Most entrepreneurs don’t notice that Google has been dropping search market share in EU nations.

The drop in market share comes at a time when Google’s enterprise is below siege:

- The DoJ beneficial separating Google from Chrome and Android amid a lawsuit in opposition to Alphabet. (I summarized the lawsuit and potential outcomes in Monopoly.)

- The Justice Division runs a separate lawsuit in opposition to Google’s promoting enterprise.

- Canada simply sued Google over anti-competitive practices in on-line adverts.

- ChatGPT, Perplexity & Co are rising thoughts and market share. (I lined the meteoric rise of ChatGPT in ChatGPT Search.)

- Google faces heavy regulation within the EU from the DMA (Digital Advertising and marketing Act), which I wrote about in 2 Internets.

So, the query is two-fold: How a lot does the drop in market share matter, and what’s the driver?

The quick reply is that the drop issues greater than Alphabet may wish to admit.

It provides oxygen to opponents and weakens the physique within the struggle in opposition to exterior brokers. Google’s income remains to be sturdy, however promoting market share is declining.

A mixture of regulation, opponents, and detrimental sentiment towards Google appear chargeable for the drop.

The implication is that entrepreneurs more and more want to trace and optimize for extra serps, however a extra fragmented enjoying area may be a possibility for extra referral site visitors from serps to web sites.

What Is Going On With Google?

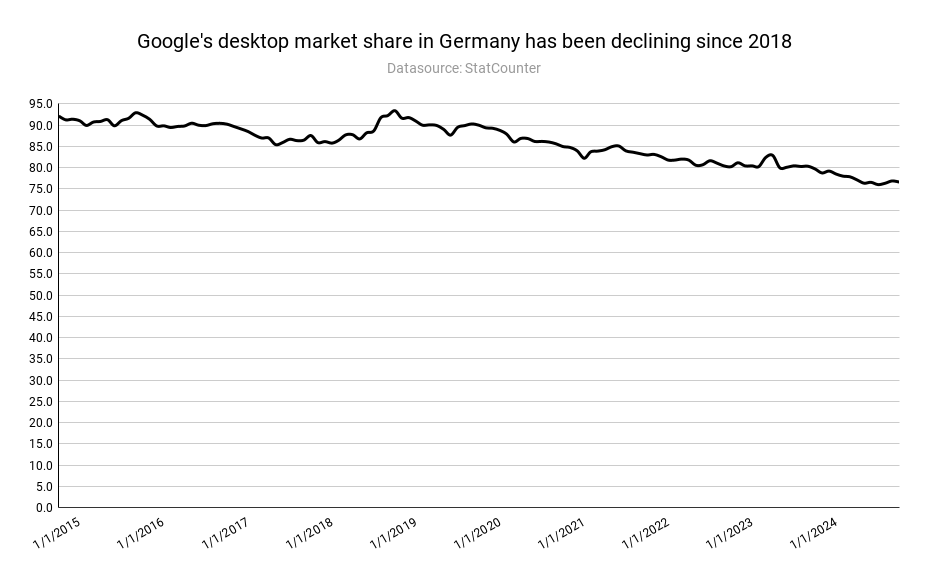

Picture Credit score: Kevin Indig

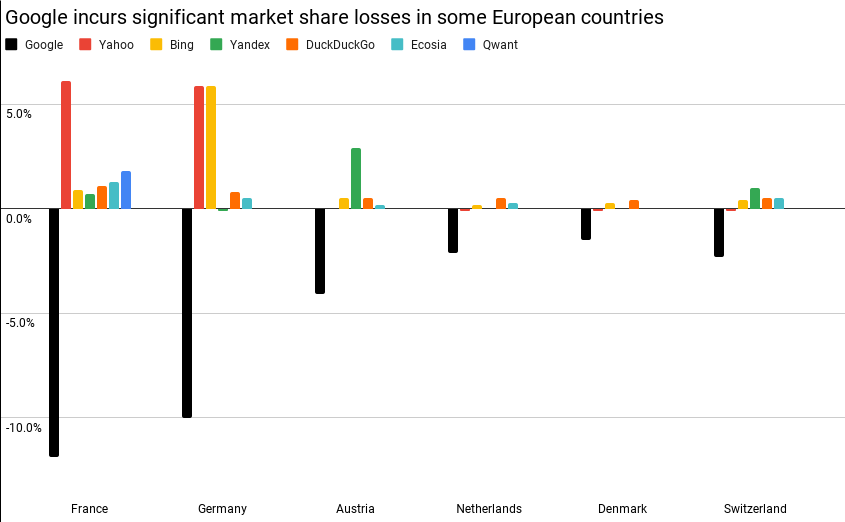

Picture Credit score: Kevin IndigGoogle’s market share during the last 10 years dipped by -5.6 pp (proportion factors) in France and -3.3 pp in Germany.

