Picture supply: Getty Photographs

When investing, it’s important to recollect to keep in mind that “time available in the market is extra necessary than timing the market“. Some traders could also be reluctant to purchase gold following latest energy, fearing they might have missed the boat. This might be a expensive mistake.

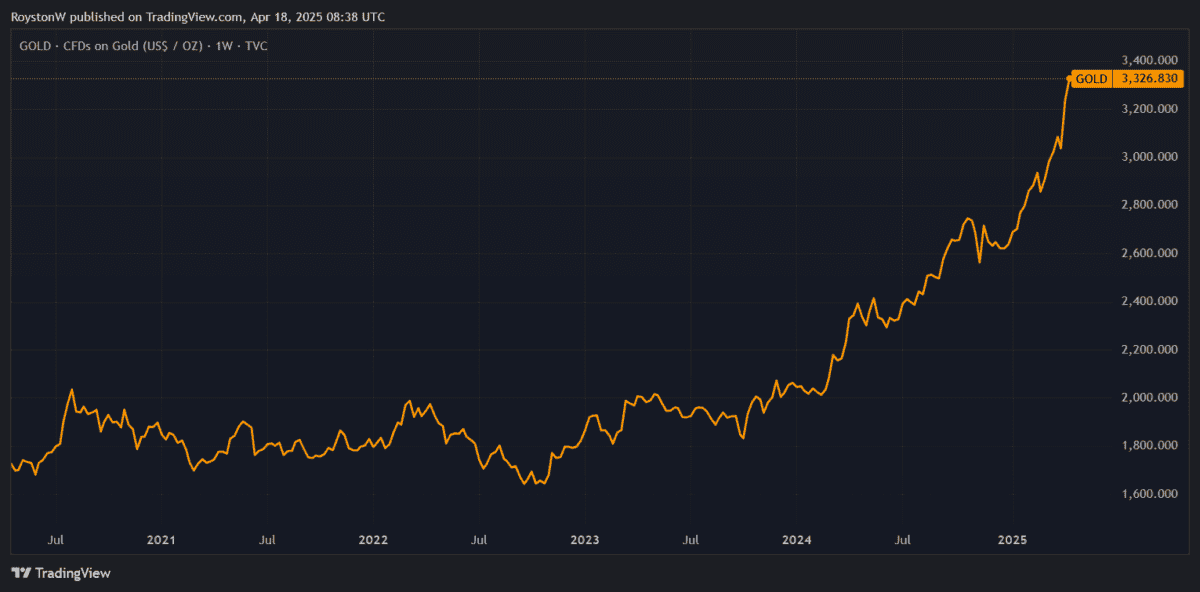

Gold’s present bull run stretches again to the second half of 2023 when it was buying and selling under $1,800 per ounce. At present it’s dealing above $3,300, which means anybody who thought-about shopping for bullion however finally held again could now be regretting their resolution.

Commodity markets are nototiously risky, the place costs are influenced by a variety of conflicting provide, demand and broader monetary market elements. So it’s fairly potential gold may reverse sharply within the weeks and months forward.

But it’s additionally simple to check gold costs sweeping nonetheless larger, pushed by macroeconomic and geopolitical tensions, sturdy central financial institution shopping for, and an additional deterioration within the US greenback.

I personally count on the yellow metallic to surpass final week’s peaks of $3,357.40 per ounce. So shopping for gold stays an attratcive choice to contemplate, for my part.

Getting bodily

However what’s the easiest way to get yellow metallic publicity? At present traders have a mess of choices, just like the basic route of shopping for bodily bars or cash.

This fashion, an investor owns the gold instantly, thus eliminating third-party danger. However this may additionally throw up storage points, and promoting bodily metallic could be sluggish.

