Picture supply: Getty Photos

On Friday night (3 January), the boohoo (LSE:BOO) share worth got here into my head. That’s as a result of I used to be watching the PDC World Darts Championship last and seen that Luke Littler, the youngest ever winner of the trophy, was carrying the boohooMAN emblem on his left shoulder.

I think these accountable for the sponsorship deal would like me to purchase one thing from the retailer’s web site, slightly than take into consideration the worth of the corporate’s shares. However it’s been a very long time since I used to be a member of its goal market of “worth aware customers aged 16-24”. When boohoo was based in 2006, I used to be a part of its supposed demographic. Alas, I’m now too outdated.

However to be trustworthy, I’m unsure Littler will qualify for lengthy both. Along with his £500,000 prize cash, he most likely doesn’t need to depend the pennies. And he doesn’t seem like the fashions on the corporate’s web site. However who does?

Contrasting fortunes

It’s been properly documented that the worth of boohoo shares has crashed over the previous 5 years.

The corporate was one of many few winners from the pandemic. It trebled its gross sales between 2018 and 2021. And for the 12 months ended 28 February 2021 (FY21), it reported adjusted earnings per share of 8.67p.

However within the face of intense competitors and altering tastes, the shares now change palms for 92% lower than they did in June 2020. Nonetheless, at their present (6 January) degree of 31.3p, I wonder if now could possibly be a very good time for me to take a position?

Examine this out

On the plus facet, the corporate’s entered 2025 with a strengthened steadiness sheet. That’s as a result of, in November, it raised £39.3m from shareholders. These proceeds had been used to assist repay £50m of a £97m time period mortgage. And simply earlier than Christmas, it introduced the sale of its London workplace for £49.5m.

The corporate’s additionally lately launched into a enterprise overview supposed to “unlock and maximise shareholder worth”. It believes that its present inventory market valuation doesn’t mirror the complete potential of, specifically, its Debenhams and Karen Millen manufacturers.

Working prices are additionally falling. Through the first half of FY25, these had been £128m decrease than for a similar interval two years earlier.

Some issues

However the largest subject I’ve is that it’s troublesome to worth boohoo when it’s loss-making. Until there’s a transparent path to profitability, it’s onerous to see it being value something.

Having stated that, Ocado Group’s apparently ‘value’ £2.7bn, regardless of reporting adjusted post-tax losses of £1.34bn over the previous 5 years!

Nonetheless, boohoo’s newest outcomes — for the six months ended 31 August 2024 — revealed falling gross sales and elevated losses, in comparison with the identical interval 12 months earlier. Of additional concern, its gross revenue margin was 2.7 share factors decrease.

Regardless of the corporate’s finest efforts, it seems to me that it’s going to be some time earlier than its worthwhile once more. And I doubt it’ll ever be capable to repeat its efficiency of FY21.

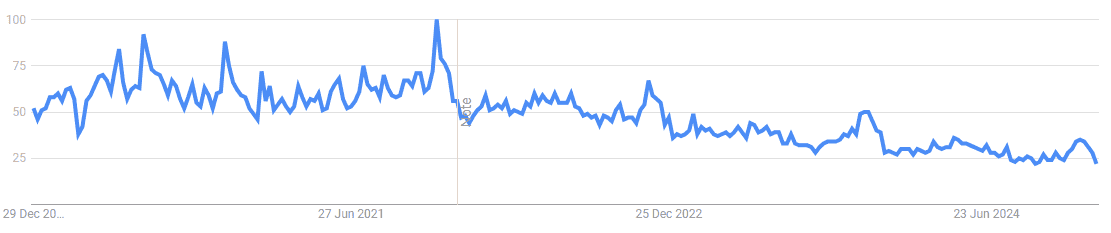

I’m additionally fearful that curiosity within the firm appears to be in decline. The chart under exhibits the variety of Google searches for ‘boohoo’, since December 2019.

Subsequently, for my part, I feel Littler’s going to make extra from boohoo in 2025 than its shareholders will. Because of this, I don’t need to make investments.