Picture supply: Getty Pictures

Smith & Nephew (LSE: SN.) shareholders obtained a Halloween fright in the present day (31 October), because the FTSE 100 inventory plunged by as a lot as 13.7%. Does this sharp drop make the medical gear maker a price inventory? And in that case, is now the time for me to swoop in and purchase?

What occurred

Smith & Nephew makes hip and knee replacements, surgical devices for sports activities accidents, and wound care options. It’s a really world enterprise, as highlighted in in the present day’s third-quarter buying and selling replace, the place China emerged because the chief wrongdoer behind the inventory’s decline.

The corporate noticed weaker-than-expected demand for its surgical merchandise on the earth’s second-largest financial system. This meant third-quarter income elevated by 4% 12 months on 12 months to $1.4bn, however missed analysts’ expectations for five.2% progress.

Excluding China, income progress was 5.9% on each an underlying and reported foundation. Nevertheless, managements says “China headwinds will proceed into 2025“.

Consequently, the agency expects annual underlying income progress of 4.5%, down from an earlier forecast of 5%-6%. For 2025 although, it expects to increase its “buying and selling revenue margin considerably to between 19% and 20%“.

CEO Deepak Nath added: “We stay satisfied that our transformation to the next progress firm, with the flexibility to drive working leverage by to the underside line, is on the proper course“.

Cut price inventory?

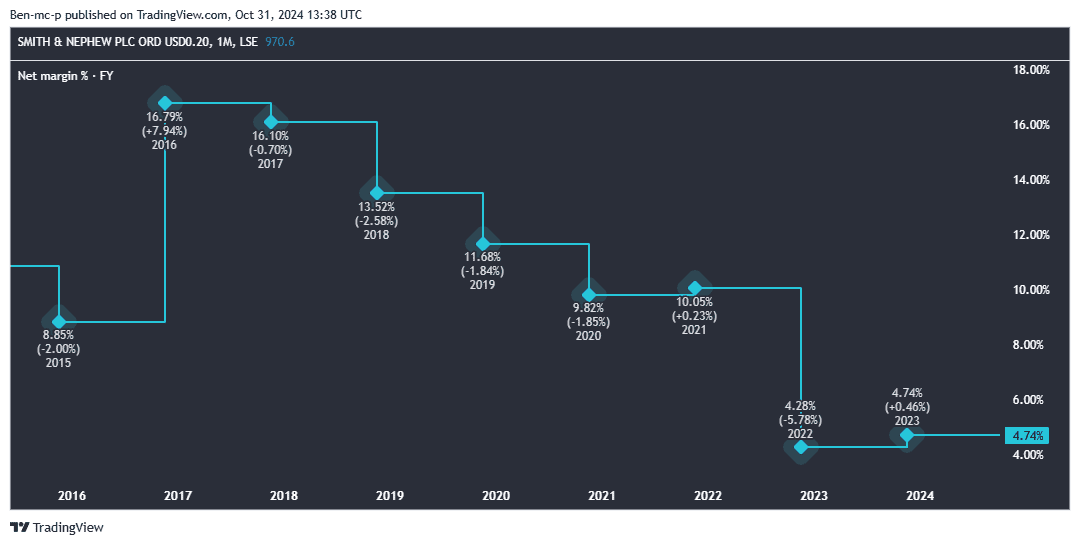

Whereas the share worth is down by greater than 40% over the previous 5 years, that doesn’t make the inventory any cheaper. Income and margins took a giant hit from the pandemic and excessive inflation, as we will see beneath.

The agency’s solely simply beginning to get again on observe, so this information is a setback.

Earnings forecasts is likely to be pegged down a bit now with the weak spot in China anticipated to proceed into 2025. However in line with the newest figures I can see, we’re taking a look at a price-to-earnings (P/E) ratio of round 13 for 2025.

If the corporate ultimately manages to kickstart income progress and increase margins, as administration has set about doing, then the inventory may properly show to be a prime worth inventory at in the present day’s worth.

The long run

After all, China is the wildcard right here. We’re seeing a number of companies reporting excessive weak spot there. And buying and selling situations may all the time worsen over the subsequent couple of years, regardless of Beijing’s greatest makes an attempt.

World inflation may additionally begin creeping again up, placing stress on margins. Due to this fact, I wouldn’t name this a ‘no-brainer’ inventory.

Taking an extended view, nonetheless, there’s loads to love nonetheless. In line with the United Nations, the variety of individuals aged 65 years or older worldwide is projected to greater than double, rising from 761m in 2021 to 1.6bn in 2050. The variety of individuals aged 80 years or older is rising even sooner.

Certainly there will likely be many extra hip, knee, and different joint replacements wanted in future. And that ought to ultimately profit Smith & Nephew, whose largest division is orthopaedics (40% of income final 12 months).

Would I make investments?

In my very own portfolio, I’ve chosen robotic surgical procedure pioneer Intuitive Surgical to get direct publicity to this world ageing pattern. However that is about as removed from a price inventory because it will get.

If I wished a less expensive approach to play this theme, I’d think about Smith & Nephew inventory after the massive fall in the present day.