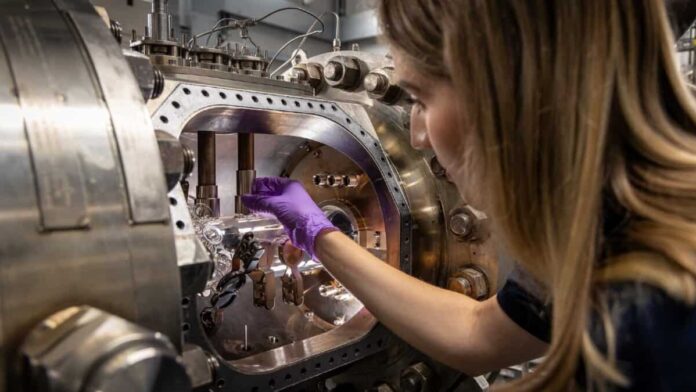

Picture supply: Rolls-Royce plc

The Rolls-Royce (LSE:RR.) share worth feels just like the ‘Speak of the City’ today. Within the final 12 months alone, the shares have soared a whopping 147%. This firm’s been on my watchlist for a very long time, however I carry on ready for the correct second to tug the set off.

So is there a shopping for alternative on the horizon, or is that this one simply going to maintain climbing increased?

An unbelievable restoration

The corporate’s turnaround story’s been nothing wanting outstanding. Many traders will keep in mind it going through extreme challenges through the pandemic resulting from its reliance on the aviation sector. Nevertheless, since then, administration’s staged a dramatic restoration underneath CEO Tufan Erginbilgiç’s management.

Price-cutting measures, strategic refocusing, and a rebound in air journey have all contributed to the corporate’s improved fortunes. Within the final month alone, the shares are up 11%.

As an investor, I maintain asking myself if that is the top of the restoration, or simply getting began? Clearly, there’s an amazing demand for the corporate’s merchandise throughout, aviation, defence, and past.

Current pleasure’s been pushed by the potential revenues in clear power. Analysts level to the large alternatives for elevated power resilience via small modular reactors (SMRs) and sustainable aviation gasoline. Nevertheless, after a sustained rally, there’s a threat that traders take income and transfer on on the first signal of bother.

The numbers

To me, the reply as to if I’ve missed the boat sits within the numbers. With analysts wanting far into the longer term for potential areas of development, and mapping out dangers, there are many opinions on the market. I attempt to give attention to metrics like discounted money circulate (DCF) calculations. This estimate suggests there’s nonetheless a wholesome 57% extra development earlier than the willpower of truthful worth’s reached.

Clearly, this sounds nice. Nevertheless, with annual earnings anticipated to say no by 1.6% for the subsequent 5 years, development could also be flattening out. If traders have loved wholesome returns of late, a sudden change in development would possibly ship just a few packing.

Let’s check out the competitors. Each BAE Techniques and Babcock Worldwide have extra interesting earnings development (7.4% and 15.2%). At a P/E of 18 occasions (in comparison with 22 occasions and 16 occasions), the Rolls-Royce share worth isn’t precisely costly, however there could possibly be higher alternatives.

Previously, my key concern was the large £5.7bn debt on the steadiness sheet. Nevertheless, latest earnings stories present the corporate’s considerably growing earnings steerage for the approaching 12 months. I think the debt load will likely be closely decreased by this time subsequent 12 months.

I’ll maintain ready

So whereas the simple cash might have already been made, there might nonetheless be an excellent quantity of potential for long-term traders. Finally, whether or not I’ve missed my likelihood with Rolls-Royce is determined by the funding horizon I’m prepared to decide to, and the success of the corporate’s long-term technique.

I nonetheless see a variety of worth within the firm’s strategic positioning and development potential. Though there could also be loads of alternatives on the market, I’ll be holding this one on my watchlist, and ready for the correct second to purchase.