Picture supply: Getty Photos

I’m uninterested in working weekends. If I need to loosen up and nonetheless keep the life-style I’m accustomed to, I would like a second earnings. One which doesn’t require working seven days every week!

However how can I earn extra earnings with out placing within the further hours at a second job?

Nicely, I’ve been wanting into high-yield dividend shares and I believe I’ve give you a plan. The analysis is finished and the numbers look stable. Now I simply want to begin placing within the preliminary funding capital.

That is my technique.

Crunching the numbers

My plan includes investing a small a part of my month-to-month wage into dividend shares. However first, I have to work out how a lot to speculate and how much returns I can count on. In any other case, I may die earlier than the funding returns something vital.

I’ve about £7,000 in financial savings and may’t afford to spare way more than £300 a month. Meaning I may put in about £10,000 the primary yr and a further £3,600 every consecutive yr. Looks as if even a good return of 10% wouldn’t pay a lot after the primary yr, proper?

Happily, the miracle of compounding returns will work in my favour!

Doubling down on dividends

The key ingredient to this plan is dividends. I have to construct a portfolio of shares with a median yield of not less than 7%. Then I have to reinvest the dividends to compound the returns.

The FTSE 100‘s stuffed with nice dividend shares. Plus, portfolio also needs to profit from round 5% a yr value development. All of it provides up!

Nonetheless, it’ll take a while. Doing the maths, I discovered that in 12 years my funding may have reached £139,460, paying dividends of round £10,000 a yr. Then I may cease the month-to-month contributions and simply benefit from the returns.

That’s not unhealthy!

So which shares are these?

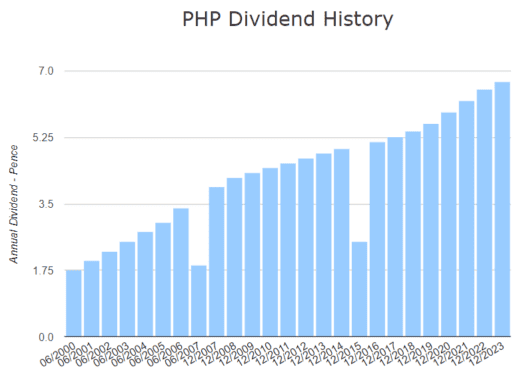

One good instance of the kind of inventory I need to goal is actual property funding belief (REIT) Major Well being Properties (LSE: PHP). Because the yr 2000, the share value has grown from 25p to over 90p, delivering an annualised return of 5.7%.

On high of that, it has a 7% yield and has been paying constant dividends for 20 years. Plus, funds have been rising at an annual charge of three.2%.

That seems like the proper inventory for my technique!

However all the pieces comes with some danger. Whereas REITs have an added tax profit, they’re extremely inclined to housing market points. Everyone knows what occurred in 2008 – when the housing market crashed, the inventory fell 54%. What’s extra, it has plenty of debt and restricted curiosity protection, in order that’s one thing to observe fastidiously.

Please be aware that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Minimal danger, most returns

To scale back danger, I’ll unfold my funding over not less than 10 dividend shares from totally different industries. Another good choices I’ve already chosen embody Aviva, HSBC and Imperial Manufacturers.

I’ll additionally open a Shares and Shares ISA, which permits me to speculate as much as £20,000 a yr tax-free. That ensures my plan will get me the utmost returns.

Will this work? It’s not possible to say for positive. Markets can go up or down primarily based on every kind of things, from political points to environmental adjustments. There’s all the time some danger of losses. However because the saying goes, “no danger, no reward”!