Picture supply: Getty Photographs

Dividends from UK shares are by no means, ever assured. As we noticed in the course of the Covid-19 disaster, even essentially the most beneficiant and financially safe firm can postpone, droop, or axe shareholder payouts when catastrophes occur.

However as traders, we are able to take steps to minimise the probabilities of dividend disappointment. Selecting defensive firms that take pleasure in secure earnings (like utilities, healthcare suppliers, and meals producers) is one tactic.

So is deciding on firms with robust steadiness sheets, market-leading positions, and diversified income streams. This may shield earnings when financial situations abruptly worsen.

It’s additionally essential to unfold one’s capital throughout quite a lot of totally different shares. Such diversification reduces the impression of firm and industry-specific elements on traders’ returns.

Three high shares

With all this in thoughts, listed here are three super-safe dividend shares on my watchlist at present.

| Dividend share | Ahead dividend yield |

|---|---|

| Assura (LSE:AGR) | 8.2% |

| Authorized & Normal | 9.5% |

| Diageo | 3.1% |

As I say, dividends are by no means a positive factor, and dealer projections can typically fall brief. But when present forecast are appropriate, a £20,000 funding unfold equally throughout these dividend shares would offer a passive earnings of £1,380 this 12 months alone.

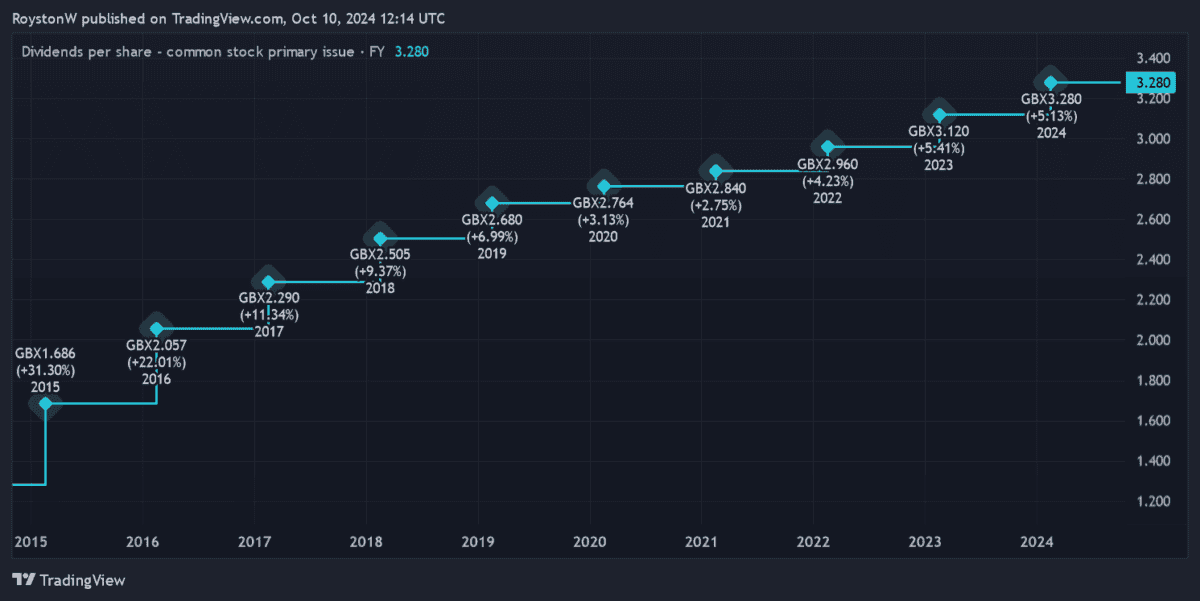

A high REIT

Out of this bunch, let’s take a deep dive into Assura first. Because the chart above reveals, this FTSE 250 firm has a protracted historical past of dividend progress even throughout occasions of disaster.

Metropolis analysts anticipate this proud file to proceed, too, even because the menace from excessive rates of interest stays.

In consequence, the agency’s dividend yields elevate to eight.5% for subsequent 12 months, and to eight.6% the 12 months after.

