Picture supply: Getty Photos

Searching for the most effective development shares to purchase within the New 12 months? Listed below are two of my favourites.

I’ve put my cash the place my mouth is and purchased them for my very own portfolio.

Video games Workshop

Final yr was a landmark one for tabletop gaming big Video games Workshop (LSE:GAW) because it entered the FTSE 100 for the primary time.

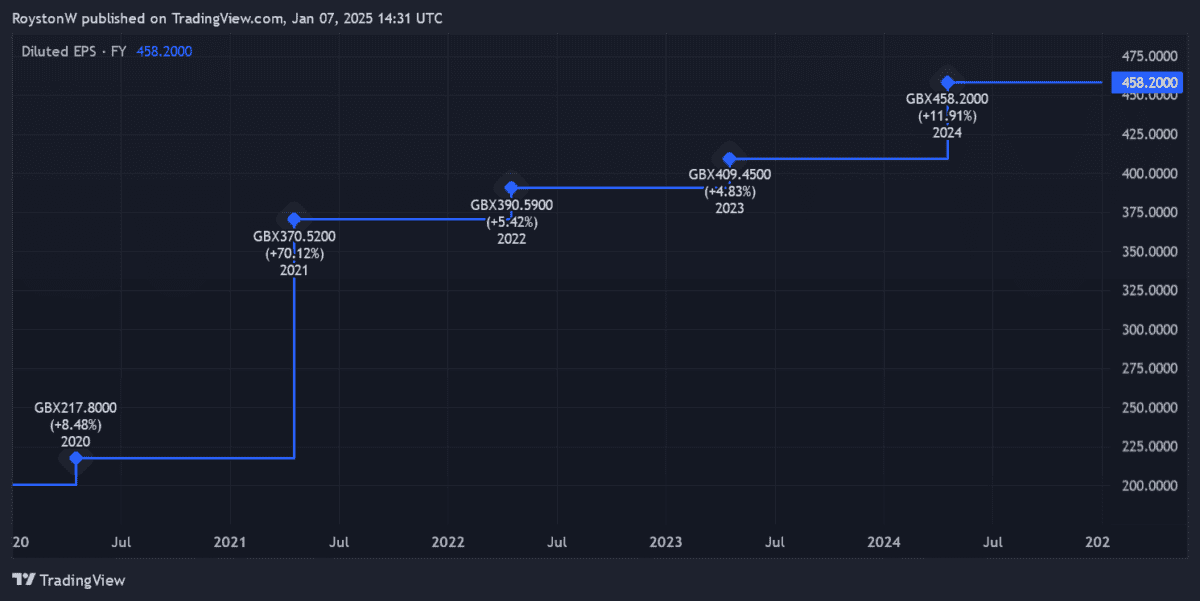

Earnings right here have grown constantly and at speedy tempo lately, because the chart beneath exhibits. Tabletop wargaming isn’t everybody’s cup of tea. But it surely’s rising quickly as international curiosity within the fantasy soars, and board gaming basically enjoys a renaissance.

By means of its Warhammer line of merchandise, Video games Workshop is on the forefront of this booming business. And it’s aiming to enter the mainstream by launching movie and TV content material with Amazon within the subsequent few years.

It’s a transfer that might supercharge gross sales of its conventional video games methods and create enormous royalty revenues in its personal proper.

Earnings look set to proceed rising strongly within the meantime, as new merchandise fly off the cabinets and the corporate grows its worldwide retailer property. Late November’s buying and selling replace underlined its continued trajectory, predicting pre-tax earnings of at the least £120m within the six months to 1 December, up 25% yr on yr.

This helps Metropolis predictions that annual earnings will develop 7% this monetary yr (to Could 2025). Earnings are tipped to extend one other 5% in subsequent yr as properly.

