Picture supply: Getty photographs

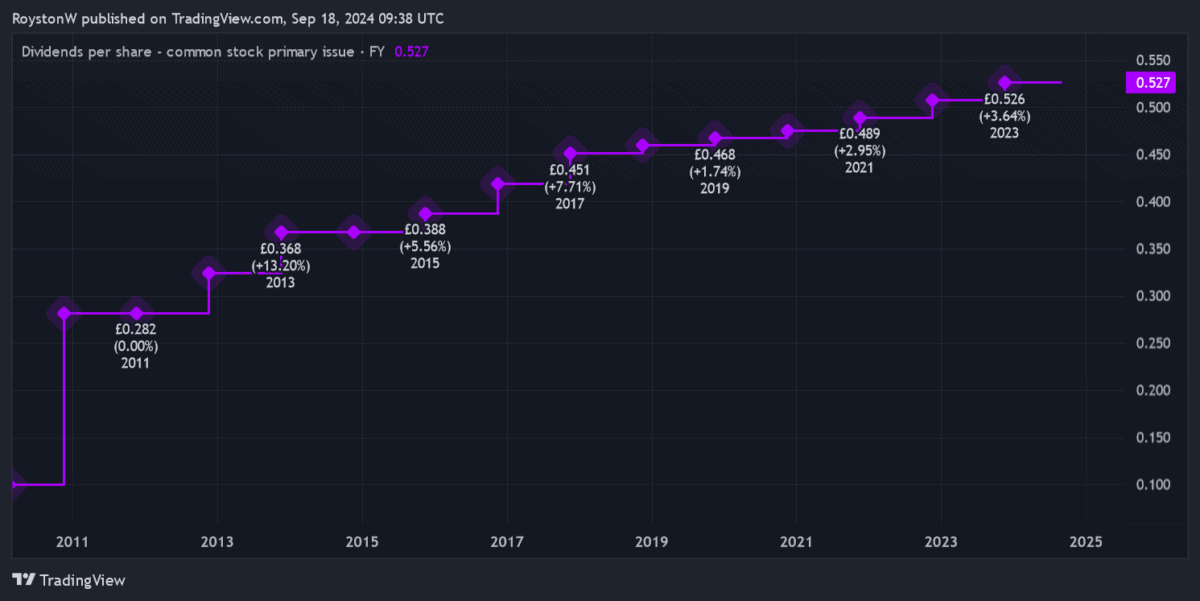

Phoenix Group (LSE:PHNX) has confirmed to be one of many FTSE 100‘s greatest dividend shares in the course of the previous decade. It even continued to boost shareholder payouts in the course of the Covid-19 disaster when different blue-chip shares have been chopping, cancelling and suspending dividends.

The Footsie’s dwelling to many nice dividend progress shares. Sage Group, Ashtead Group and Halma are only a few blue-chip shares with lengthy information of unbroken payout progress.

Nonetheless, these corporations don’t provide the market-mashing dividend yields of Phoenix shares. These ultimately rise by way of 10% over the medium time period, because the desk beneath reveals.

| Yr | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2024 | 54p | 3% | 9.9% |

| 2025 | 55.7p | 3% | 10.2% |

| 2026 | 57.3p | 3% | 10.5% |

The prospect of constructing a FTSE 100-beating dividend revenue over the interval is tantalising to me. The typical ahead yield for Footsie share sits manner again at 3.5%.

