Picture supply: Getty Photos

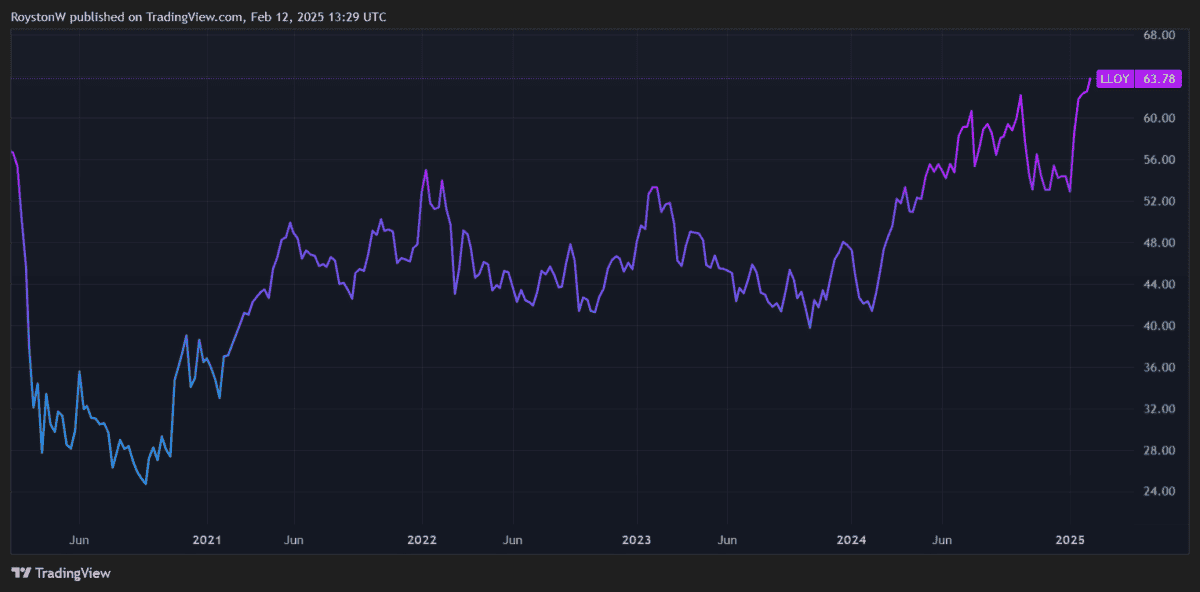

There’s little doubt that Lloyds Banking Group (LSE:LLOY) shares provide super worth on paper.

It appears like a cut price primarily based on predicted earnings — its price-to-earnings (P/E) ratio is 9.3 instances. The financial institution additionally provides first rate worth in view of predicted dividends, with its yield at a FTSE 100-beating 5.2%.

