Picture supply: Getty Photographs

After I retire, which I count on will likely be not less than a few many years from now, I hope to prime up my pension earnings with passive revenue from my Shares & Shares ISA. Collectively, these earnings might make my retirement extra financially snug and satisfying.

For the final decade, I’ve been investing in UK and US shares as a part of my technique to construct a portfolio massive sufficient to assist me by means of my retirement. For sure, the cash invested over that interval has added up over time.

Nevertheless, thousands and thousands of Britons are sitting on financial savings that received’t ship life-changing returns over the long term attributable to destructive actual charges. So with £25,000 in financial savings, I might look to place that cash to work by investing in shares and funds.

Whereas investing might sound inherently extra dangerous to many individuals, a well-diversified portfolio can truly assist handle threat over the long run. Right here’s the way it’s performed.

Mitigating threat

Funds, ETFs (exchange-traded funds), and trackers provide cost-effective methods to unfold investments throughout a number of firms, sectors, and geographical areas.

This enables us as traders to mitigate the influence of poor efficiency from any single funding. These devices additionally permit traders to realize broad market publicity, probably balancing between US, UK, and world markets.

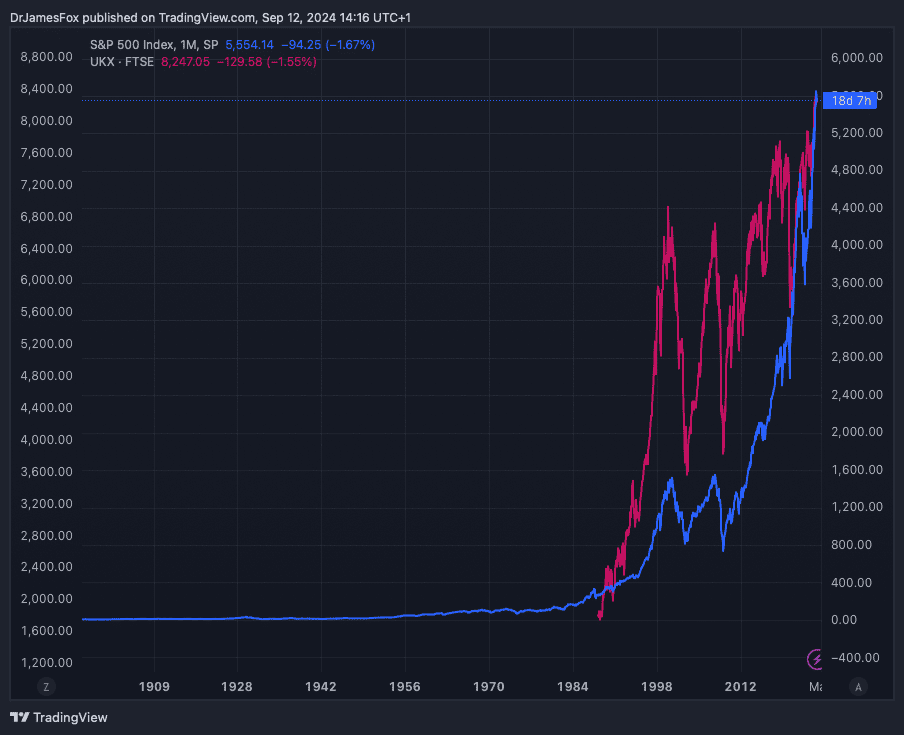

Traditionally, inventory markets have proven robust long-term development potential. From 1900 to 2023, US shares returned 6.4% yearly in actual phrases, whereas UK shares delivered 5.3%.

Taking a look at barely newer statistics, the S&P 500, a benchmark for the US inventory market, has delivered a median annual return of about 10.7% since its introduction in 1957.

This outpaces inflation and lots of different types of funding. We are able to achieve entry to those returns by merely investing in trackers funds or buying shares in sector particular funds.

Taking this 10.7% charge of return and assuming I can replicate that over the approaching many years, it will take 20 years for me to show my £25,000 right into a portfolio that might ship £12,000 a yr.

A good selection

There are lots of methods to speculate, and this is determined by circumstances and on our aims. Personally, given my occupation and the truth that I put cash into my ISA month-to-month, I favor to choose one or two new shares each month — usually re-picks.

Nevertheless, if I had been beginning investing with a lump sum right now, I’d take into account spreading my cash throughout funds and ETFs, just like the Vanguard S&P 500 UCITS ETF GBP (LSE:VUSA).

It’s among the many hottest ETFs for good cause. It merely tracks the efficiency of the S&P 500 index, providing European traders easy accessibility to the US inventory market. It offers publicity to 500 of the biggest US firms, representing about 80% of the US fairness market capitalisation.

It additionally stands out for its low value, with an expense ratio of simply 0.07%, considerably decrease than many actively managed funds. It’s extremely liquid, making it straightforward for traders to purchase and promote shares with out incurring massive spreads or transaction prices.

After all, even probably the most numerous of funds can go down in addition to up. Recessions, commerce wars, and precise wars might additionally negatively influence the efficiency of US shares, and this ETF. Nonetheless, quick, medium, and long-term efficiency has been very robust.