Picture supply: Getty Photos

Investing in a mixture of US and UK shares with a long-term outlook is usually a street to an opulent retirement. By sticking to a plan and dedicating a large quantity of earnings every month, it’s doable to herald appreciable returns — and obtain generational wealth.

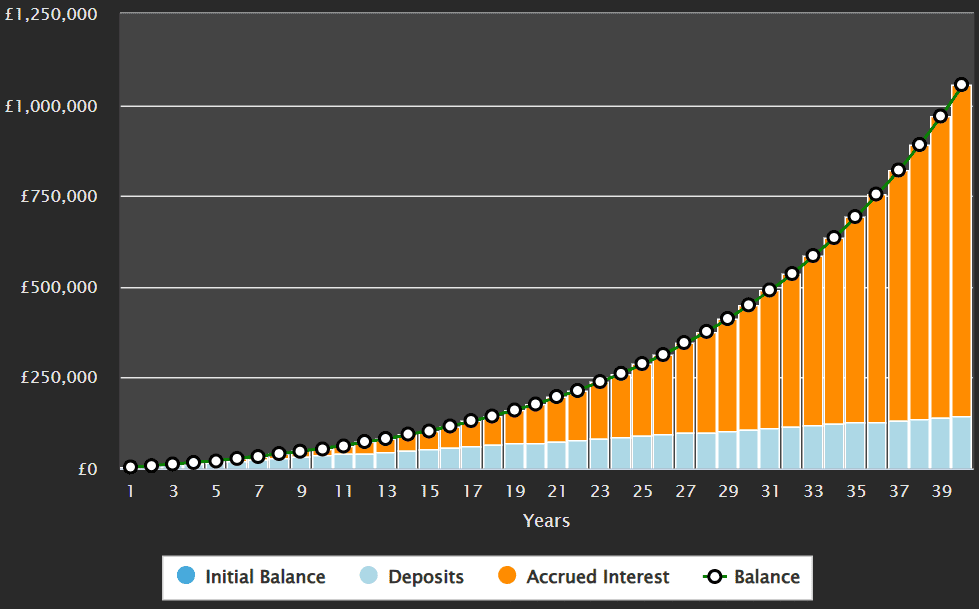

I do know it’s an overused phrase but it surely’s price repeating: the earlier one begins, the higher. The miracle of compounding returns means there is usually a big distinction between 20 years and 30 years. The snowball impact means the returns develop exponentially, with every further 12 months leading to much more speedy development.

Nonetheless, that doesn’t imply it’s simple — or assured. There’s a myriad of various geopolitical elements to think about that may ship international markets hovering or tanking. At instances, it may be a nerve-wracking expertise that requires endurance and dedication — however the reward could also be definitely worth the danger.

Let’s do some calculations.

The street to riches

The S&P 500 has returned 12% on common previously decade, with dividends included. The FTSE 100 has returned solely 6.3%. That means traders ought to focus purely on US shares however a mixture of each is an efficient strategy to defend a portfolio towards a market downturn in a single area.

It’s lifelike to imagine a well-balanced portfolio of UK and US shares may return 8% on common. A month-to-month funding of £300 into an 8% portfolio may develop to £177,884 in 20 years. Preserve going for an additional 20 years and the compounding returns would carry the whole as much as £1,054,284.

That’s a very long time but when a devoted investor began at 30, they may attain it quickly after retirement. Even a late starter at 40 may attain virtually half one million in 30 years.

High UK development shares

The S&P 500 could have hosted some spectacular development shares lately however the FTSE 100 shouldn’t be ignored. Shares like Video games Workshop and Alpha Group have loved spectacular development lately.

Nonetheless, I’m extra a fan of well-established corporations with confirmed monitor data of long-term development potential. One which I believe UK traders ought to contemplate is 3i Group (LSE: III), a global funding firm primarily centered on personal fairness and infrastructure.

Its portfolio consists of steady, cash-generating companies that assist constant dividend funds. Its flagship holding, Motion, is a European low cost retailer that has delivered distinctive development.

The inventory has steadily elevated from 460p per share to three,874p. That’s a 742% improve, representing an annualised development of 11.2% per 12 months.

It’s dividend development is much more spectacular, growing a compound annual charge of 32% over the previous 15 years. That reveals robust dedication to returning worth to shareholders.

Nonetheless, there are drawbacks to think about. As a non-public fairness agency, 3i’s earnings will be unstable and intently tied to financial cycles. Efficiency charges and asset valuations fluctuate with market sentiment, which might impression dividend stability. Moreover, its reliance on a couple of key property, like Motion, introduces focus danger.

Nonetheless, the corporate has persistently delivered robust efficiency, mirrored in its rising web asset worth (NAV) and rising dividends. Its funding in infrastructure, particularly, gives dependable earnings over time, making it interesting to passive earnings seekers.