Picture supply: Getty Photographs

UK share costs have largely been buoyant in 2024 following years of underperformance. The FTSE 100 and FTSE 250 have each gained round 7% because the begin of the 12 months. However the spectre of a inventory market crash continues to unnerve traders at because the fourth quarter will get underneath manner.

In reality, analysis from Saxo Financial institution has revealed “a notable shift in market sentiment in comparison with earlier quarters, as investor confidence in international fairness markets softens.”

How possible is a inventory market crash? And what ought to I do?

Sentiment sinks

Saxo interviewed 712 of its purchasers. Its report confirmed that “whereas many respondents stay optimistic, there’s rising concern over inflation, rates of interest, and geopolitical dangers, all of which proceed to form market expectations for the following three months.”

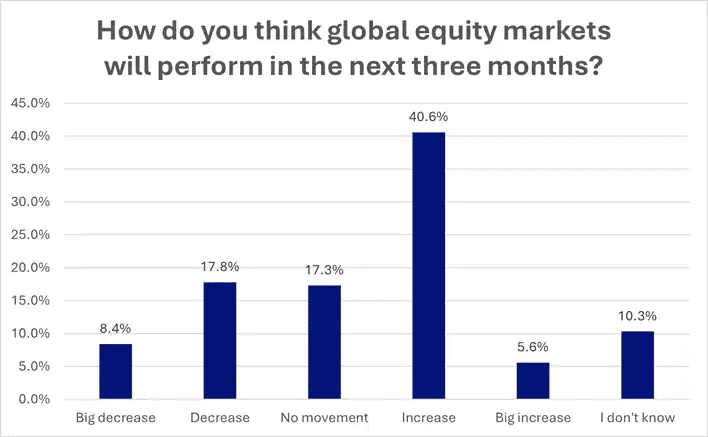

Because the chart exhibits, traders stay optimistic in regards to the course of inventory markets in quarter 4. Some 40.6% of these questioned count on share costs to extend within the interval.

Nevertheless, consumer optimism is declining at an alarming fee. Saxo mentioned that 42.1% of respondents anticipated inventory markets to rise in Q3, which itself was down sharply from 50.5% throughout Q2.

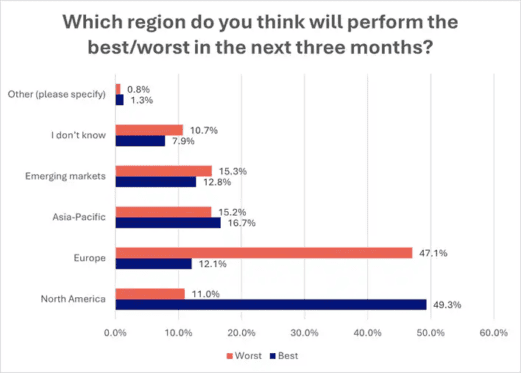

Worryingly for UK traders, the financial institution’s clients imagine European share indexes will carry out most poorly this quarter.

An awesome 47.1% of these surveyed assume Europe would be the greatest underperforming sector. That is up sharply from the 25.9% that made the identical prediction in Q3.

Considering like Buffett

So what occurs subsequent? The reality is that no one is aware of. Attempting to guess the near-term course of inventory markets makes a idiot of even probably the most skilled investor.

For this reason I plan to proceed shopping for shares for my portfolio. As a long-term investor like Warren Buffett, the prospect of some momentary turbulence doesn’t put me off.

In reality, if inventory markets crash, I’ll be seeking to snap up some bargains. Whereas previous efficiency is not any assure of the long run, I’m reassured by the inventory market’s constant skill to rebound from shocks.

Take the FTSE 100, for example. It’s recovered strongly from quite a few crises since its inception in 1984 to put up document highs of 8,474.41 factors earlier this 12 months. These embrace the dotcom bubble, the 2008/09 monetary disaster, the Brexit referendum, and the Covid-19 pandemic.