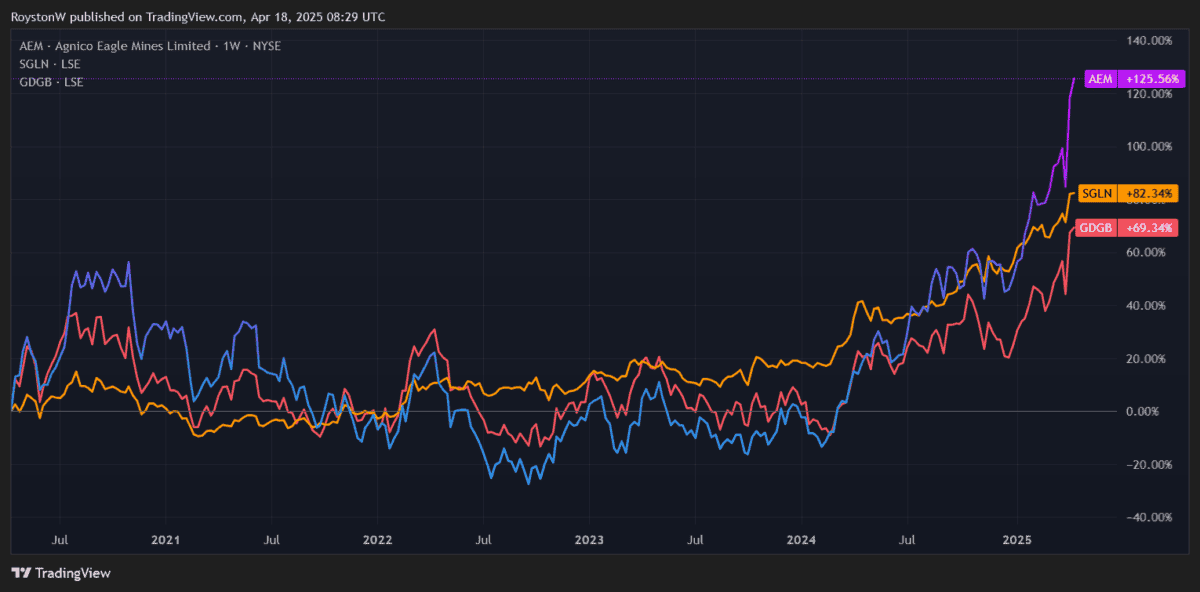

People may take a look at an exchange-tracker fund (ETF) that follows the gold value, which could be easier and faster. Buyers pay the fund supplier a administration price for this service, although such prices could be low. The iShares Bodily Gold ETC (SGLN) as an example, has an ongoing expense ratio of simply 0.12%.

Alternatively, traders can search to experience the gold value not directly by shopping for shares in gold mining corporations.

Focusing on higher returns

It is a riskier method because it exposes traders to the unpredictable enterprise of metals mining. Nonetheless, it will probably additionally result in higher returns as miners’ income typically rise sooner that the metallic itself. Buyers may get a passive revenue by firm dividends.

Once more, traders can do that by contemplating an ETF that comprises gold shares. The VanEck Gold Miners ETF (GDGB) for instance, holds shares in 57 completely different corporations, a top quality which in flip helps traders to unfold out danger.

One other potential route is to purchase particular person gold shares. I feel Agnico Eagle Mines (NYSE:AEM) might be an important particular person share to contemplate.

Whereas previous efficiency isn’t at all times dependable information to future returns, Agnico’s sturdy operational observe file has led it to outperform each gold ETFs and gold inventory funds:

The Canadian firm owns a raft of world-class property in its house nation and in Australia, Finland and Mexico. Not solely are these super-stable locations for miners to do enterprise. Manufacturing from its initiatives are going from energy to energy.

In 2024, group output rose 1% to new file peaks of three,485,336 ounces. What’s extra, Agnico’s all-in sustaining prices (AISCs) had been $1,239 an oz., nicely under the present costs of gold.

Proudly owning Agnico shares as a substitute of a basket of gold shares carries higher danger. However on steadiness, I feel it’s a good way to contemplate tapping into the dear metallic.