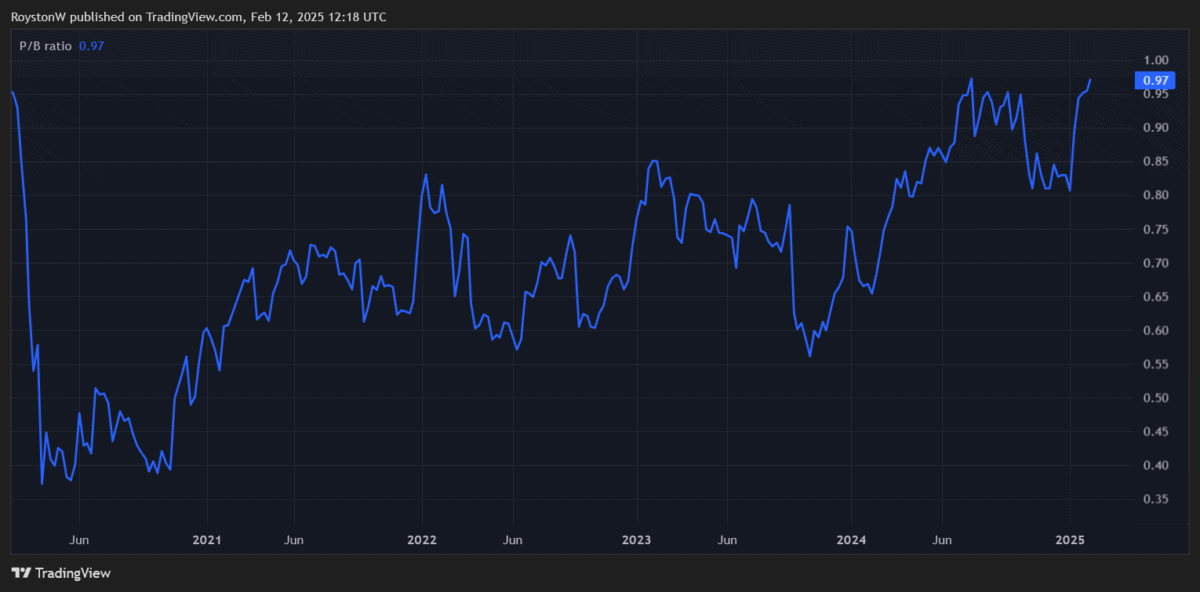

Lastly, with a price-to-book (P/B) ratio under one, Lloyds additionally trades at a slight low cost to the worth of its belongings.

However I don’t see Lloyds’ share value as a superb cut price. Relatively, my view is that the financial institution’s low-cost valuation displays the excessive threat it poses to traders and its poor progress prospects trying forward.

Listed here are 4 causes I’m avoiding the Black Horse Financial institution immediately.

1. Rising mortgage competitors

Indicators of restoration within the housing market are nice information for the UK’s largest mortgage supplier. House mortgage demand is recovering strongly as purchaser confidence improves.

Mortgage approvals for dwelling purchases leapt 28% 12 months on 12 months in December, authorities knowledge exhibits.

Nevertheless, margins on this key product phase are crumbling as competitors intensifies. Santander and Barclays have sliced some mounted mortgage charges to under 4% this week, whereas others are additionally chopping amid a race to the underside.

Lloyds could have no selection however to observe the herd, lest it loses new patrons and re-mortgagers to its rivals.

2. Margin pressures

The outlook for Lloyds’ margins is already fairly gloomy because the Financial institution of England (BoE) ramps up rate of interest cuts.

Internet curiosity margins (NIMs) at group degree have been wafer skinny within the third quarter of 2024, at 2.94%. They dropped 21 foundation factors 12 months on 12 months, and will plummet extra sharply if BoE charge reductions warmth up because the market expects. This would go away little-to-no room for earnings progress.

Consultants recommend rates of interest will decline to at the very least 4% by the tip of December, down from 4.5% immediately.

3. Struggling financial system

On the brilliant aspect, charge reductions will doubtless enhance Lloyds by supporting credit score demand and spending on different monetary merchandise. They might additionally cut back the extent of credit score impairments the financial institution endures.

But a dismal outlook for the UK financial system suggests it may nonetheless face points on each these fronts. The BoE’s resolution to chop its 2025 progress forecasts by half (to 0.75%) is a worrying omen.

With the central financial institution additionally tipping inflation to rise once more, Lloyds faces a ‘stagflationary’ quagmire which will harm earnings past this 12 months. Main long-term structural points for the UK financial system embrace labour shortages, falling productiveness, and commerce tariffs.

4. Monetary penalties

The ultimate — and maybe largest risk — to Lloyds’ share value in 2025 is the potential for crushing misconduct prices.

To recap, the motor finance business is topic to a Monetary Conduct Authority (FCA) probe into potential mis-selling. Following a court docket case final September, analysts assume lenders might be on the hook for tens of billions of kilos.

Because the business’s main participant, Lloyds — which made £15.6bn value of automobile loans within the first 9 months of 2024 — might be accountable for a big chunk of this. RBC Capital thinks the associated fee to the financial institution might be an eye-watering £3.9bn, although remember that estimates have been shifting greater in current months.