StatCounter has by no means recorded such a low share since measuring knowledge in January 2009.

France and Germany are usually not the one ones. Most EU nations noticed Google’s market share drip within the final 5 years (cellular):

- Austria: -4.1 pp.

- Poland: -3.1 pp.

- Switzerland: -2.3 pp.

- Netherlands: -2.1 pp.

- Denmark: -1.5 pp.

Zooming additional in additionally doesn’t change issues. Google market share during the last 12 months (cellular):

- France: -4.6 pp.

- Austria: -3.2 pp.

- Poland: -2.4 pp.

- Germany: -2.1 pp.

- Switzerland: -1.3 pp.

- Netherlands: -1.0 pp.

- Denmark: -1.0 pp.

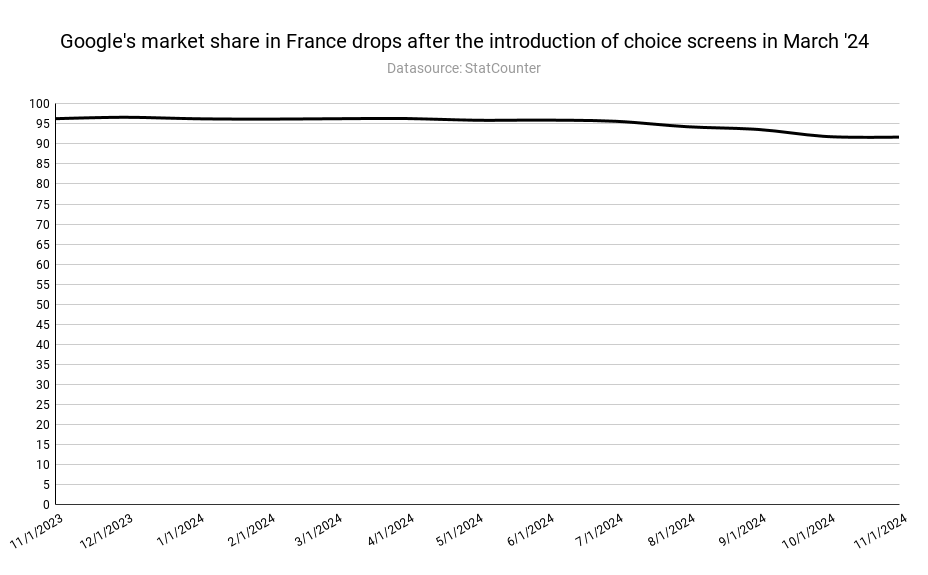

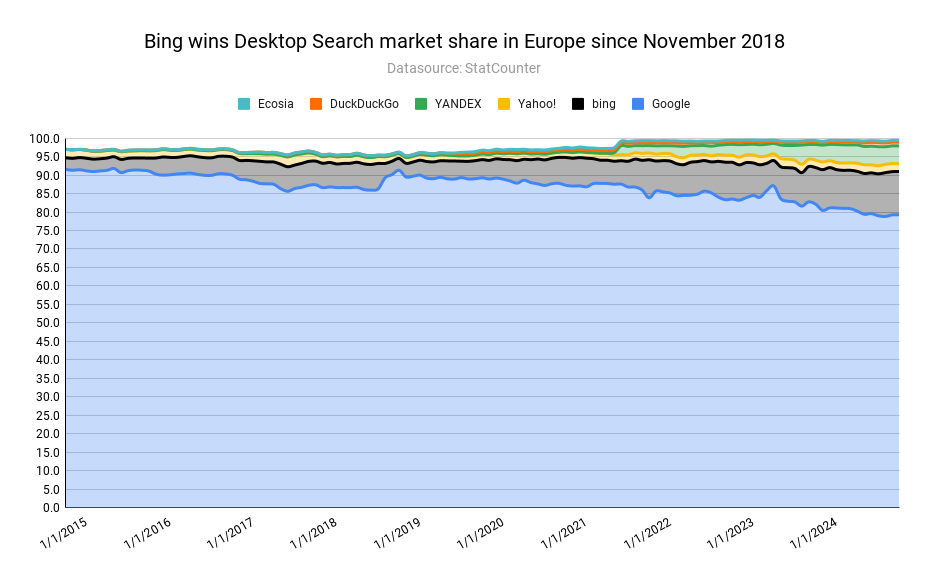

What’s happening? The image turns into clearer after we take a look at when the pattern modifications. There are two inflection factors: November 2018 and April 2024.

