Picture supply: Getty Pictures

Inventory market buyers have been handled to a white-knuckle trip in April. It’s been a month characterised by moments of worry, euphoria, wild volatility, and massive share worth swings due to Trump’s tariffs curler coaster. Consequently, each the FTSE 100 and S&P 500 are within the pink for 2025 so far.

However one ‘protected haven’ asset is proving its mettle amid huge inventory market turbulence. The gold worth just lately reached a brand new file excessive above $3,200 per ounce. Many analysts consider bullion may proceed to rise within the months and years forward.

VanEck Junior Gold Miners UCITS ETF (LSE:GDXJ) is an exchange-traded fund (ETF) that gives publicity to the gold mining sector. Right here’s why it’s price contemplating in right now’s difficult investing surroundings.

A novel type of gold publicity

Investing in gold mining shares presents completely different alternatives and dangers than shopping for the pure commodity itself. Naturally, there’s a powerful correlation between the value of gold and the share costs of corporations that mine the dear metallic.

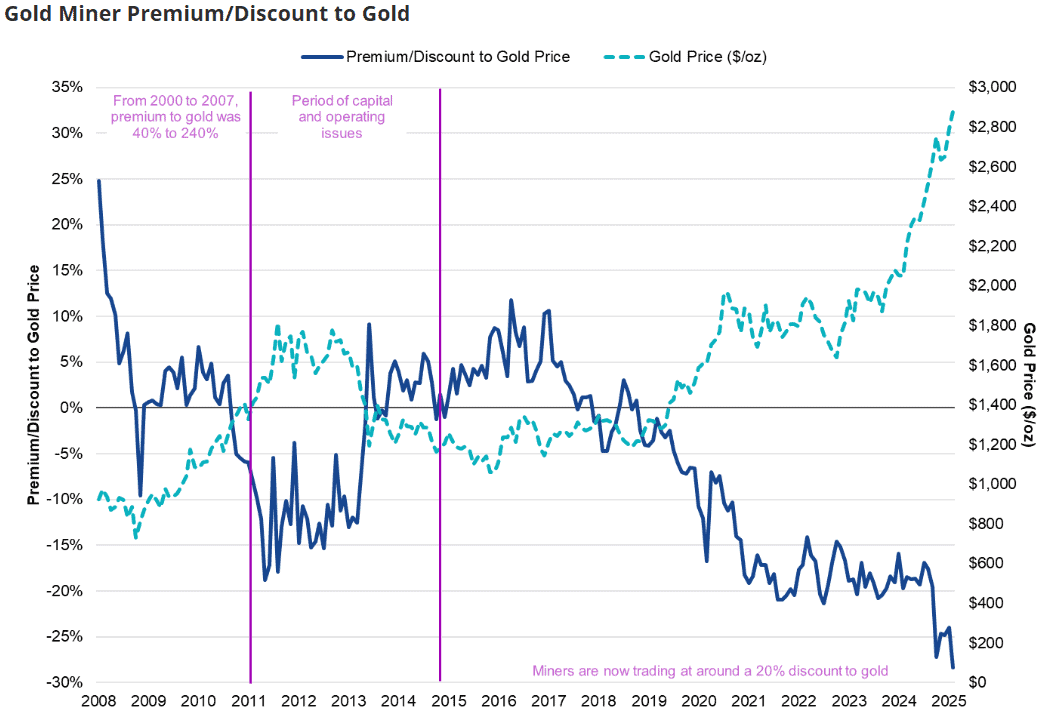

However gold miners can generally outperform or underperform worth actions in bodily gold. Resulting from operational efficiency, manufacturing prices, and leveraged gold publicity, mining companies have distinct dynamics for buyers to remember.

In recent times, a major low cost has emerged between gold miners and the yellow metallic. This implies there could possibly be a possible worth funding alternative in gold mining shares right now. The gulf might begin to slim.

Investing in early-stage miners

The VanEck Junior Gold Miners UCITS ETF is the one fund of its form obtainable in Europe. It gives publicity to smaller mining shares, “a few of that are within the early phases of exploration“.

Just below 59% of the 84 corporations within the ETF’s inventory market portfolio are outlined as mid-cap shares, valued between $3bn and $20bn. Some acquainted examples from the FTSE 100 index embrace Endeavour Mining and Fresnillo. The remaining share holdings have market caps beneath $3bn.

Investing in corporations within the early phases of their progress cycles might be engaging since there’s potential for takeovers by bigger producers. Typically, shareholders stand to learn from such strikes. Acquisition targets can expertise share worth spikes throughout negotiations, though this isn’t all the time the case.

Nonetheless, such companies even have larger share worth volatility than extra mature miners. In addition they carry better dangers of default and might be much less aggressive.

Shelter from the inventory market storm?

Gold mining shares typically expertise worth fluctuations which might be unbiased of broad market cycles. In occasions of uncertainty, these companies can profit from investor nervousness. As we’ve seen this 12 months, capital can quickly circulation from different areas of the market into protected haven property.

That stated, VanEck’s ETF isn’t resistant to present difficulties. Practically 48% of the portfolio is concentrated in Canadian gold mining corporations. These companies depend on the US as a serious export vacation spot.

Trump’s resolution to impose 25% tariffs on Canadian imports may make gold from the nation inordinately costly for American refiners and jewellers.

Nonetheless, I believe this ETF could possibly be a useful portfolio addition to contemplate. I wouldn’t wish to be overly uncovered to gold miners, however they will supply helpful diversification for buyers involved about wealth preservation in right now’s uneven inventory market.