Video games Workshop’s robust outlook is mirrored by its elevated price-to-earnings (P/E) ratio of 27.2 occasions. Whereas I believe the corporate is worthy of this premium valuation, it means its shares may probably hunch if any hiccups happen.

Greggs

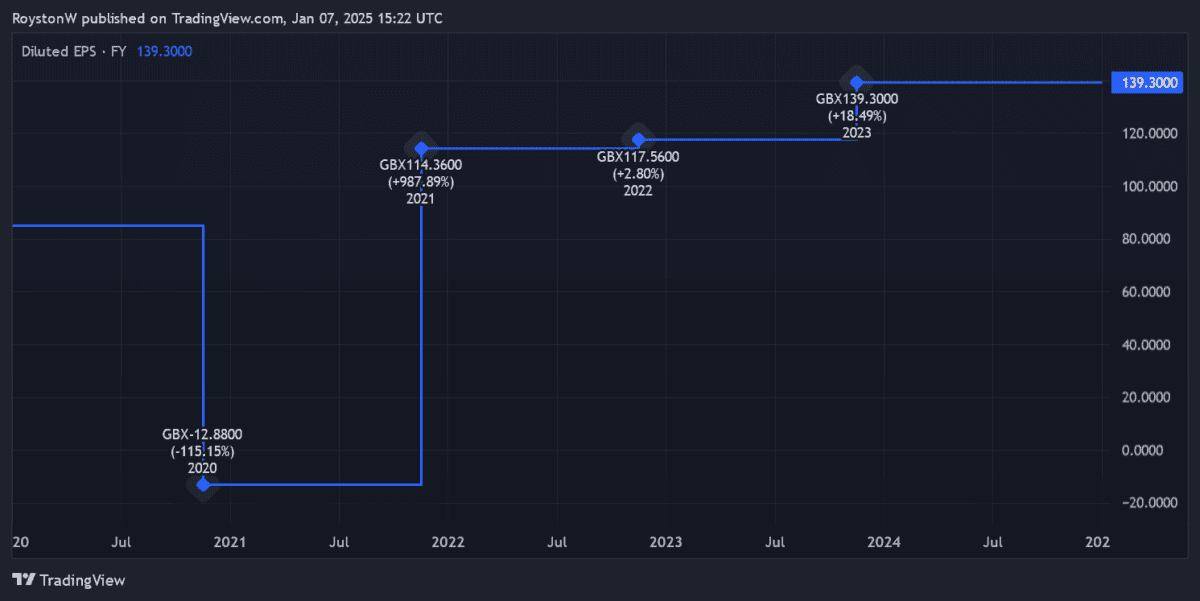

Pandemic apart, Greggs (LSE:GRG) has additionally loved spectacular earnings development lately. That is thanks largely to an enlargement technique that’s pushed gross sales round three-quarters increased since 2019.

For 2024, Metropolis analysts assume the FTSE 250 firm’s earnings rose 8% yr on yr. They’re forecasting additional meaty development — of seven% and eight% — in 2025 and 2026.

That is maybe unsurprising given Greggs’ dedication to continue to grow its retailer property from present ranges of round 2,560. It deliberate for between 140 and 160 new retailers in 2024 alone, and plans to have 3,500 company-managed and franchise retailers up and operating within the subsequent few years.

Competitors within the food-on-the-go market is intense and stays a risk. However Greggs’ recipe of providing generational favourites (like sausage rolls and doughnuts) at engaging costs helps it efficiently navigate this hazard. Newest financials confirmed gross sales up 12.7% between 1 January and 28 September.

The baker’s additionally successfully tailoring its providers to satisfy the wants of the fashionable shopper. Current measures embody introducing a click on and accumulate service, constructing drive-thru retailers, and lengthening opening hours into the night.

In the present day Greggs trades on a ahead P/E ratio of 20.8 occasions. Whereas the inventory isn’t low cost, I don’t it will have an effect on its possibilities of printing additional spectacular good points following final yr’s wholesome rise.