Picture Credit score: Kevin Indig

Picture Credit score: Kevin IndigThe info exhibits a shift away from Google beginning round April, a month after Android and Apple launched selection screens for browsers and serps.

In different phrases, Google can now not be the default search engine on cellular and desktop units. We’re beginning to see the outcomes.

Nevertheless, not all nations see a dip. Why?

Why Are Some Nations Flat?

Google’s market share isn’t down in each EU nation, e.g.:

- Portugal.

- Spain.

- Italy.

- Eire.

How come? These nations are a part of Europe, and customers see a selection display screen.

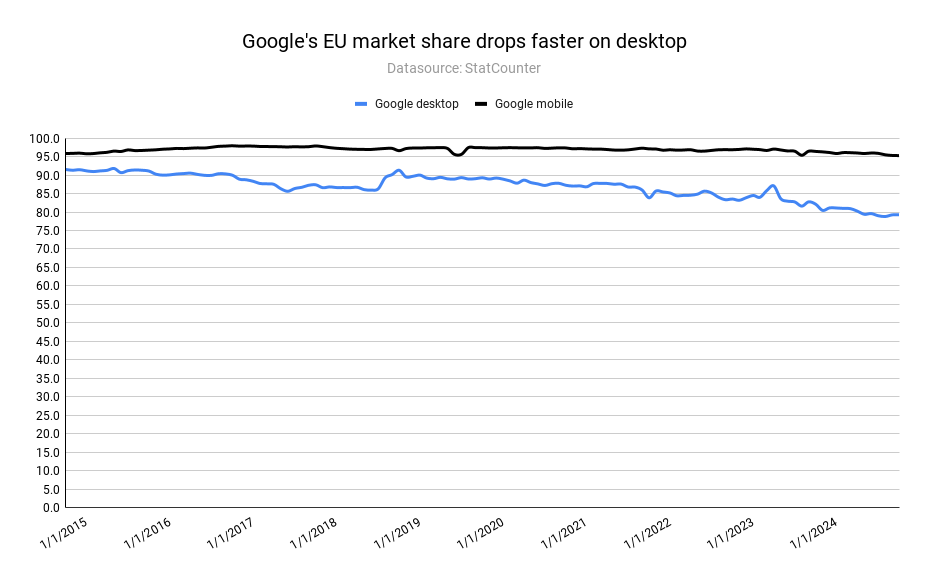

The reply is units. The nations listed above misplaced market share on desktop however not cellular.

Picture Credit score: Kevin Indig

Picture Credit score: Kevin IndigThis occurs in every single place within the EU. During the last 5 years, Google misplaced -2.1% market share on cellular in comparison with -10% on desktop within the EU.

Why?

An enormous a part of the reason being the unique distribution settlement with Apple.

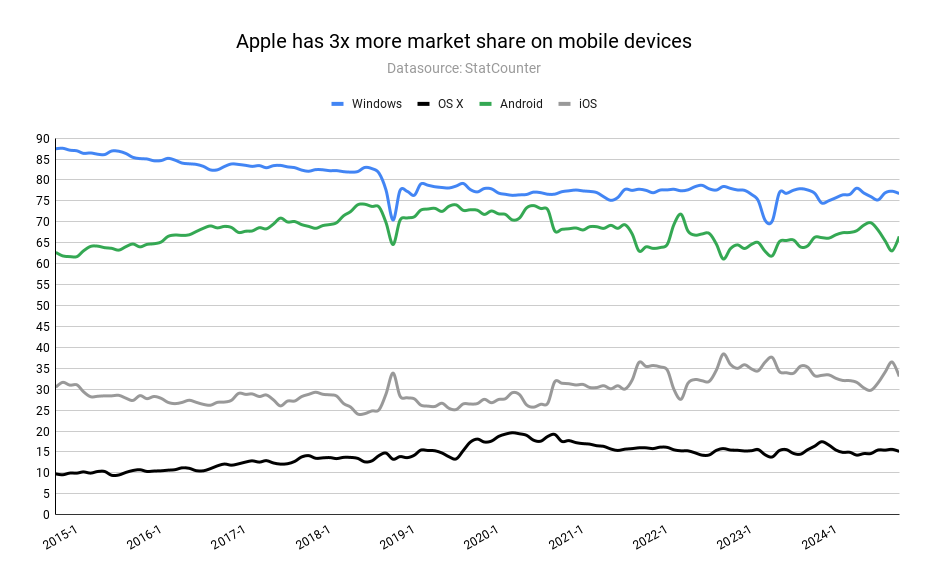

Home windows is the dominant desktop working system, with +75% within the EU, largely due to its domination in company computing. MacOS has solely 15.1%.

Whereas Android (Google’s working system) additionally has the bulk market share on cellular with 66.5%, Apple’s iOS has 33%.

