Picture supply: Getty Pictures

After we look again in just a few years, I feel this may show to be a good time to put money into small-cap development shares. Many of those smaller UK companies are buying and selling at low valuations, regardless of having tonnes of potential.

Trying forward, investor sentiment may get a lift as inflation and rates of interest fall. So I feel now’s an opportune time to think about snapping up UK small-cap shares.

Analysts are bullish on this one

One which’s lately caught my eye is Kooth (LSE: KOO). This can be a digital psychological well being supplier with a market cap of simply £114m.

Since going public in 2020, the inventory has risen 36%. Nevertheless, its down 19% from a excessive reached three years in the past.

On 17 September, Canaccord Genuity reaffirmed its ‘purchase’ ranking on the inventory and issued a 580p share value goal. On the identical day, Berenberg Financial institution additionally reissued its ‘purchase’ ranking, with a 590p goal.

If these are realised, they’d signify features of as much as 81% from the present 326p value. Naturally, this isn’t assured to occur. However when there’s such a giant discrepancy, my ears prick up.

What does the agency do precisely?

Kooth works with the NHS, native authorities, charities, and companies to supply digital psychological well being providers to youngsters and younger individuals. It’s one of many largest and most trusted suppliers within the UK.

Final 12 months although, Kooth gained a contract with the California Division of Well being Care Providers price not less than $188m. It would provide digital psychological well being care to 13- to 25-year-olds throughout all 58 counties within the state till mid-2027.

Within the first half, the agency’s income surged 179% 12 months on 12 months to £32.5m. This was pushed by the growth within the US, which now accounts for about 70% of complete annual recurring income.

The gross margin expanded to 82.4%, up from 68.8%, whereas adjusted EBITDA was £7.8m. Publish-tax revenue got here in at £3.9m, up from £0.5m.

Whereas Kooth is rising properly, it doesn’t have a protracted monitor report of profitability. This will increase the chance to the funding case.

Psychological well being epidemic

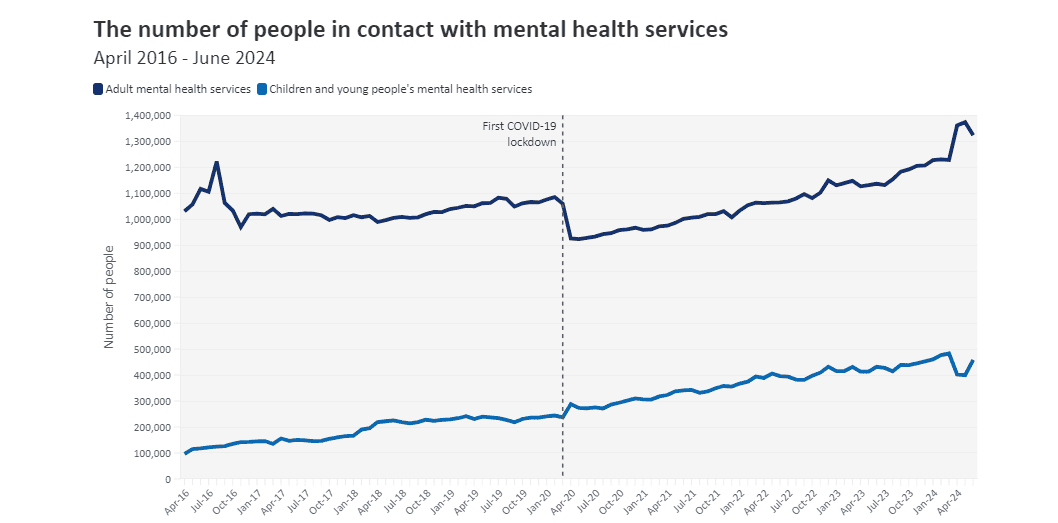

Stepping again, this (sadly) looks like a big and rising market. Social media is resulting in rising ranges of tension and melancholy amongst younger individuals.

In response to the British Medical Affiliation, the speed of individuals aged 17-19 probably experiencing a psychological well being dysfunction rose by roughly 150% between 2017 and 2022.

Shockingly, Kooth says that 22% of highschool college students within the US have significantly thought-about suicide previously 12 months.

These points aren’t more likely to go away within the digital age, which ought to end in rising demand for the corporate’s on-line psychological well being platform.

My resolution

There are a selection of issues I like right here from an funding perspective:

- Rising income, most of it recurring

- Robust objective at its core (sturdy ESG)

- Robust steadiness sheet, with internet money of £14.9m

- Seemingly growth into different US states (it’s additionally gained a contract in Pennsylvania)

- Getting into the $30bn Medicaid market

The agency is just simply turning worthwhile, so the P/E ratio is of little use. However the inventory is buying and selling at about 1.7 occasions forecast gross sales. That’s very low cost for a rising enterprise, in my view.

I’ll take into account shopping for Kooth shares with spare money in October.