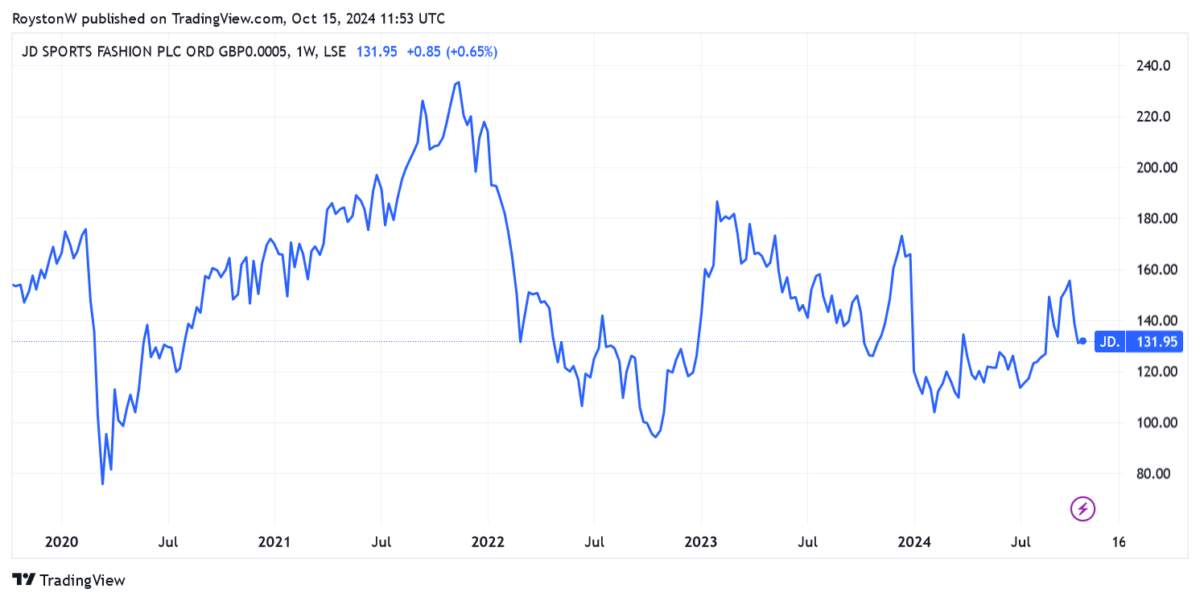

One FTSE 100 discount

JD Sports activities Vogue (LSE:JD.) is a beaten-down Footsie share I’m already contemplating shopping for for my portfolio. After a shock drop throughout January, the retailer stays round 20% cheaper than it was in the beginning of 2024.

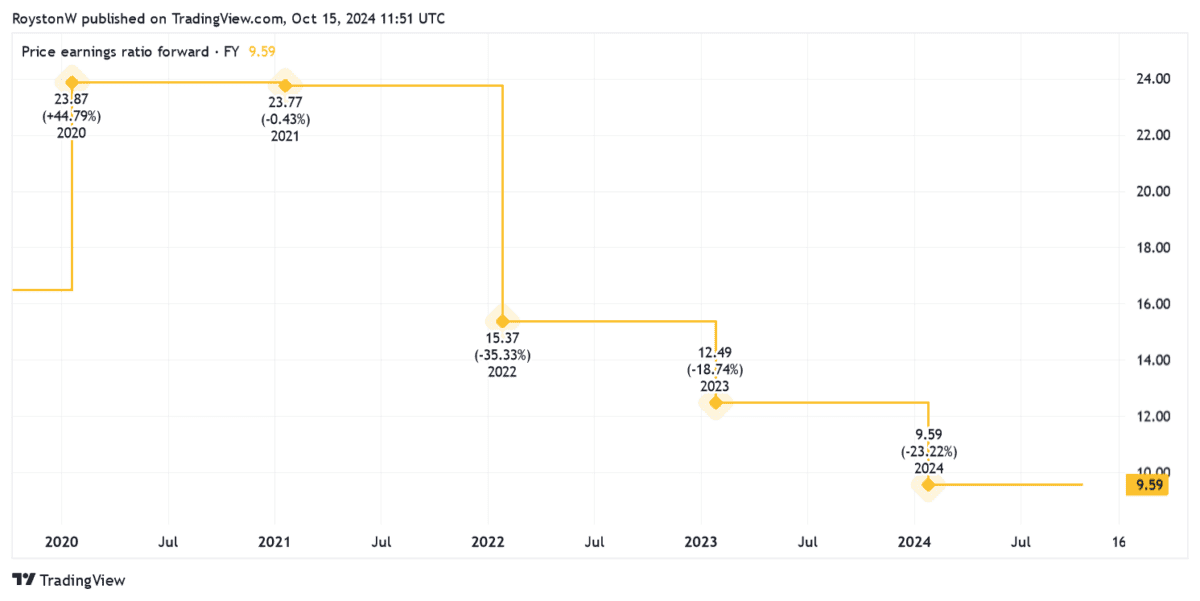

Because of this, it trades on a ahead price-to-earnings (P/E) ratio of simply 9.6 instances. Because the chart exhibits, that is considerably beneath readings of the previous 5 years.

JD’s share worth plummeted in January because it warned on income as a result of weak gross sales. This stays a menace going ahead, however one I imagine is baked into the corporate’s rock-bottom valuation.

Buying and selling on the sportswear big can also be displaying indicators of getting stabilised. Natural gross sales rose 6.4% within the six months to July, pushing pre-tax income to a forecast-beating £405.6m. Revenue was a decrease £397.8m the 12 months earlier than.

I believe JD might ship robust long-term returns because the sports activities style phase grows within the coming years.