Picture supply: Getty Pictures

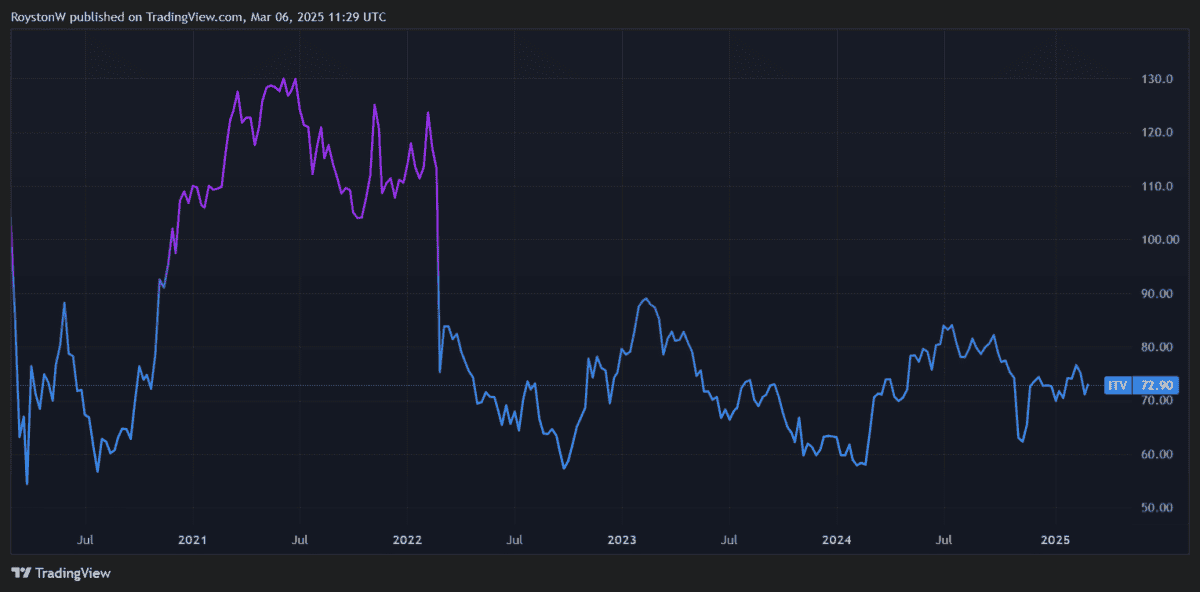

ITV (LSE:ITV) shares are rising strongly once more following a bumpy few months. Issues on the broadcaster’s manufacturing division, combined with considerations over the well being of the UK financial system and route of rates of interest, weighed on investor sentiment late final yr.

Nevertheless it’s on the entrance foot once more Thursday (6 March) after a stable set of buying and selling numbers for 2024. These confirmed adjusted pre-tax earnings up 19%, at £472m.

At 72.90p per share, ITV’s share worth was final round 5% larger on the day. And if dealer forecasts show appropriate, it can proceed to rise through the subsequent 12 months. However how reasonable are the Metropolis’s estimates?

One other 17% rise?

As with every share, a variety of opinions exist the place ITV’s share worth is heading. One significantly bleak forecast has the industrial broadcaster slumping 18% from present ranges, to 60p per share. On the different finish of the size, probably the most bullish estimate has the FTSE 250 firm leaping 58% to 115p.

General, Metropolis analysts are overwhelmingly constructive on ITV shares for the subsequent yr. The common worth goal amongst eight brokers with scores on the inventory is 85.57p per share, marking a 17% premium to as we speak’s worth.

Nonetheless low cost

What suggests important worth rise potential from present ranges? When mixed with predicted dividends, a lump sum funding as we speak might yield a major whole investor return. Metropolis analysts expect a 5.1p per share money reward in 2025, leading to an enormous 6.9% dividend yield.

