Picture supply: Getty Photographs

I wish to retire comfortably with a second revenue to enhance my pension. With about 30 years left till retirement, I’m making an attempt to determine how I can try this with solely £8,000 in financial savings.

Thankfully, the miracle of compound returns is on my facet!

That, together with just a few different suggestions and methods, might internet me a dependable second revenue of £1,000 a month – if I play my playing cards proper.

Scale back my outgoings

Many individuals say the easiest way to economize is to cut back spending. Effectively, the identical goes for investing – if I cut back my outgoings, I can maximise my returns. On this case, outgoings are tax.

I can minimise my tax by opening a Shares and Shares ISA, which permits tax-free returns on investments of as much as £20,000 a yr. I believe this is a superb first step on the journey to reaching my objective.

Please observe that tax therapy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Construct a profitable portfolio

There are a number of methods to speculate my financial savings, some simpler than others and a few extra profitable than others. A regular financial savings account is the most secure choice however supplies little or no curiosity. A barely extra unstable authorities liquidity fund normally solely returns 4% or 5% a yr.

To intention for the perfect outcomes, I’m seeking to construct a portfolio of 20 or extra diversified shares with long-term progress potential. The UK’s main index, the FTSE 100, has offered common returns of seven.75% because it started, so I really feel 7% is a conservative common to intention for.

One instance of a share I plan to purchase is Unilever (LSE:ULVR).

Unilever is without doubt one of the largest multinational shopper items corporations, advertising and marketing merchandise to over 190 international locations worldwide. In its newest outcomes launched on 8 February 2024, Unilever reported a 2.6% enhance in working revenue since final yr. Its magnificence and wellbeing division carried out greatest, with underlying gross sales progress of 8.3%.

With €75.27bn in belongings and €54.5bn in liabilities, Unilever has €20.76bn in fairness. In contrast with €28.23bn in debt, its debt-to-equity (D/E) ratio of 1.36 is down from 1.73 in early 2022. That’s nonetheless excessive nevertheless it’s an excellent enchancment.

Unilever faces the danger of provide chain disruption following the continued battle within the Center East that’s led to assaults on delivery containers. Fluctuating foreign money change charges are one other minor threat, contributing to a slight discount in Unilever’s income this previous yr. Each these dangers threaten the corporate’s total efficiency.

Like many corporations, Unilever’s share value has been subdued not too long ago resulting from lingering impacts of the pandemic. Nonetheless, a 30-year timeframe, I can see how Unilever recovered effectively following each the 2000 and 2008 market crashes.

Hold constructing my funding

I do know that my preliminary financial savings alone will not be sufficient to succeed in my objective of £1,000 a month in returns. I might want to make some extra month-to-month contributions for the following 30 years if I hope to try this.

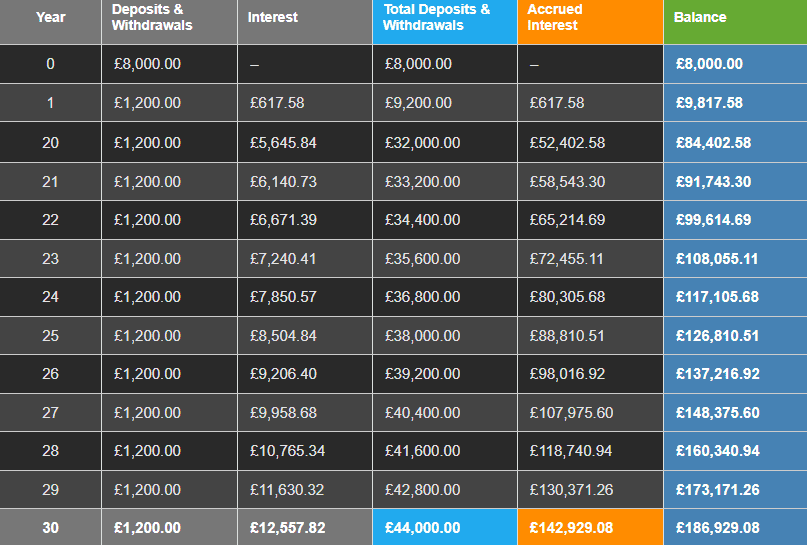

If I can keep a mean annual return of seven% and make investments an extra £100 a month, then my funding might develop to £186,929 in 30 years. That will internet me returns of £12,557 a yr – simply over £1,000 a month.