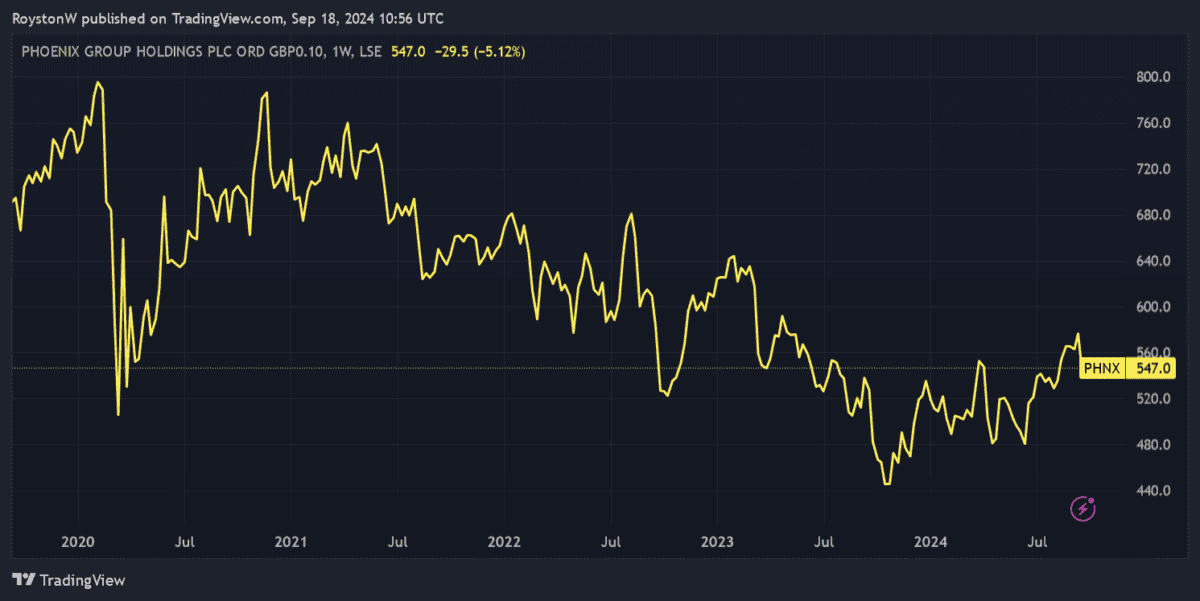

However dividends are by no means assured, and I would like to think about how sensible these forecasts are. I have to additionally take into account different elements that influence Phoenix’s funding case. Massive dividends would possibly rely for nothing if the corporate’s share value plummets.

Right here’s my view of the monetary companies mammoth.

Dangerous omen

To be trustworthy, my first tackle Phoenix’s dividend prospects isn’t an encouraging one. I’m taking a look at dividend cowl, which signifies how nicely predicted payouts are coated by anticipated earnings.

Like dividend forecasts, income estimates may miss their mark. So a studying of two instances and above gives buyers with strong safety.

Within the case of Phoenix, predicted earnings of 44.9p per share for 2024 are literally decrease than the anticipated dividend per share of 54p.

The connection switches from subsequent 12 months, however dividend cowl of 1 instances and 1.1 instances for 2025 and 2026, respectively, is much from sturdy.

Good omen

That stated, I wouldn’t say Phoenix’s poor dividend cowl is a dealbreaker. Earnings per share have repeatedly surpassed dividends in recent times, however this hasn’t hampered the corporate’s potential to pay an enormous and rising dividend.

Previous efficiency isn’t a dependable information of the longer term. However a look at Phoenix’s steadiness sheet fills me with optimism.

As of June, its Solvency II capital ratio was 168%. This was nicely inside the corporate’s goal of 140% to 180%.

Phoenix is a cash-generating machine. And as a possible investor I’m inspired by its potential to repeatedly meet — and even beat — its money creation targets.

Sturdy money era within the first half, for example, led the agency to say “we’re assured of delivering on the top-end of our £1.4bn to £1.5bn goal vary in 2024.”

A prime dividend share

As a consequence, I’m fairly upbeat on Phoenix’s dividend forecasts for the following few years. My predominant concern is whether or not its share value may battle by way of to 2026. Powerful financial circumstances and the ever-present risk of market volatility may adversely influence the enterprise.

Nonetheless, as a long-term investor this isn’t a dealbreaker for me. I imagine that Phoenix’s share value will rise steadily over time as demographic adjustments drive demand for retirement merchandise. I truly assume it may rise in worth as rates of interest fall.

And within the meantime, I may stay up for extra juicy dividends. It is a share I’ll severely take into account after I subsequent have money spare to speculate.