And since Google is the default search engine on Apple units by paying a $20 billion charge, its place is extra stable within the EU on cellular – till the DMA pressured selection screens in March.

Picture Credit score: Kevin Indig

Picture Credit score: Kevin IndigHowever what about nations that present a decline in Google’s market share earlier than March? Method earlier than!

Why Does The Dip Begin Earlier In Some Nations?

Picture Credit score: Kevin Indig

Picture Credit score: Kevin IndigGoogle misplaced market share in nations like Germany and Portugal as early as November 2018. So, there should be one thing else happening in addition to selection screens and device-specific dynamics.

Two issues occurred in 2018: First, GDPR, the European knowledge safety legislation, got here into impact in Might 2018. Second, the EU fined Alphabet €4.34 billion for antitrust violations associated to Android’s market dominance.

Each occasions didn’t immediately lower Google’s market share however set off a interval of Google distrust that gave area to smaller opponents like DuckDuckGo and Bing.

Europeans are way more privacy-sensitive, which suggests regulatory fines and privateness legal guidelines affect shopper habits way more than the U.S.

For instance, the European privateness search engine StartPage will get 56% of searches from the EU and 21% from the U.S.

Customers go to Google much less due to privateness considerations. France declared to not use Google as a default search engine for some ministries in November 2018.

Selection screens and public notion are the most important drivers behind Google’s decline. Google sends much less referral site visitors to web sites. So, what’s the impact?

Who Wins What Google Loses?

Picture Credit score: Kevin Indig

Picture Credit score: Kevin IndigThe largest winner of Google’s decline is Bing. The ever-second search engine is the most important beneficiary of Google’s decline.

It’s very potential that ChatGPT and its shut affiliation with Microsoft gave its search engine a much bigger enhance in Europe than initially assumed, however Bing can be the second selection in cons’ minds.

Now, these numbers are nonetheless peanuts, and serps like DuckDuckGo, Ecosia, and QWANT license search outcomes from Bing and Google. So, you would say that Google and Bing win, in any case.

Nevertheless, Ecosia and QWANT are engaged on a joint net index to change into impartial from different serps.

How for much longer till DuckDuckGo and others announce their very own index as effectively? When the alpha will get weaker, the smaller animals scent the chance.

Regardless of the decline in market share, Google’s search income remains to be rising impressively quick at its scale. Why?

- Market share doesn’t must correlate with search quantity or monetizable queries.

- There are extra cellular than desktop searches, and cellular searches drop to a smaller diploma.

- Google nonetheless dominates in different markets – the EU won’t be sufficient to place a dent into Google’s income that the corporate couldn’t compensate.

- Google has been extra aggressive in search monetization than the drop in market share.

Relative advert income development, which is predicted to fall beneath 50% subsequent 12 months, may very well be a greater indicator than absolute development.

I additionally wish to level out a caveat within the knowledge: StatCounter gathers knowledge by measuring referral site visitors on 1.5 million websites. There’s a likelihood that Google sending out much less site visitors to web sites and protecting it to themselves impacts the numbers.

What Are The Implications?

Google’s dropping market share within the EU, mixed with potential antitrust cures (like a pressured finish to the distribution settlement with Apple) and extra competitors, will doubtless fragment Search additional.

In different phrases, we would optimize for extra serps (once more). Most of them may perform equally in rating however may want web site house owners to take devoted indexing actions, corresponding to integrating with Bing’s IndexNOW.

We’ve already dusted off our Bing Webmaster Instruments when it turned out ChatGPT is utilizing Bing outcomes for its search function. What’s subsequent? Perplexity webmaster instruments? Boosted by rising market share, search engine optimization professionals ought to pay extra consideration to Bing.

Different serps don’t have webmaster instruments but – to my shock. What higher strategy to foster a relationship with web site house owners than a portal? However with more and more impartial indices, that would change into a actuality quickly.

Satirically, the monopoly lawsuit in opposition to Google comes simply as the corporate will get extra competitors. A 1% market share of a large like Alphabet can create a unicorn with $1.75 billion in ARR.

Browsers play a important position within the search engine wars. The DoJ is pushing for Chrome to divest from Google, and OpenAI is working by itself browser.

For my part, OpenAI should purchase Arc. Both manner, browsers are the last word web person interface and provide extra person info than serps can chew.

I wish to be clear that I don’t suppose Google is doomed to fail. Google has all of the substances to come back out on high within the “new AI world.” The one purpose it can fail is by standing in its personal manner.

France is ditching Google to reclaim its on-line independence

OpenAI Considers Taking up Google With Browser

Featured Picture: Paulo Bobita/Search Engine Journal