Picture supply: Getty Pictures

Terry Smith doesn’t have a tendency to carry too many FTSE 100 shares in his £23.9bn Fundsmith Fairness portfolio. He has even much less now after disposing of his Diageo (LSE: DGE) holding final month.

In contrast, I added to my holding in August. Ought to I reverse that call? Listed below are my ideas.

Choose a purpose

Now, the very first thing to say is that we don’t know why Fundsmith bought the spirits large. Its newest factsheet merely states: “We exited our place in Diageo in the course of the month“.

However there isn’t any scarcity of potential causes. The share value is down 14.5% 12 months to this point and 39% since late 2021. It’s became a serial underperformer.

Final 12 months (FY24), the corporate noticed declining volumes, gross sales and earnings. There was an embarrassing buildup of unsold booze in Latin America, which raised questions on its stock administration.

Trying forward, the agency has additionally warned that FY25 goes to be difficult. Its medium-term 5-7% annual natural progress goal now appears to be on the rocks (or a minimum of on ice).

I reckon there’s sufficient in all that to show Smith bearish. However maybe he additionally worries that Gen-Z is consuming much less. Non-alcoholic cocktails are on the rise.

In the meantime, there’s proof that weight-loss medicine like Wegovy and Zepbound are lowering demand for spirits. In response to analysis from Morgan Stanley, between 56% and 62% of alcohol shoppers on these drugs reported consuming much less. Round 14% to 18% stated they’d lower out booze altogether!

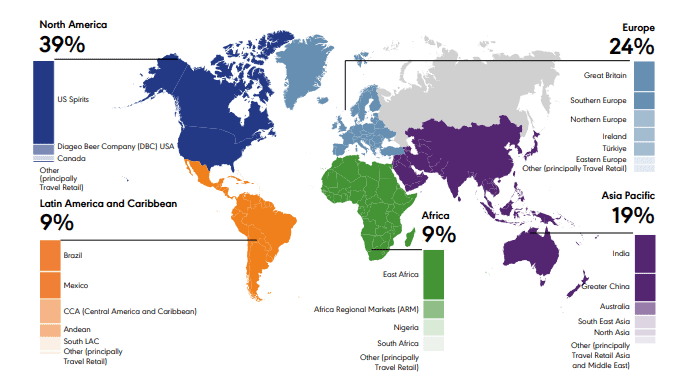

These tendencies are notably pronounced in North America, the place Diageo generates 39% of web gross sales.

Share of reported FY24 web gross sales by area (%)

I’m not promoting but

Writing all that, I really feel like whipping out my cellphone and dumping my Diageo shares too!

The explanation I received’t is as a result of I imagine Diageo’s present weak spot is cyclical, not structural. In different phrases, I nonetheless anticipate important future demand for the agency’s premium manufacturers.

It has a boatload of those. In whisky, it owns Johnnie Walker, Crown Royal, Bulleit, and Buchanan’s. In vodka, Smirnoff, Cîroc, and Ketel One. In tequila, Don Julio and Casamigos.

A few of its manufacturers, similar to Guinness and Baileys, are basically in a class of their very own.

Plus, regardless of its annus horribilis, the agency nonetheless managed to make practically $6bn in working revenue. And it generated $2.6bn of free money circulation, up $400m on the earlier 12 months. I’ve seen far worse from struggling companies not too long ago.

There’s additionally a dividend that now yields 3.4% on a forward-looking foundation. Nothing’s sure with dividends, however I believe the payout may proceed rising steadily for many years to return.

Lastly, the shares are at present valued on 17.7 potential earnings. I imagine that’s a reasonably engaging valuation, which is why I not too long ago added a number of extra shares to my portfolio.

Some issues change slowly

Regardless of what I sometimes learn, I’m skeptical that sure issues — cigarettes, oil, quick meals, booze — are going through imminent existential threats.

The world inhabitants is rising quickly and many individuals are going to get so much richer in future. Whether or not in inns, eating places, cocktail bars or airports, Diageo’s timeless manufacturers will nonetheless be there ready for them.

![Just released: our latest Hidden Winners 'sell' recommendation [PREMIUM PICKS] Just released: our latest Hidden Winners 'sell' recommendation [PREMIUM PICKS]](https://www.consultingproteam.com/wp-content/uploads/2024/02/Just-released-our-latest-Hidden-Winners-sell-recommendation-PREMIUM-PICKS-696x464.jpg)