Picture supply: Getty Pictures

I’m searching for the perfect dividend shares to purchase for a four-figure passive earnings in 2025. However I’m not simply concentrating on short-term returns. I’m in search of corporations that might pay a big and rising dividend earnings over time.

Listed below are two from the FTSE 100 and FTSE 250 on my radar at present:

| FTSE 100/FTSE 250 inventory | 2025 dividend per share (f) | Dividend yield |

|---|---|---|

| Rio Tinto (LSE:RIO) | 310.4p | 6.5% |

| Grocery store Earnings REIT (LSE:SUPR) | 6.13p | 8.2% |

If forecasts are appropriate, a £20,000 lump sum funding unfold equally throughout these shares will present £1,480 value of dividends in 2025 alone.

Right here’s why I’d purchase them for my portfolio if I had money to take a position at present.

Rio Tinto

Rio Tinto’s a share I already maintain in my Shares and Shares ISA. And following latest heavy share value weak spot I’m contemplating rising my stake.

In addition to boasting that vast 6.5% dividend yield, the mega miner additionally now trades on a low price-to-earnings (P/E) ratio of 8.9 instances.

Earnings are at risk as China’s financial system — which gobbles up swathes of the planet’s uncooked supplies — experiences as prolonged stoop. However I feel the cheapness of Rio Tinto’s shares at present displays this menace.

I actually imagine earnings right here will rise strongly over the long run as commodities demand booms. This shall be pushed by themes like the expansion of synthetic intelligence (AI), the renewable power increase, and ongoing urbanisation and infrastructure spending throughout the globe.

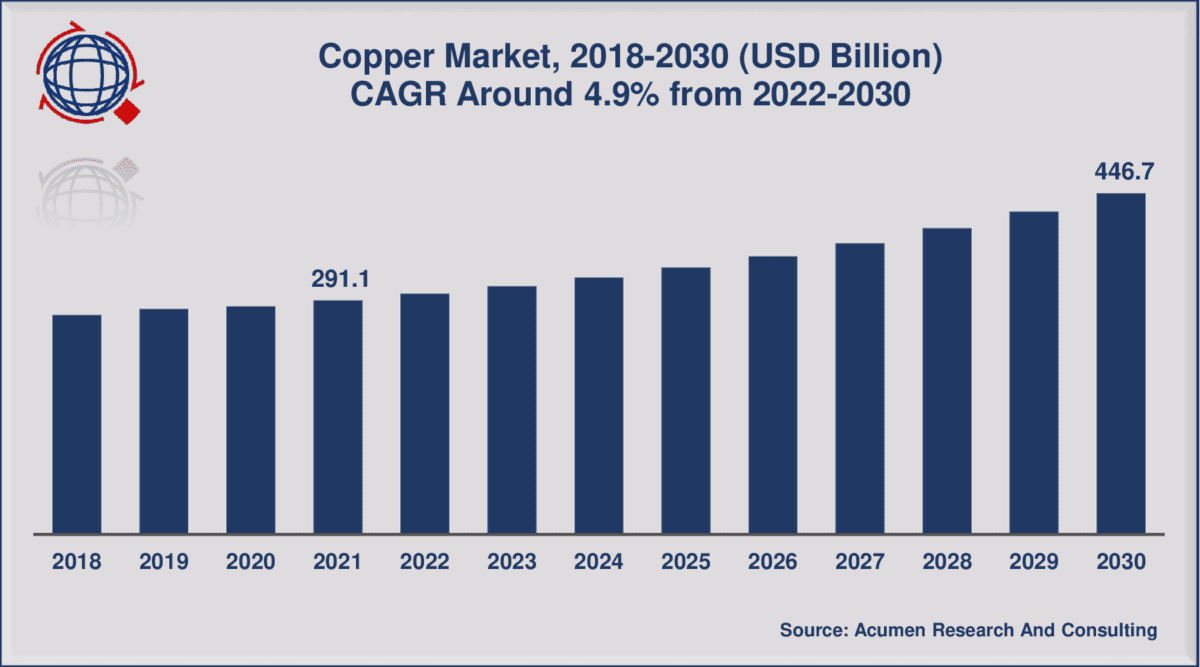

And so now may very well be an ideal dip-buying alternative. Because the chart beneath exhibits, demand for Rio’s copper alone may very well be set to rise strongly via to 2030 no less than.

Within the meantime, I feel the robustness of Rio’s steadiness sheet ought to assist it proceed paying giant dividends even when earnings underwhelm. Its net-debt-to-EBITDA ratio was simply 0.4 instances as of June.

Grocery store Earnings REIT

Rio’s dividend yield for subsequent 12 months sails above the FTSE 100’s 3.5% ahead common. Grocery store Earnings REIT’s much more spectacular for the monetary 12 months ending subsequent June, at north of 8%.

Property shares like these might be nice methods to supply a second earnings. Underneath REIT guidelines, these corporations should pay a minimal of 90% of annual rental income out within the type of dividends. That is in trade for sure tax benefits.

Actual property shares like this aren’t at all times distinctive buys for passive earnings although. As rates of interest rise, earnings come below stress as internet asset values drop and borrowing prices enhance. This may in flip put dividends below stress.

Please be aware that tax remedy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

Nonetheless, with a raft of price cuts tipped for the subsequent 12 months, now may very well be a superb time to contemplate Grocery store Earnings REIT. I particularly prefer it due to its concentrate on an ultra-stable a part of the property market which, in flip, gives it with stability in any respect factors of the financial cycle.

It additionally has its heavyweight tenants (inlcing Tesco and Sainsbury’s) locked on long-running contracts, offering earnings with extra visibility. The agency’s weighted common unexpired lease time period (WAULT) is round 12 years.