Picture supply: Getty Photos

Shopping for undervalued progress shares can produce stable long-term beneficial properties. Since I’ve a long time left in my investing journey, I’m completely satisfied to have publicity to extra risky investments in my portfolio to attempt to beat the market.

With indicators that macroeconomic circumstances might enhance, I’m hopeful that one FTSE 100 progress inventory I personal is perhaps gearing up for a share value rally.

Scottish Mortgage Funding Belief (LSE:SMT) is the inventory I’m speaking about. Right here’s why I’m bullish on the fund’s progress prospects as we speak.

A reduction that may not final

Baillie Gifford‘s £13.7bn managed fund invests in a high-conviction portfolio of progress shares world wide.

It’s a one-stop store for diversification throughout main inventory market names. These embrace semiconductor giants Nvidia and ASML and e-commerce titans reminiscent of Amazon and its Latin American rival MercadoLibre. It additionally invests in unlisted shares like Elon Musk’s enterprise SpaceX.

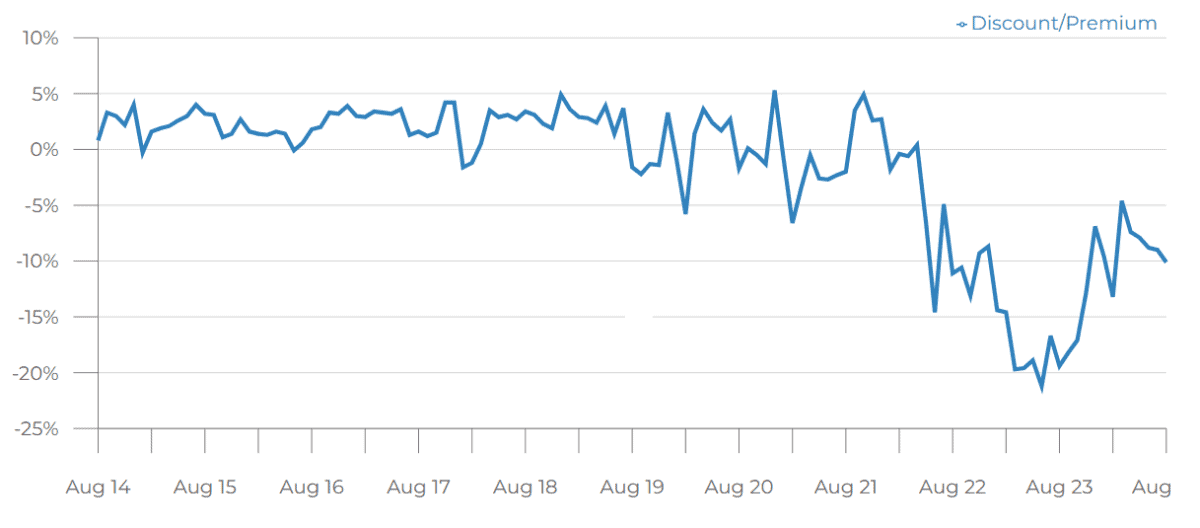

Assessing the web asset worth (NAV) of a closed-ended fund’s investments is one approach to calculate how low cost its share value is. It’s not dissimilar to measuring a standard firm by its guide worth.

At the moment, the Scottish Mortgage share value (just a little above £8 as we speak) stands at a steep 10% low cost to its NAV. For many of the previous decade, it’s traded at a slight premium.

Nevertheless, the post-pandemic hole between the share value and underlying worth of the belief’s investments has narrowed since mid-2023. It appears like time is perhaps of the essence for buyers who wish to purchase low cost Scottish Mortgage shares.

Share value progress

Rate of interest cuts are excessive on the agenda for main central banks throughout the globe. Standard investing knowledge suggests this might enhance the efficiency of progress shares like these in Scottish Mortgage’s portfolio.

That’s as a result of the attraction of fixed-income investments like bonds falls, encouraging buyers to hunt out higher-risk alternatives for progress.

As well as, the administration group has proven dedication to revive the share value again to its pandemic glory days when it briefly modified palms above £15.

A two-year share buyback programme for at the least £1bn price of shares is the most important that’s ever been performed by a UK funding belief. I view this as a shareholder-friendly transfer and an necessary step to deal with the present low cost.

Volatility’s a priority for potential buyers. Scottish Mortgage isn’t a ‘regular as she goes’ funding. The potential of large share value slumps is an intrinsic danger of chasing increased progress.

I even have issues in regards to the fund’s personal fairness publicity. This was a consider a boardroom bust-up that hit the headlines final yr. Finally, it led to the departure of Professor Amar Bhidé who slammed the door on the way in which out in his public feedback.

Unlisted shares are tough to worth. It’s worrying when these closest to the motion categorical doubts in regards to the belief’s technique.

I’m an optimistic shareholder

Regardless of the dangers, I imagine the Scottish Mortgage share value is primed for progress because of a shifting financial local weather and the NAV low cost.

I’m not a fan of each inventory within the portfolio, however I like nearly all of the fund’s investments. That’s adequate for me. I’ll proceed to carry my shares for the long run.