Picture supply: Getty Photographs

I don’t deal with the inventory market plunge of current days as motive to panic. As an alternative, I see it as an ideal alternative to purchase nice UK shares at knock-down costs.

I make investments primarily based on what returns I can count on to make over the long run. It is because inventory markets all the time have a manner of bouncing again strongly following corrections and crashes.

Shopping for in on the backside provides me an opportunity to reinforce my eventual returns. So which shares am I taking a look at at the moment? Listed below are two of my favourites — together with a top-class exchange-traded fund (ETF) — that I’ll take into account shopping for once I subsequent have money to speculate.

All-rounder

Vodafone Group (LSE:VOD) shares look grime low cost throughout quite a lot of completely different metrics. Its ahead price-to-earnings (P/E) ratio clocks in at simply 9.9 instances, whereas its corresponding dividend yields stands at 7.3% for this 12 months.

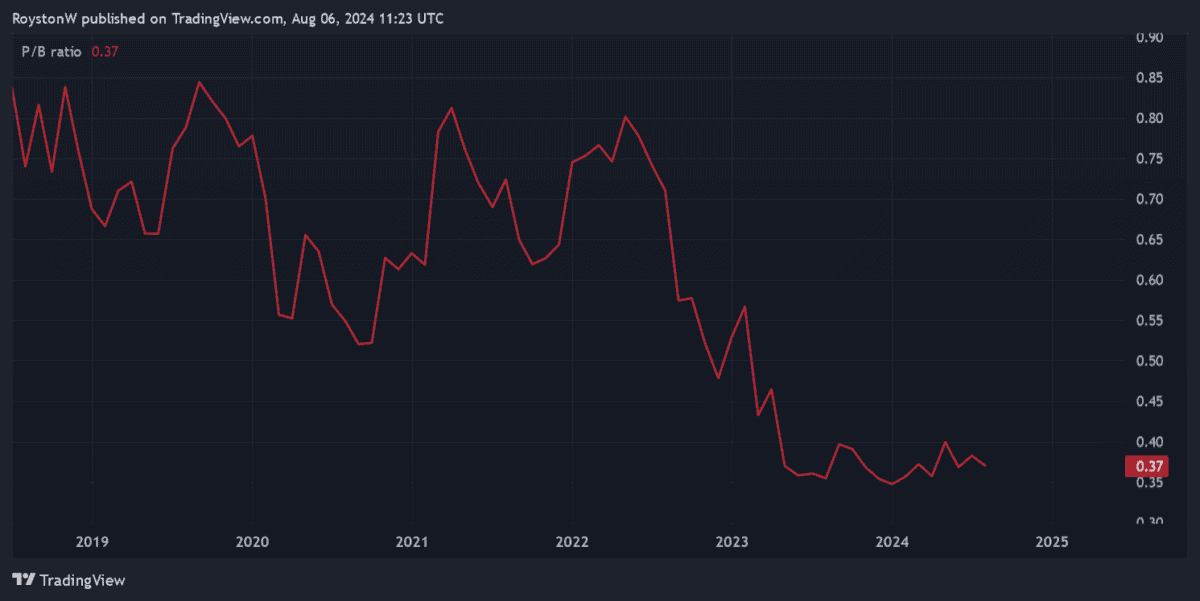

And the FTSE 100 telecoms large trades on a price-to-book (P/B) ratio of simply 0.4. Any studying beneath 1 signifies {that a} share is undervalued.

Vodafone’s share value has plummeted on worries over a US recession and its affect throughout the globe. Nevertheless, telecoms income have a tendency to stay broadly steady throughout the financial cycle, suggesting to me that this sell-off is unwarranted.

However, the enterprise does face important aggressive pressures. Nevertheless, I nonetheless suppose Vodafone has glorious funding potential as our more and more digitalised lives drive telecoms demand.

Defence star

Babcock Worldwide Group‘s (LSE:BAB) shares additionally look very low cost at present ranges. Metropolis analysts suppose annual earnings right here will soar 42% this monetary 12 months. And so the defence large trades on a price-to-earnings development (PEG) ratio of 0.3.

Just like the P/B ratio, a price beneath 1 signifies distinctive worth.

Similar to Vodafone, Babcock operates in a extremely defensive sector, and so earnings needs to be unaffected by broader financial circumstances. In truth, the outlook right here is fairly encouraging because the worsening geopolitical panorama prompts corporations to quickly rearm.

however I’ve to keep in mind that defence timing contracts will be unpredictable. It’s an issue that may adversely have an effect on share costs together with dividends.

A prime fund

The iShares Edge MSCI World Worth Issue UCITS ETF (LSE:IWVL), in its personal phrases, was established to “seize undervalued shares relative to their fundamentals.” Right this moment it holds positions in 399 shares unfold throughout North America, Europe and Japan, which in flip provides buyers a good way to unfold threat.

The fund isn’t resistant to bouts of maximum volatility, as the previous few days have proven. However its deal with low cost shares may restrict value falls if market circumstances worsen.

For instance, it’s eager on the semiconductor business however has steered clear of costly Nvidia shares. As an alternative it’s opted for the likes of Intel and Qualcomm.

These enterprise commerce on ahead P/Es of 19.9 instances and 16.1 instances, respectively. Each readings are far beneath the a number of of 39.5 instances for Nvidia shares.

Slightly below 1 / 4 of the ETF’s cash is locked into data expertise shares. So it could possibly be very susceptible within the occasion of a US recession. However on stability I nonetheless suppose it’s an awesome fund to contemplate.