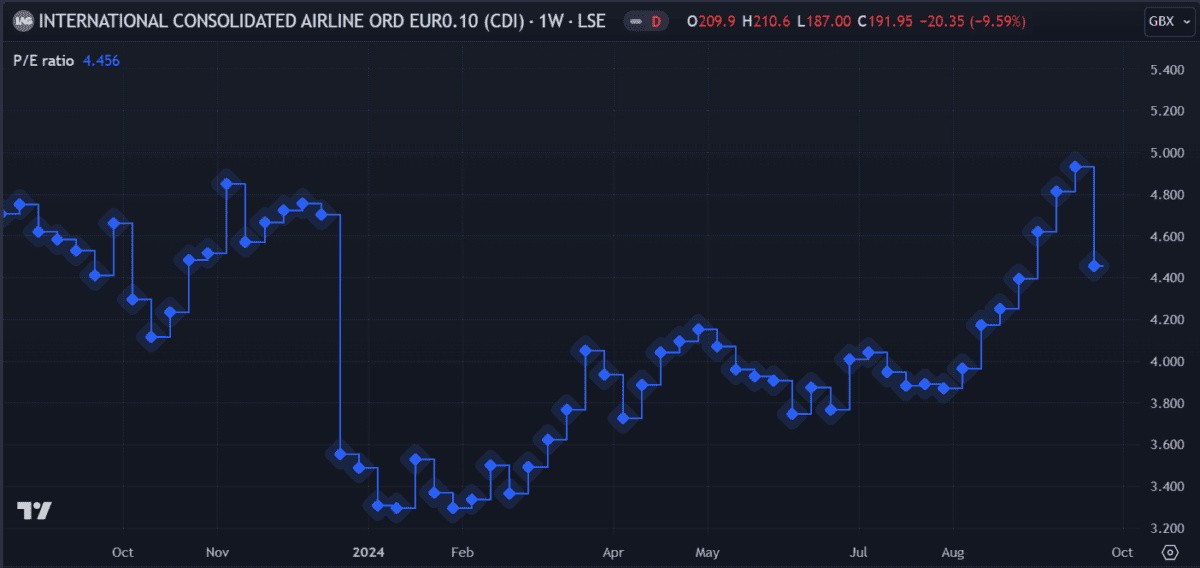

And IAG’s valuation seems enticing relative to its friends. The corporate’s trailing price-to-earnings (P/E) ratio of 4.45 is effectively under the business common, suggesting that it could be undervalued. This might provide buyers a beneficial entry level into the inventory.

Total, analysts seem optimistic about its. Financial institution of America and Bernstein issued purchase and outperform scores on the inventory prior to now month, citing components such because the restoration in air journey, cost-reduction initiatives, and potential mergers and acquisitions.

Dangers to contemplate

Whereas IAG presents a number of compelling funding alternatives, it’s necessary to contemplate the dangers concerned. One being the volatility of the airline business. Elements akin to gasoline costs, financial downturns, geopolitical occasions, and pure disasters can have a considerable influence on airline profitability.

Moreover, its enterprise mannequin faces threats from labour disputes, regulatory modifications, and technological developments. These components may negatively have an effect on the corporate’s operations and monetary efficiency.

Furthermore, the corporate faces stiff competitors from low-cost carriers like Ryanair and easyJet. It might have to adapt its enterprise methods if it hopes to stay aggressive and maintain its market share.

My verdict

IAG affords a mixture of development potential, monetary stability and what I feel is a pretty valuation. The corporate’s sturdy monetary place, diversified enterprise mannequin, and optimistic analyst sentiment counsel that it could be a value contemplating.

Nonetheless, there are dangers to consider that have an effect on each the airline and the broader business. I’m not planning to purchase extra shares this month but when I had been, this one would possibly make it onto my checklist.