Picture supply: Getty Photos

Incomes £10,000 of passive earnings monthly requires a big pot of cash. And ideally, it might all be in a Shares and Shares ISA as each the capital good points and earnings can be fully free from tax.

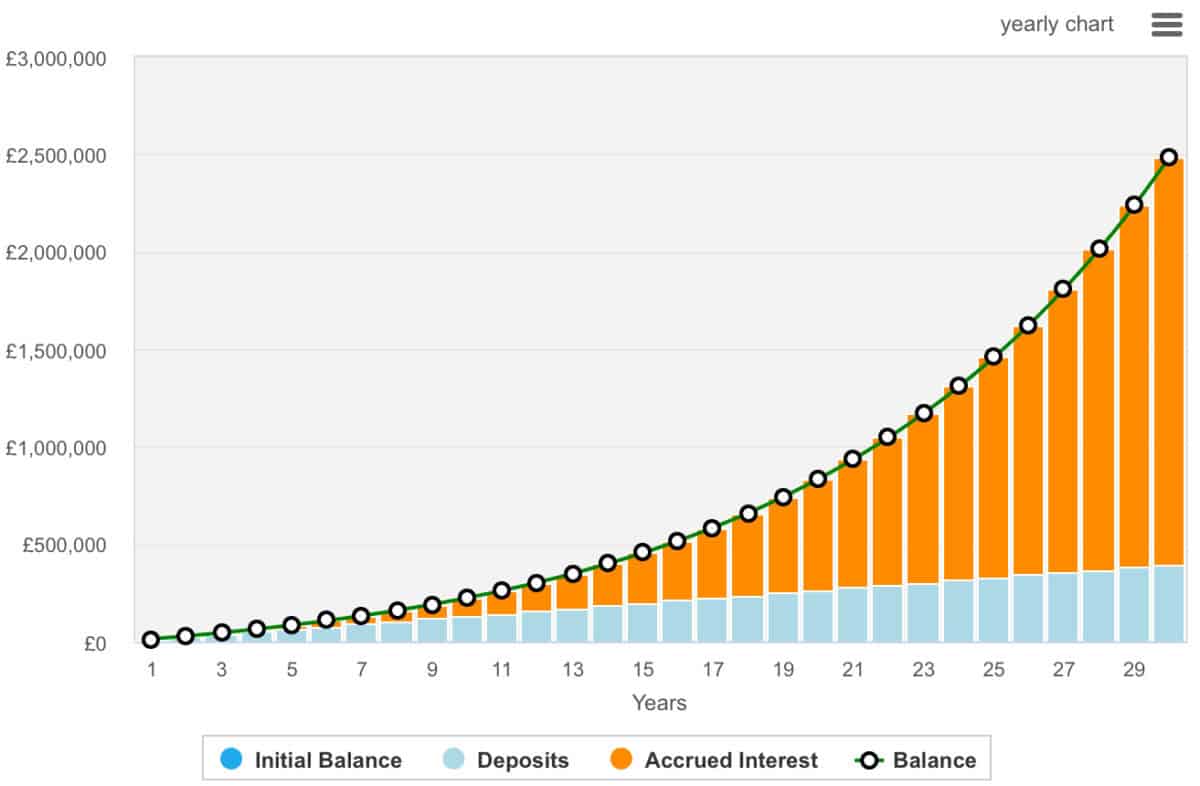

Actually, my calculations recommend that, in an effort to probably earn £120,000 yearly, an investor would want £2.4m in an ISA. Clearly, that’s a big chunk of cash, and with a most annual contribution of £20,000, it might take a while to realize.

However is it achievable? Doubtlessly. It simply takes time, consistency, and a robust funding technique.

Please observe that tax remedy relies on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Doing the maths

There are many methods to succeed in the identical consequence. Nonetheless, right here’s a method of working the maths. Let’s assume month-to-month contributions of £1,100, or £13,200 yearly over 30 years, and a ten% annualised return. On the finish of the interval, an investor would have a bit greater than £2.4m. In fact, not everybody can obtain a ten% annualised return over the long term. Though, many traders have performed so just by investing in index monitoring funds.

Nonetheless, it’s necessary to do not forget that many novice traders lose cash. They might throw cash after dangerous making an attempt to get wealthy fast… many people have been there. As an alternative, traders are higher off take a diversified strategy, maybe opting to place nearly all of their cash in direction of index funds and reinvesting their dividends. This regular strategy will leverage compounding and hopefully keep away from expensive losses.

The place does Bitcoin are available?

Properly, I’ve usually averted Bitcoin, and I can’t maintain it inside an ISA anyway. Nonetheless, I can put money into corporations that take care of Bitcoin or mine Bitcoin, like MARA Holdings (NASDAQ:MARA).

So, what’s so nice about MARA Holdings? Truthfully, it’s not a inventory I really like, however I respect it might be of curiosity to traders who’re bullish on Bitcoin. It’s one of many largest Bitcoin miners globally, holding round 46k BTC as of February, valued at roughly $3.9bn.

The corporate mines Bitcoin and strategically purchases extra cash, with its reserves rising considerably over the previous yr. As an example, in 2024, MARA mined 9,457 BTC and bought 22,065 BTC at a median value of $87,205.

MARA has additionally diversified its operations by lending 7,377 BTC (16% of its reserves) to 3rd events, producing modest single-digit yields. This lending technique goals to offset operational prices whereas sustaining its Bitcoin holdings. MARA additionally operates a community of information centres powered by renewable vitality, together with a wind farm in Texas and a number of services in Ohio.

Regardless of its spectacular long-term development — up 2,463% over 5 years — the inventory is risky. Actually, it’s down 60% over three months. That’s maybe unsurprising as Bitcoin is now cheaper than its common procurement value above. Furthermore, traders ought to observe that it’s turning into onerous to mine Bitcoin, and long-term traders must be cautious of regulatory adjustments. Mara additionally makes use of debt to fund Bitcoin investments.

It’s not a inventory that I’m trying so as to add to my portfolio within the close to time period. Nonetheless, I’m going to maintain watching.