Picture supply: Getty Photographs

Ferrari (NYSE: RACE) shares rose 11% final week after the long-lasting Italian automaker posted file annual earnings. This implies the expansion inventory is up 45% in 12 months and greater than 200% over 5 years.

However after such an enormous run, is it nonetheless value investing in?

The facility of true luxurious

The corporate’s enterprise mannequin is constructed on shortage. Or as founder Enzo Ferrari famously mentioned: “Ferrari will all the time ship one automotive lower than the market demand.”

This can be a delicate balancing act between securing short-term earnings whereas preserving long-term model exclusivity and pricing energy. Administration has fine-tuned this to a precision related to one of many agency’s high-calibre engines.

In 2023, it offered 13,663 autos, simply 3.3% greater than 2022. But income rose 17% to €5.97bn whereas web revenue surged 34% to €1.25bn.

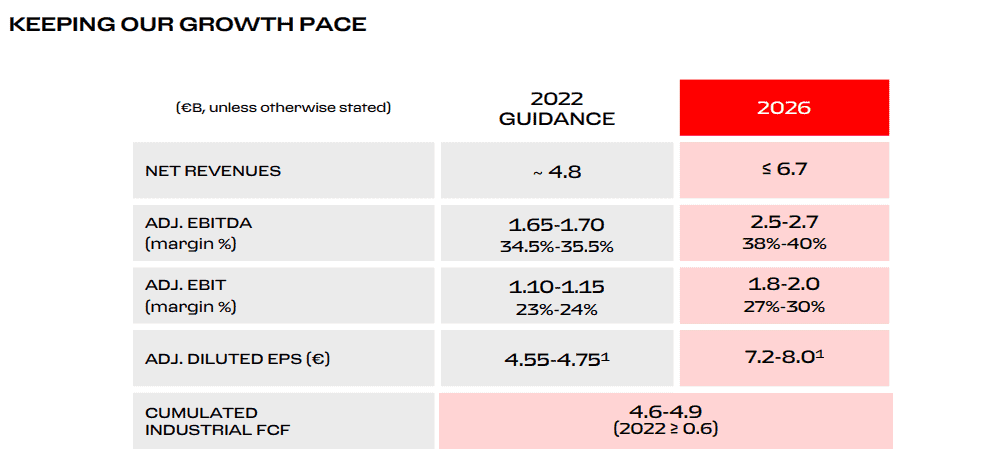

Consequently, administration affirmed “confidence into the excessive finish of our 2026 goal” set out in 2022.

It has such confidence as a result of each automotive Ferrari is constructing between now and 2026 already belongs to somebody. And these wealthy patrons are spending “distinctive” extra quantities on personalised configurations like bespoke inside stitching patterns and particular paint finishes.

Ferrari plans to lift the value on these high-margin personalisations by mid-single-digit percentages. I believe its wealthiest clients won’t be fazed.

Nurturing model fairness

In the meantime, at a time when corporations are determined to develop in China — residence to the world’s highest variety of billionaires — Ferrari is limiting gross sales there to 10% of total quantity.

Administration says China remains to be a “very younger” market that isn’t “margin-accretive” (there are tariffs on luxurious imports). Due to this fact, the annual variety of automobiles shipped will keep at round 1,200 because it moderates its development cadence there.

I suppose you are able to do that in the event you’re Ferrari!

Valuation

Presently, the inventory is priced like considered one of its supercars — very luxuriously. Adjusted earnings per share is anticipated to advance from €6.90 to €7.50 in 2024. So we’re taking a look at 46.5 occasions forecast earnings.

This can be a comparable earnings a number of to luxurious peer Hermès Worldwide (48), although greater than double that of LVMH (23.8). And it’s in direction of the higher finish of its historic a number of vary, which suggests investing as we speak could possibly be dangerous.

That mentioned, a premium valuation is clearly warranted. As talked about, the order e book on present fashions covers all of 2025 (and additional in some circumstances), that means there’s little or no likelihood of a serious earnings disappointment earlier than then.

Make investments extra money?

In 2024, income is forecast to rise 7% to €6.4bn. Nevertheless, it’s vital to recollect this slower development is by design. The corporate’s worth lies in not being a mass-market producer.

Long run, I’m very bullish. Sir Lewis Hamilton is becoming a member of its Scuderia Ferrari F1 racing workforce in 2025. As one of many world’s most marketable sportspeople, Hamilton ought to assist develop its Sponsorship, Industrial and Model enterprise section.

This division at present accounts for round 10% of group gross sales, however is already on monitor to double between 2022-2026.

Moreover, the primary totally electrical Ferrari is about for launch within the closing quarter of 2025.

All issues thought-about, I’m not going to purchase extra shares as a result of robust run and better valuation. However I definitely would if there was any huge share value pullback.