Elevated rates of interest depress internet asset values (NAVs) for property shares and may considerably increase their borrowing prices. However the defensive nature of Assura’s operations — it owns and lets out main healthcare properties, like physician surgical procedures — permits it to pay a big and rising dividend every year.

The actual property funding belief (REIT) is increasing quickly, to assist it develop earnings past the medium time period. However sector guidelines imply that this costly programme doesn’t have catastrophic implications for dividends.

Below REIT rules, Assura should pay a minimal 90% of annual rental earnings out within the type of dividends. Mixed, these elements make the enterprise a rock-solid earnings decide in my guide.

Please be aware that tax therapy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

FTSE 100 dividend stars

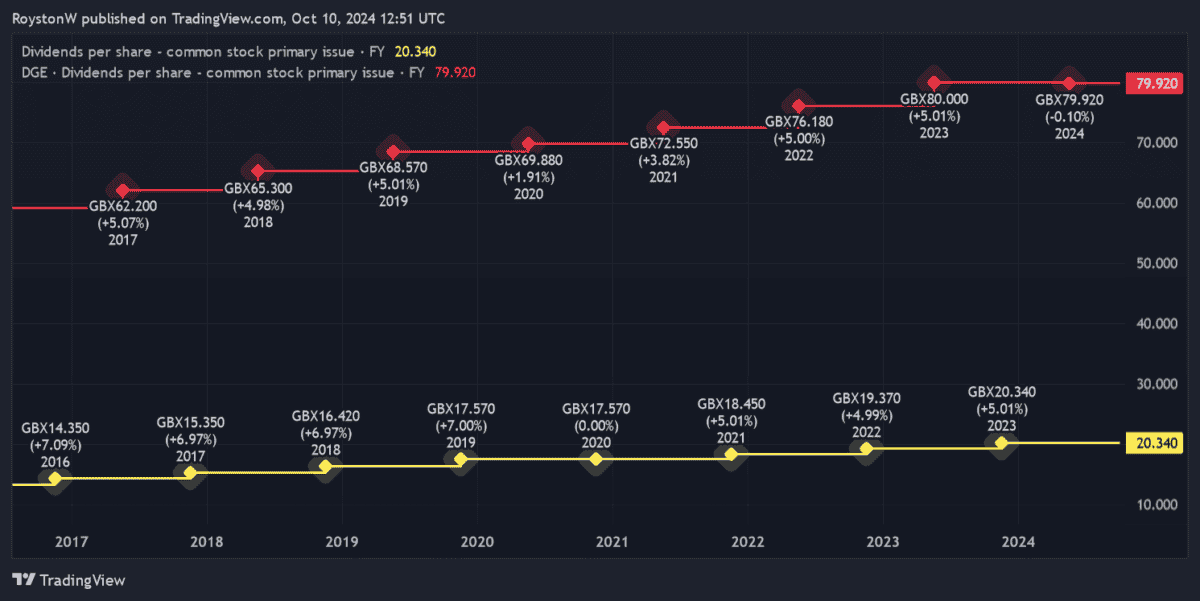

Mixed with Authorized & Normal and Diageo in a portfolio, I believe I may take pleasure in a really spectacular dividend for years to return. As you’ll be able to see, these two shares even have lengthy histories of sustained payout progress.

Monetary companies agency Authorized & Normal doesn’t function in a defensive sector. Certainly, future gross sales could stay susceptible if rates of interest stay excessive.

However the FTSE 100 agency’s steadiness sheet has nonetheless allowed it to commonly develop dividends over the previous decade. And with a Solvency II capital ratio of 223%, it stays money wealthy at present.

Diageo, in the meantime, is one other dependable dividend inventory due to its robust place within the largely resilient alcoholic drinks market. Whereas it faces excessive aggressive pressures, trendy labels like Guinness and Captain Morgan assist to minimize this menace.

I additionally just like the Footsie agency’s vast diversification throughout totally different geographies and drinks segments. This gives earnings (and thus dividends) with added stability.