Picture supply: Getty Photographs

From an funding perspective, the S&P 500 seems to be dangerous proper now. A heavy focus in some costly names has multiple analyst forecasting weak returns for the following 10 years.

That may trigger buyers to show away from the US when searching for alternatives. However I feel that’s a mistake – exterior of the index, there are some shares I just like the look of very a lot.

An oil firm

One instance is Chord Power (NASDAQ:CHRD). Earlier this 12 months, the corporate merged with Enerplus to kind the most important oil producer within the Williston Basin.

My thesis right here is comparatively easy. Administration studies its belongings will permit it to extract oil for 10 years at low costs and I feel that is going to make for robust investor returns.

Chord’s stability sheet is extraordinarily robust. And that enables the corporate to return important quantities of the money it generates to buyers by way of dividends and share buybacks.

This units it other than different oil shares and makes it very enticing from my perspective. I feel it seems to be like a cut price even when US shares as an entire are at traditionally costly ranges.

Manufacturing

Chord’s place within the Williston means its prices are greater than its counterparts which might be based mostly within the Permian. However I feel there’s nonetheless lots for buyers to be enthusiastic about.

Again in August, the agency anticipated producing round $700m in free money this 12 months based mostly on a $70 oil value. And from subsequent 12 months, that must be boosted by synergies from the Enerplus transaction.

Since then, West Texas Intermediate (WTI) has dropped to round $67 per barrel. However Chord’s market cap is at present beneath $8bn, which I feel makes issues very fascinating.

At that degree, there may properly nonetheless be an excellent free money stream return obtainable to buyers even when oil costs have additional to fall. However there’s extra to the story than this.

Dividends

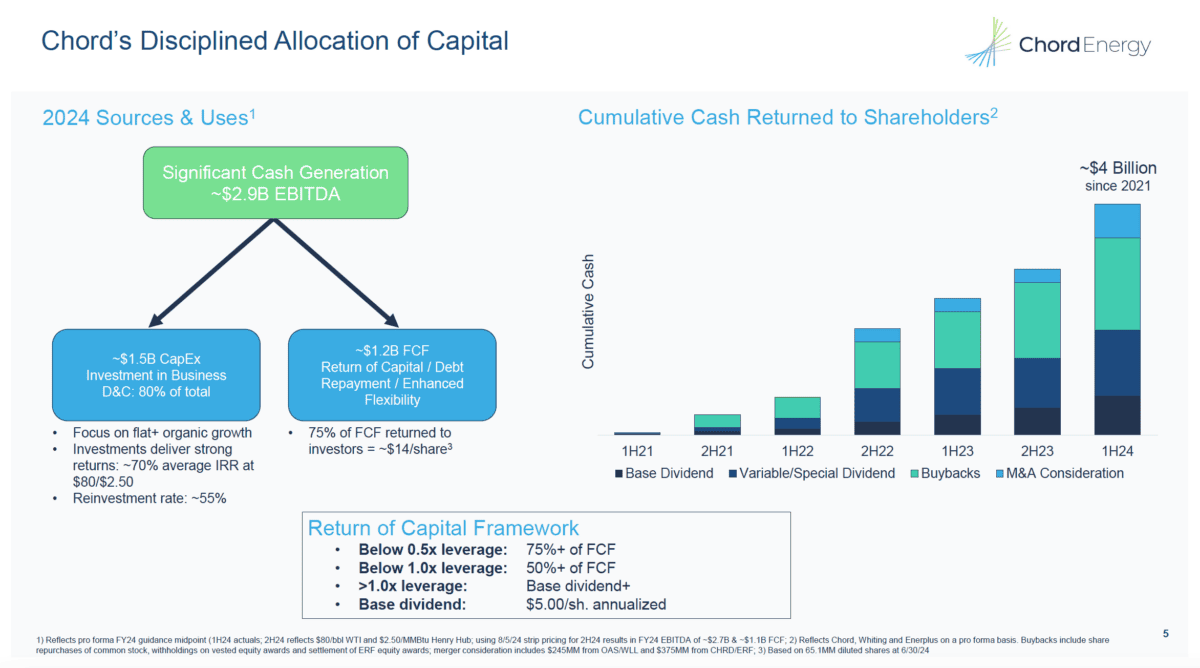

As a substitute of exploration, Chord seems to be to return its free money to shareholders. The agency goals to maintain its leverage ratio beneath 1 and units its dividend coverage based mostly on how properly it achieves this.

Supply: Chord Investor Presentation August 2024

Proper now, the corporate has a internet debt-to-EBITDA ratio of 0.3. At that degree, 75% of the free money the corporate generates will get returned to buyers as dividends.

A constructive view on the outlook for WTI is a mandatory situation of investing in oil shares in any respect. But when the oil value stays above $70 for the following 10 years, issues might be very fascinating.

If I invested £1,000 right now, I feel there’s an opportunity I may get 100% of that again in dividends within the subsequent 10 years. And with rates of interest falling, there aren’t many alternatives like that.

A inventory to contemplate?

There are many causes to be unsure concerning the outlook for oil costs. Proper now, the most important menace might be elevated manufacturing from OPEC at a time when demand is weak.

Buyers with a constructive outlook for oil may need to try Chord Power, although. US shares basically is likely to be costly, however I feel there’s nonetheless wonderful worth on provide right here.