Picture supply: BT Group plc

Considered over a number of completely different timeframes, BT (LSE: BT.A.) shares have fairly actually destroyed shareholder wealth.

The inventory’s poor long-term efficiency highlights the risks of shopping for shares in an organization solely primarily based on a persistently low price-to-earnings a number of (P/E). Usually, a enterprise could have a lowly valuation for a motive.

That’s why I don’t make funding choices solely primarily based on a share value chart. In the beginning, I spend money on companies which I consider the market is undervaluing given its future prospects. On this foundation, do BT shares match the invoice?

Capital funding

When the just lately departed CEO took cost again in 2019, his technique to allow continued progress was by the use of capital funding. And BT has definitely achieved that.

It has been within the thick of big investments in new community applied sciences like full fibre and 5G. I can’t dispute that this was the proper factor to do. In spite of everything, this funding isn’t in blue-sky initiatives. This important infrastructure funding ought to finally energy a brand new section of financial growth for the UK.

Nevertheless, all that shareholders have seen is falling money flows and a weakening stability sheet.

Renewal of debt

The corporate’s mounting debt profile stays my primary concern. As of November 2023, it stood at £19.7bn, twice your complete market cap.

A good portion of this debt was added at ultra-low rates of interest. However as an increasing number of of that debt matures, it is going to should be refinanced at increased charges.

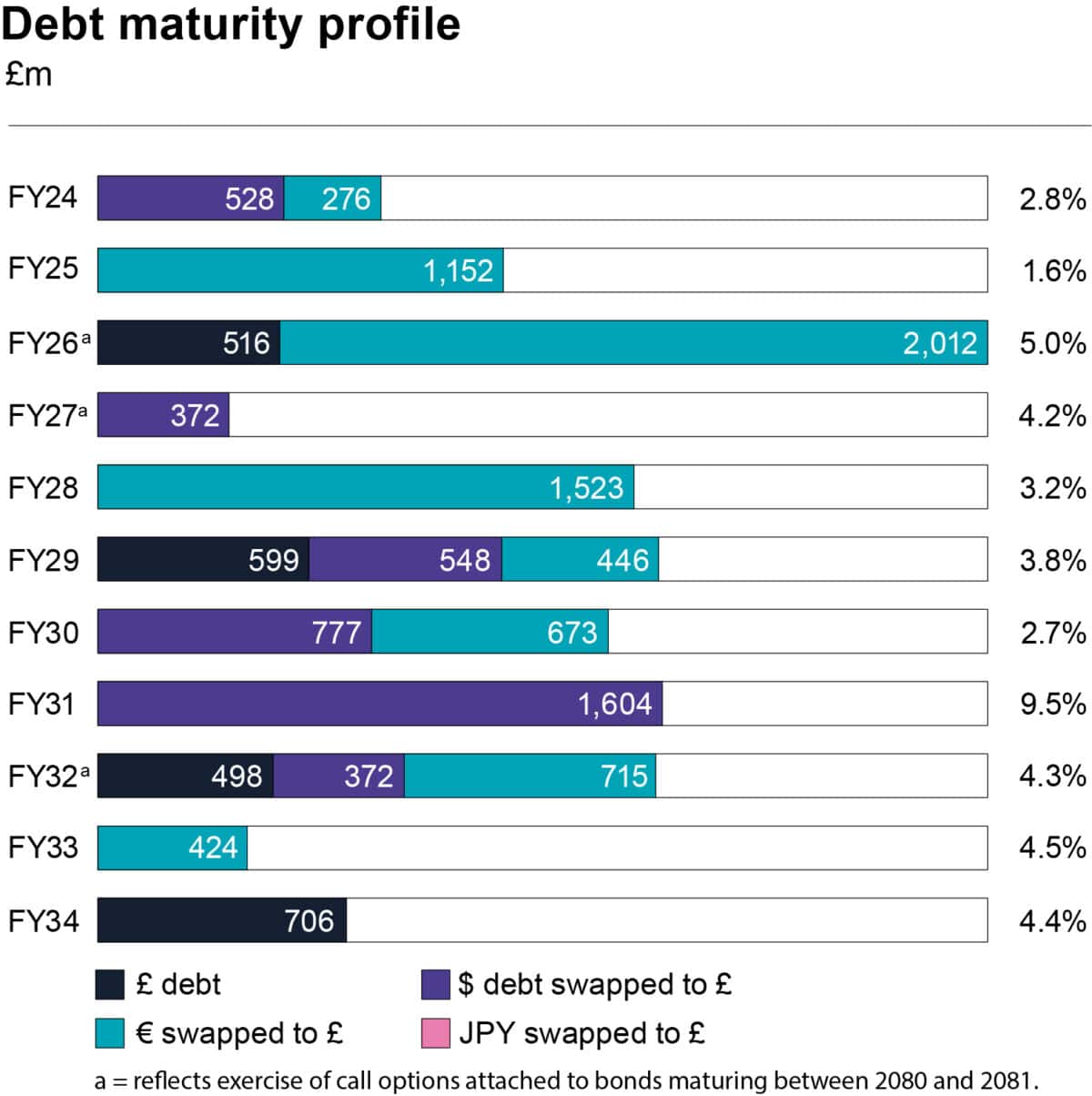

The next chart exhibits the corporate’s debt maturity profile over the subsequent 10 years.

Supply: BT Annual Report 2023

Within the subsequent three years, about £4bn will should be refinanced. That’s a ticking time bomb for me.

After all, one must consider that charges are anticipated to fall over the approaching years. However that in itself stays a dangerous wager. Inflation is way from tamed. Price cuts might properly stoke a brand new inflationary wave.

One factor I stay assured about is that we’re unlikely to be going again to a zero-rate setting any time quickly. Due to this fact, curiosity funds on its debt will find yourself being considerably increased.

Lengthy-term potential

In H1 FY24, construct efficiencies, primarily in Openreach, have enabled it to barely scale back its full-year Capex outlook. In the end, this may feed itself into an enhancing money circulation place. However this might simply be the start.

Over the subsequent few years, BT expects its construct of fibre to premises will peak. Past that peak, it’s guiding to count on not less than a £1bn discount in capex. By the tip of the last decade, it forecasts that normalised free money circulation might be twice what it was final 12 months.

As extra customers and companies migrate away from conventional copper strains to fibre optics, restore volumes are anticipated to fall by as a lot as half.

If I make investments at this time, I’m being amply rewarded to attend out the subsequent few years with a 7% dividend yield. And that is comfortably lined by earnings.

However, the macro image to me doesn’t look good. The UK is now formally in recession. BT’s Enterprise division EBITDA is falling and unlikely to bounce again shortly. Competitors stays intense and the regulatory setting usually unfriendly. I don’t rule out an funding, however not now.