Picture supply: Getty Photos

Yearly, UK residents can put as much as £20,000 in a Shares and Shares ISA. Nonetheless, buyers don’t have to max out their ISA contributions to construct wealth.

As an alternative, many individuals get began by investing just some kilos a day. Over time, and when mixed with a wise funding technique, this could compound into appreciable wealth.

The nice and cozy-up

Opening the ISA’s just like the investing equal to warming up earlier than the gymnasium. The Shares and Shares ISA offers UK residents with a spot to shelter their investments from capital good points tax and tax on dividends.

After opening a Shares and Shares ISA with a good funding brokerage, an investor can deal with constant contributions to their portfolio, even when the quantities are modest. Common contributions, mixed with the ability of compounding, can considerably develop wealth over time.

Please be aware that tax therapy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Combine it up just a little

Similar to going to the gymnasium, after we make investments, we have to combine it up just a little. And by that, I imply diversification. Traders ought to look to unfold their cash throughout totally different asset courses, together with shares, bonds and funds, whereas exploring quite a lot of geographies.

Many novice buyers within the UK will seemingly need to spend money on corporations and types they know greatest, a lot of which will likely be UK-listed shares. Nonetheless, the US market affords buyers alternative to diversify additional, arguably with higher entry to rising and superior applied sciences.

The way it may look

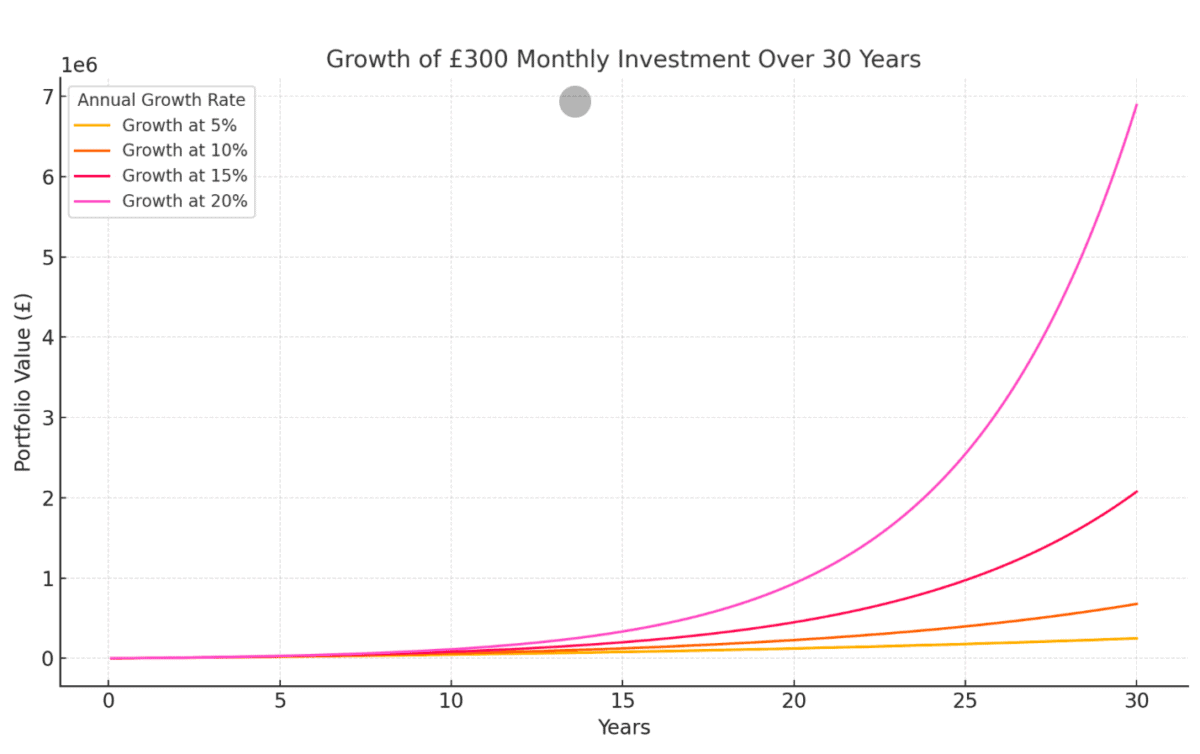

An investor contributing some like £300 month-to-month can obtain vital portfolio progress relying on the annual return fee, which is enhanced by the ability of compound returns. Whereas poor funding selections can lead to losses, right here’s how funding may develop over 30 years.

Whereas 20% annualised progress is barely often achieved by a few of the greatest buyers, be aware how £300 a month may rework into almost £7m over 30 years. Nonetheless, for context, many seasoned buyers can beat even 20%. J Mintmyzer, for instance, has averaged over 40% yearly over the previous decade.

One inventory for consideration

Traders trying to obtain a point of diversification instantly might think about investing in Scottish Mortgage Funding Belief (LSE:SMT). The UK-based funding belief is a FTSE 100 constituent however spend money on primarily in corporations working in superior and disruptive applied sciences, principally within the US.

After some current re-jigging, the portfolio’s largest three holdings at the moment are Amazon, Mercado Libre and Elon Musk’s privately-traded SpaceX. The primary two shares, accounting for round 12% of the portfolio collectively, level to ongoing confidence in on-line retail. Nonetheless, Scottish Mortgage has a really various portfolio, which additionally contains some luxurious shares together with Ferrari.

Any considerations? Effectively, with round 1 / 4 of the portfolio consisting of shares that aren’t publicly traded, buyers might query the valuations of those privately held belongings. For instance, SpaceX is reportedly valued at $350bn. That may very well be a tough determine to digest, particularly after we know so little in regards to the firm’s operations.

Nonetheless, regardless of some appreciable volatility throughout the pandemic, this inventory’s delivered very spectacular returns for shareholders. In reality, it’s doubled in worth over seven years.