Picture supply: Getty Photos

Many penny shares have accomplished poorly since rates of interest shot up in 2022. That is smart, in fact, as larger charges make borrowing dearer and might enhance the prices of servicing present debt.

And even in the very best of instances, the businesses behind penny shares aren’t identified for flexing robust monetary muscle tissue! Furthermore, traders can at the moment get very respectable returns from simply holding money.

In the meantime, we nonetheless don’t know for positive when charges will begin coming down. And even after they do, there’s no assure that small-cap shares will robotically bounce again.

All this raises the query of whether or not it’s even value contemplating penny shares in any respect.

Backside-up versus top-down

Broadly, there are two distinct approaches to choosing shares and developing a portfolio. These are top-down and bottom-up investing.

The primary seems on the massive image by contemplating macroeconomic traits and elements like GDP development, rates of interest, and inflation. Basically, it’s about figuring out which shares and sectors are more likely to profit from the present and future financial atmosphere.

The second methodology includes specializing in the basics of a person firm, comparable to its monetary well being, aggressive place, and development prospects. This bottom-up stock-picking type can uncover hidden gems and alternatives in any market situation.

The primary method has its deserves and could be profitable. In follow, many traders truly use a mixture of each. However I favour the latter method.

It signifies that simply because UK rates of interest stay at a 16-year excessive, I’d nonetheless contemplate investing in the suitable penny inventory.

Shopping for the worry

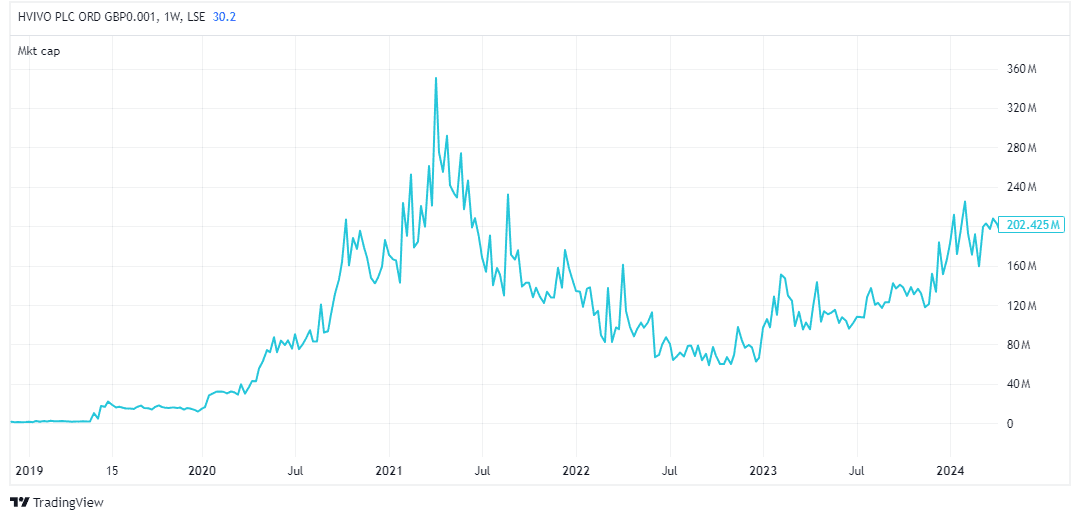

To provide an instance, I first invested in hVIVO (LSE: HVO) in late 2022 when it was a 12p penny inventory with a market cap of £80m. The share value was down 50% 12 months so far.

On the time, the Financial institution of England had simply carried out its largest rate of interest hike in 33 years. Consequently, it stated the UK confronted the longest recession since data started!

Relatively than operating for the hills, I invested within the small healthcare agency. That’s as a result of I favored what I noticed regardless of the broader financial doom and gloom.

hVIVO is a distinct segment chief in testing infectious and respiratory illness vaccines in human problem trials. It was signing report contracts and each income and earnings have been on target.

Importantly, it had no debt to fret about and was, I judged, being unfairly punished by way of no fault of its personal. Quick-forward to at the moment, the share value is 30p and the market cap, £202m.

Nonetheless value a gander

Now, I ought to observe that my portfolio additionally has its fair proportion of clangers. For instance, a penny inventory I maintain known as Agronomics is now down 40%!

In the meantime, hVIVO nonetheless faces dangers, notably competitors and any sudden adjustments within the regulatory atmosphere. It’s not a house run fairly but.

My objective right here is to indicate {that a} bottom-up method to choosing shares could be very fruitful. It really works the identical whether or not it’s a whale of an organization or a relative stickleback.

However the potential good points from investing in the suitable penny inventory could be a lot bigger as a result of agency’s smaller dimension. It’s nonetheless value in search of small-cap shares in 2024.