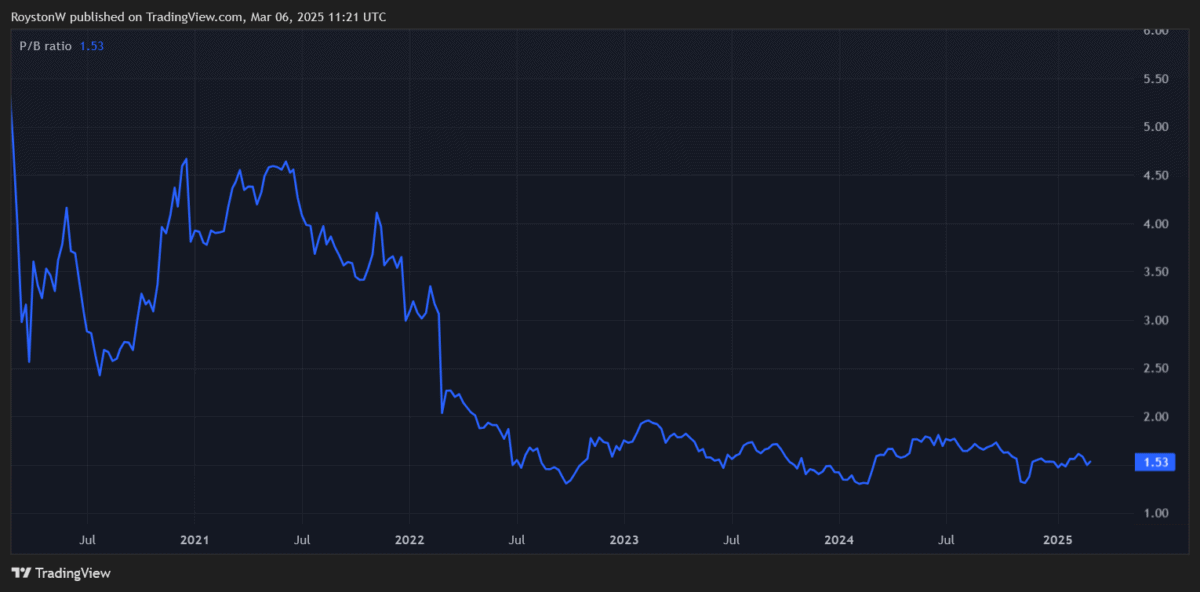

Encouragingly, ITV shares proceed to commerce at an honest low cost to their long-term common. This theoretically supplies added scope for the broadcaster to rise in worth.

Metropolis analysts assume annual earnings will improve 4% in 2025, to eight.99p per share. This leaves the agency with a price-to-earnings (P/E) ratio of 8.1 instances, a way beneath the 10-year common of 9.9 instances.

ITV’s price-to-book (P/B) ratio of 1.5 in the meantime, can also be properly beneath the long-term common (because the chart exhibits).

With its ahead dividend yield additionally above the 5.5% common for the previous decade, I feel the enterprise might proceed attracting curiosity from worth hunters.

Quietly assured?

But an extra rise in ITV shares is not at all a performed deal. Promoting revenues might crumble once more if financial circumstances worsen. Tighter advertising and marketing restrictions on unhealthier meals from October might also hit advert gross sales exhausting.

Intense competitors from different broadcasters, to not point out US streaming giants like Netflix and Amazon‘s Prime service, might additionally weigh on efficiency.

However on the entire, I’m optimistic that ITV’s share worth might proceed rising. With demand for content material steadily rising, and artistic strikes within the US over, I imagine ITV Studios can hold shining (earnings right here reached document highs in 2024).

I’m additionally inspired by the breakneck momentum of ITVX. It’s been Britain’s quickest rising streaming platform through the previous two years and drove ITV’s digital advert revenues 15% larger final yr.

Lastly, the agency’s cost-cutting programme additionally continues to surpass expectations. It delivered £60m of financial savings in 2024, beating estimates by a cool £10m. I feel ITV shares are value severe consideration as we speak.