Picture supply: Getty Photos

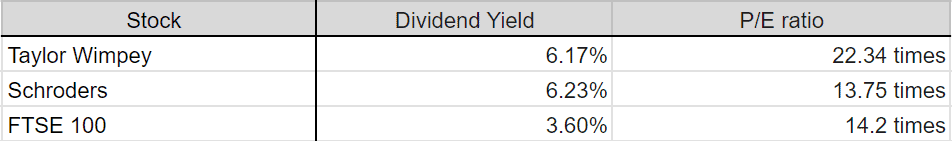

I’m trying to find extra high-yield dividend shares on the FTSE 100 to beef up my passive revenue portfolio. However the yield alone isn’t all the things — I’m additionally on the lookout for ones with rock-bottom price-to-earnings (P/E) ratios. Undervalued shares with excessive yields provide the right mixture of progress and worth.

Taylor Wimpey (LSE: TW.) and Schroders (LSE: SDR) have caught my consideration. They’ll in all probability be among the many prime 10 dividend-paying shares on the FTSE 100 quickly since Vodafone and Burberry will reduce dividends from subsequent yr.

However are they each price shopping for?

Yield-wise, they’re nearly an identical, each round 6.2%. Taylor paid a 9.58p dividend per share final yr, up from 9.4p in 2022. It was decreased in 2019 to three.84p however has in any other case been rising steadily since 2011. Earlier than 2008, the housebuilder paid a 15.75p dividend however was compelled to chop it fully for 3 years.

Schroders’ dividend was 21.5p final yr with no change from the earlier yr. It didn’t reduce or scale back dividends in the course of the 2008 monetary disaster or Covid (though progress did pause). Total, the asset supervisor has a stable 15-year dividend progress charge of 9.61%.

From this knowledge, I can see that Schroders is a extra dependable dividend payer whereas Taylor Wimpey recovers quickly after cuts.

Worth-busters

With regards to worth, the winner’s clear. Primarily based on future money stream estimates, Taylor is undervalued by solely 11%. It additionally has a excessive P/E ratio of twenty-two.2, greater than each the UK market and {industry} common.

Schroders’ P/E ratio of 14.4 is much extra enticing, under each the UK market and its {industry} common. What’s extra, future money stream estimates put Schroders’ share value at 40% under honest worth.

Value progress

Dividends apart, will both of the shares internet me important returns?

Right here I see an enormous discrepancy. Taylor climbed 34% between August 2023 and August 2024, whereas Schroders fell 20%!

On one hand, that doesn’t look nice for the asset supervisor — however it might imply the present value has extra room to develop. The housing big, then again, is close to its highest value in three years.

However what actually makes a distinction right here is industry-specific danger. Trying again 20 years, Taylor’s down nearly 18% as a result of the inventory was decimated by the housing disaster in 2008. Schroders barely registered the crash and subsequently grew 238% within the 20 years previous August 2024.

Future prospects

As a housebuilder, it’s extra vulnerable to UK rate of interest adjustments and native financial points. The brand new Labour authorities’s housebuilding plans are more likely to hold it in excessive demand. However an financial upset might ship it tumbling once more.

Schroders is extra tied to international monetary markets and fewer liable to native volatility. Whereas progress of late has been adverse, it’s extra constant over lengthy durations. Nonetheless, this does imply it might undergo losses even when the UK economic system’s doing effectively.

Total, I feel the dependable funds and a steady value make Schroders a better option than Taylor Wimpey for me for passive revenue. So I plan to purchase it for my dividend portfolio once I subsequent have money to speculate.