Picture supply: Getty Photos

I’m searching for nice shares to purchase this month for a successful passive revenue. In fact, I’m not simply searching for dividend shares that at present have the largest yields. As an alternative, I’m trying to find companies in fine condition to develop shareholder payouts over time.

The next dividend shares would give me the most effective of each worlds, I imagine.

| Inventory | 2024 dividend per share | Dividend yield | 2025 dividend per share | Dividend yield |

|---|---|---|---|---|

| Tritax Huge Field REIT (LSE:BBOX) | 7.64p | 4.7% | 8.09p | 5% |

| Major Well being Properties (LSE:PHP) | 6.9p | 6.8% | 7p | 6.9% |

Right here’s why I believe they’re value a detailed look this October.

Tritax Huge Field REIT

Tritax’s merger with UK Industrial Property REIT in Could opened the door for promotion to the FTSE 100. And it enters the index as one in every of its greatest dividend payers. Because the desk above exhibits, dividend yields sail above the three.5% common for the broader Footsie for the following two years.

Actual property funding trusts (REITs) like this may be nice decisions for revenue buyers. It is because they’re obliged — in alternate for tax perks — to pay not less than 90% of annual rental revenue out within the type of dividends.

It’s additionally as a result of they have an inclination to have tenants locked down on long-term contracts, offering them the with the important money flows (to not point out the boldness) to pay a big and normally rising dividend over time.

At Tritax, the weighted common unexpired lease time period (WAULT) for its core Basis belongings was 14 years as of June.

This bodes effectively for future payouts, as does its place in a fast-growing market. Demand for the fashionable logistics hubs it specialises in ought to steadily develop as e-commerce volumes rise, provide chains are optimised, and corporations make investments to enhance their ESG credentials.

Larger-than-normal rates of interest have put property shares like Tritax Huge Field beneath strain extra not too long ago. This stays a menace going ahead. However receding inflation means the Financial institution of England seems poised for a flurry of charge cuts, offering a sector-wide increase.

Please observe that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

Major Well being Properties

Like Tritax Huge Field, Major Well being Properties is categorised as a REIT, giving buyers the identical dividend advantages. However over the following two years not less than its dividend yields are extra spectacular approaching 7%.

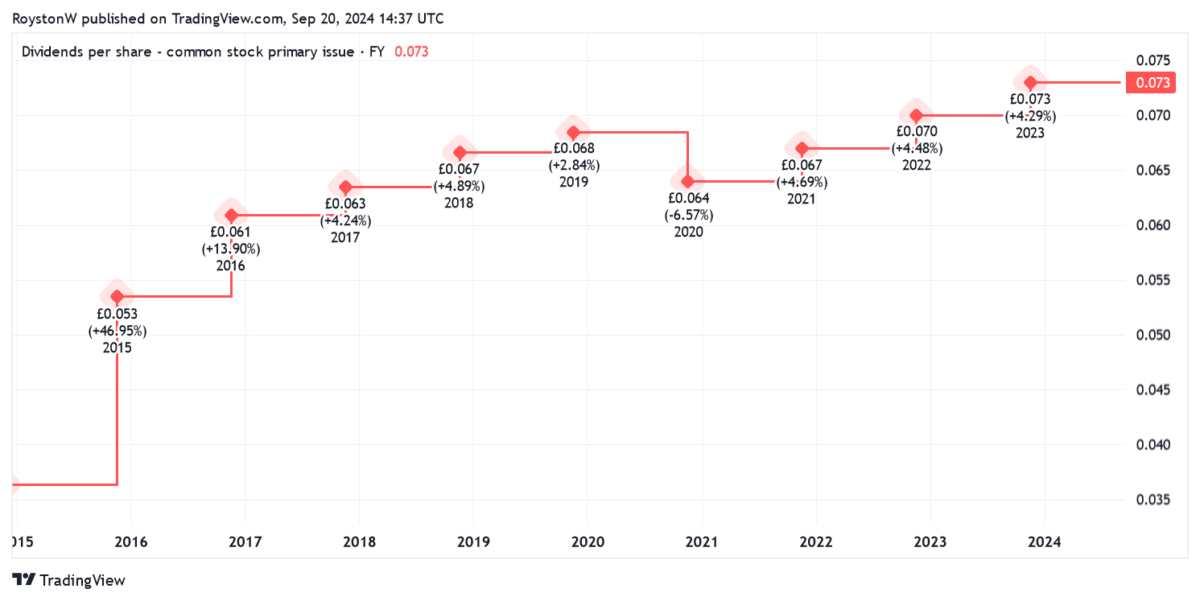

Moreover, its file of dividend development’s additionally higher. Shareholder payouts have risen yearly all the way in which again to 2009.

Like its sector peer, it has its tenants signed into long-running contracts. Its WAULT sits at a meaty 9.8 years as of June.

Major Well being additionally has an ace up its sleeve that makes it a dependable dividend payer. The agency’s give attention to healthcare properties (reminiscent of GP surgical procedures) signifies that rents are primarily assured by native authorities and the NHS.

As with Tritax, the longer term course of rates of interest creates uncertainty right here. Earnings may additionally come beneath strain if healthcare coverage modifications within the UK. But, on steadiness, I believe Major Well being Properties is a superb revenue share to think about.